The first important report of the week was just released. In fact, there won't be too many important reports over the next three days, but there will be many significant events, particularly the meetings of three central banks. The U.S. inflation report directly influences the outcomes of the Federal Reserve's meeting, which will be known on Wednesday evening. The Consumer Price Index in November was 3.1% YoY, showing a slowdown from 3.2%. The core index was 4%, showing no slowdown. What does this mean, and what conclusions can we draw now?

First and foremost, I want to note that inflation in America has started to slow down very gradually. This is an expected development as the FOMC rate has remained unchanged for three consecutive meetings. If there are no additional rate hikes, the impact on inflation and the economy diminishes. In simpler terms, the same rate cannot constantly lead to a 0.3-0.5% decline in inflation. Therefore, the slowdown in the decline was predictable, and the Fed was prepared for it.

Secondly, it is necessary to note that core inflation still exceeds the target level twice as much. This is a significant gap, and it may take at least a year to eliminate it. So what kind of decisions can the Fed make? In my opinion, nothing has changed after the release of the inflation data. If the Fed showed no signs of additional tightening after it jumped to 3.7%, it is even less likely to do so now. The same applies to a possible interest rate cut. The CPI is not low enough for the central bank to start talking about monetary easing. Perhaps talk of rate cuts will come in a few months when inflation is at least at the 2.5% mark, but not now.

Based on everything mentioned above, we came to the conclusion that the dollar did not receive any grounds to start a new rally. The dollar rose after the report, but it may be replaced by a decline on Wednesday. In other words, economic data have not undergone significant changes for the Fed to change its position.

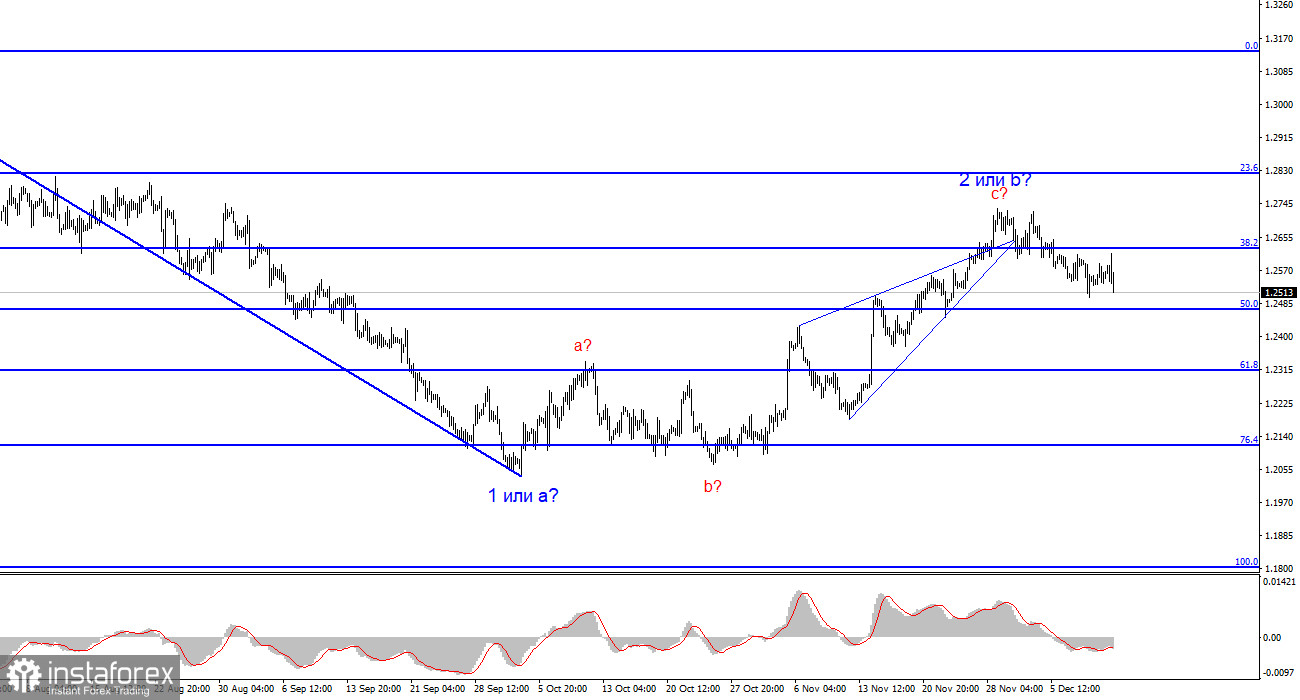

Based on the analysis, I conclude that a bearish wave pattern is still being formed. The pair has reached the targets around the 1.0463 mark, and the fact that the pair has yet to surpass this level indicates that the market is ready to build a corrective wave. Wave 2 or b has taken on a completed form, so in the near future I expect an impulsive descending wave 3 or c with a significant decline in the instrument. I still recommend selling with targets below the low of wave 1 or a. At the moment, wave 2 or b can be considered completed.

The wave pattern for the GBP/USD pair suggests a decline within the downtrend. The most that we can count on is a correction. At this time, I can recommend selling the instrument with targets below the 1.2068 mark because wave 2 or b will eventually end, and it could do so at any moment. The longer it takes, the stronger the fall. The narrowing triangle is a harbinger to the end of the movement.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română