EUR/USD

In the previous review, we tied the rise of counter-dollar currencies to the development of risk sentiment in the broader market. Yesterday, the S&P 500 stock index surpassed the nearest peak from July 27 (4612), and now it has a good target at the level of 4818, which is a record high (January 2022). Oil prices have edged up. Yields on US government bonds have not changed for the third day in anticipation of tomorrow's Federal Reserve meeting.

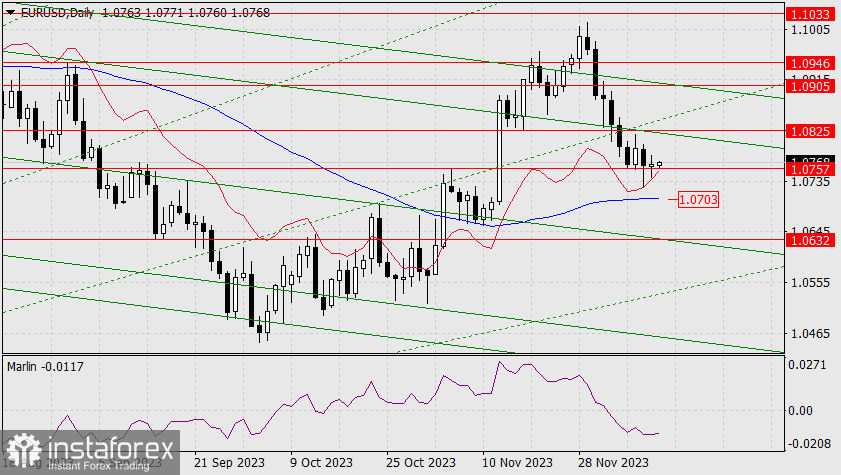

On the daily chart, the price has consolidated above the level of 1.0757. The Marlin oscillator is slowly turning upward. If there are no significant events that can hinder the euro, the price will continue to rise towards the target level of 1.0825.

A potential bullish breakout, in continuation of the decline from November 29, will take place if the price surpasses the support of the MACD line in the area of 1.0703. The first bearish target will be 1.0632.

On the 4-hour chart, the price is consolidating symbolically above the support of 1.0757. The signal line of the Marlin oscillator, after the previous convergence, entered the uptrend territory. Overcoming the level of 1.0825 will support the uptrend, as resistance is strengthened by the approaching MACD line.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română