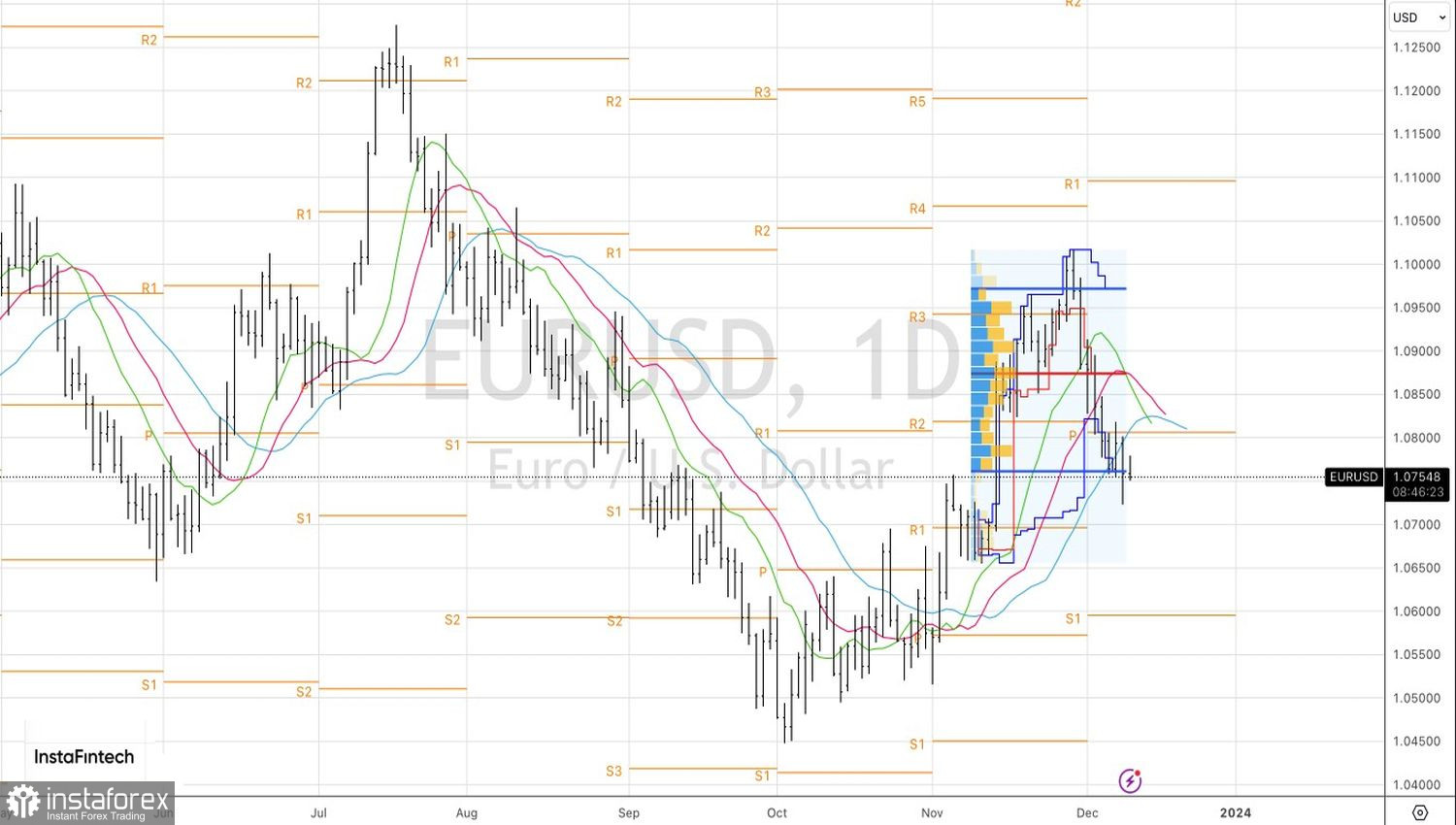

No matter how strong market greed is and how great the global risk appetite, the euro has too many vulnerable points for EUR/USD not to fall. Thanks to the S&P 500 rally in response to robust U.S. labor market data for November, the main currency pair managed to avoid a rout. Initially, it declined to 1.0725, but then the rise in the U.S. stock market threw a lifeline to the euro bulls.

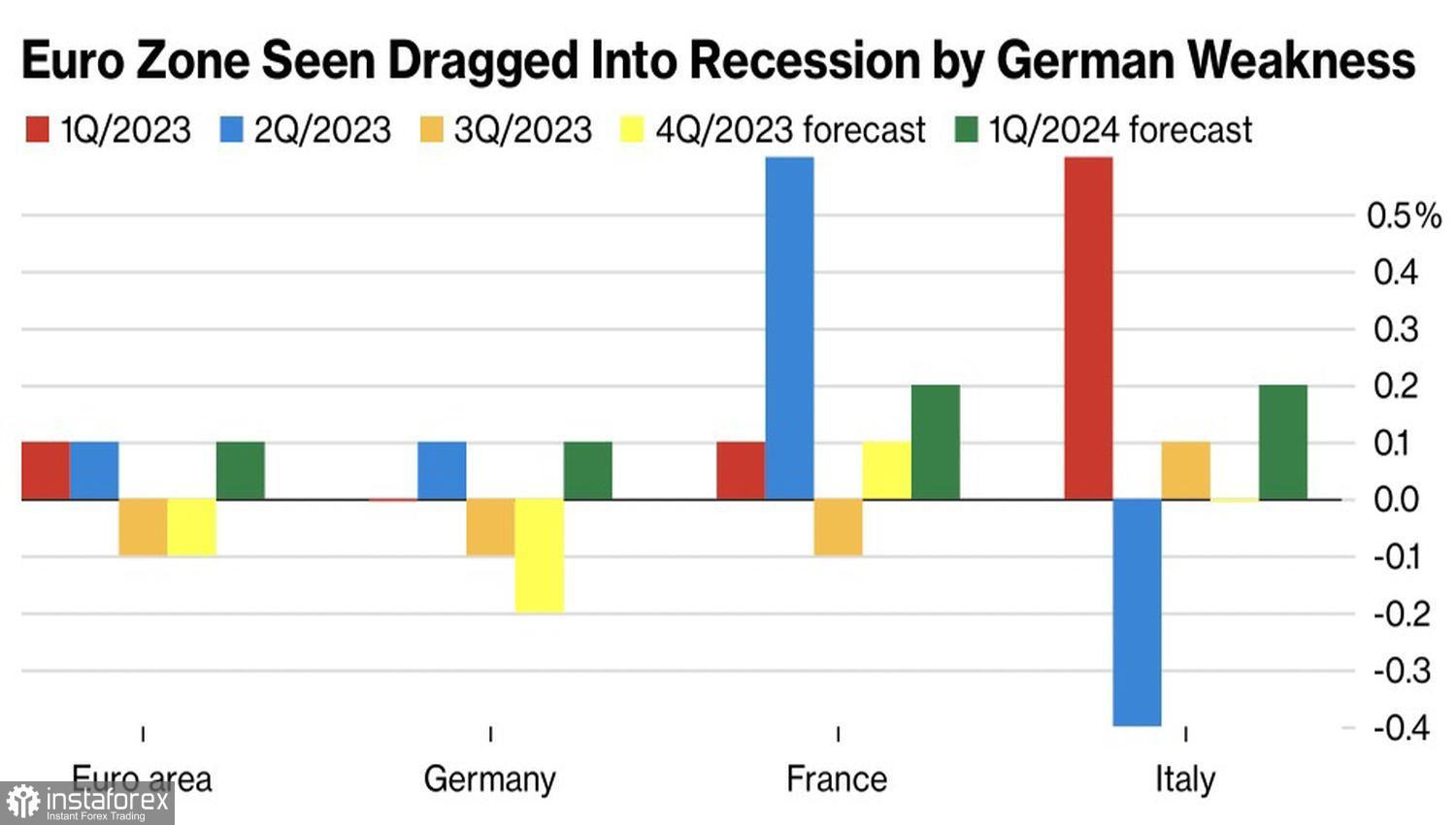

According to the consensus forecast of Bloomberg experts, in the fourth quarter, due to problems in the German economy, the Eurozone's GDP will shrink by 0.1% QoQ. This will be the second consecutive contraction, indicating a technical recession.

Dynamics of European Economies

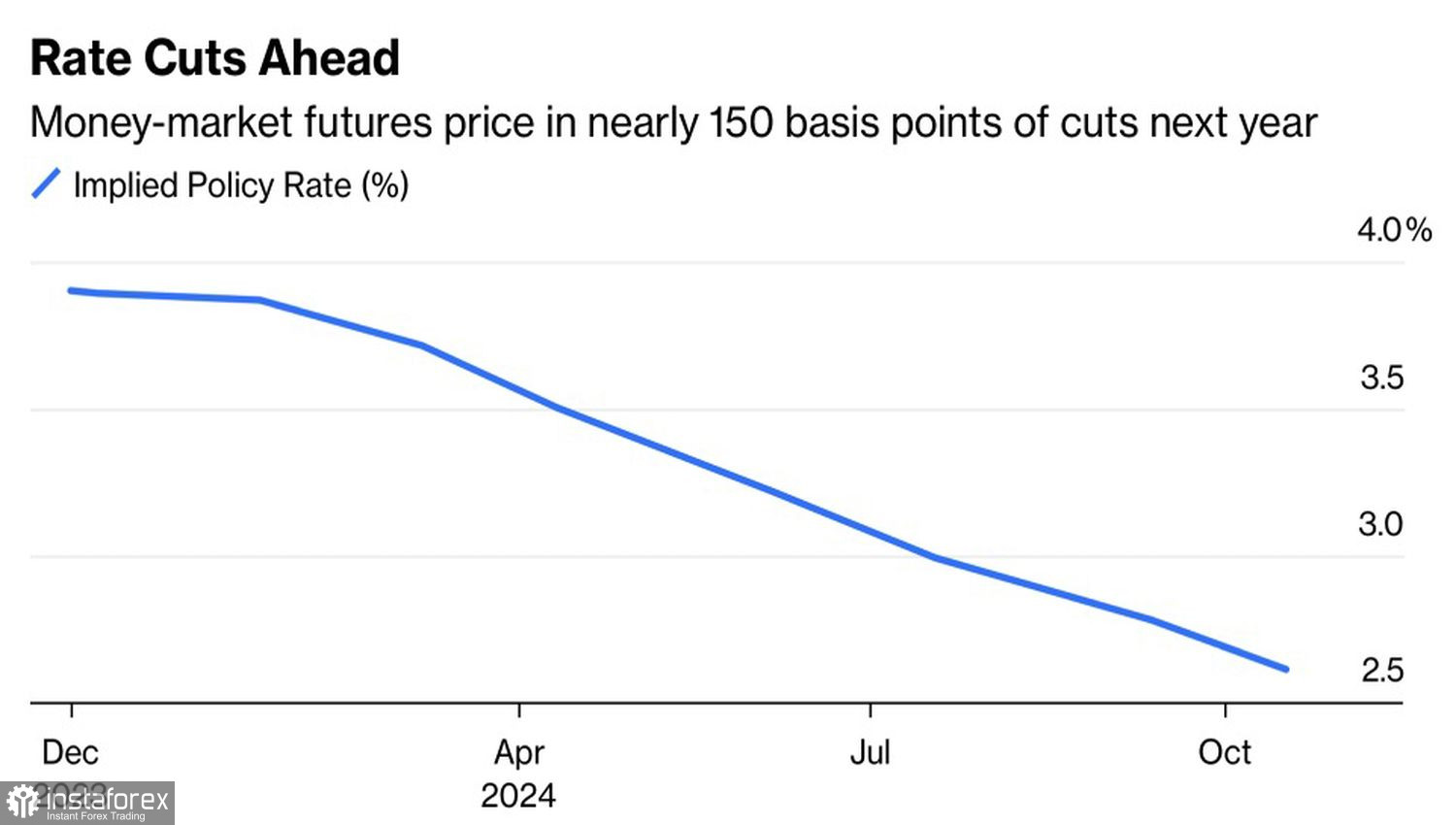

Export-oriented Germany suffers not only from weak external demand but also from a budget crisis. The economy, which was recently considered the engine of GDP growth in the currency bloc, is now dragging it down. With inflation rapidly approaching the 2% target, a deposit rate of 4% is a big problem for the Eurozone. The region is used to living with much lower borrowing costs. It's no wonder that the futures market expects the ECB to cut rates by 150 bps in 2024, which is more than -100 bps in the U.S. and -75 bps in the UK.

Investors believe that the European Central Bank will be the first to embark on the path of monetary expansion. This could happen as early as April. The different pace of monetary policy easing and the divergence in economic growth between the U.S. and the Eurozone dictate the need to sell EUR/USD. While this is hindered by a high global risk appetite, what will happen when U.S. stocks go down?

ECB Interest Rate Expectations

The main reason for the November–December rally in the S&P 600 is the expectation of a soon dovish pivot by the Fed and a reduction in the federal funds rate to 4.5% in 2024. These assumptions are based on a faster-than-expected decline in the growth rate of U.S. inflation in October. However, Bloomberg experts forecast a slowdown in consumer prices from 3.2% to 3.1% in November and the maintenance of core inflation at 4%. If it does not quickly return to the target, what's the point for the Fed to ease monetary policy?

Most likely, in its December forecasts, the FOMC will not show a reduction in the federal funds rate by more than 25–50 bps next year. This will be a shock to financial markets expecting a more significant cut. As a result, the S&P 500 may collapse both after the release of inflation data and after the announcement of the results of the December Fed meeting. The fall of the stock index will deprive the euro of its main trump card and force EUR/USD to hit bottom.

Technically, on the daily chart, the main currency pair continues to struggle for the lower boundary of the fair value range of 1.076–1.097. If it falls under the control of the bears, it will be possible to increase the shorts formed from 1.094. Conversely, a victory for the bulls will prompt consideration of a reversal and a transition to long positions on EUR/USD.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română