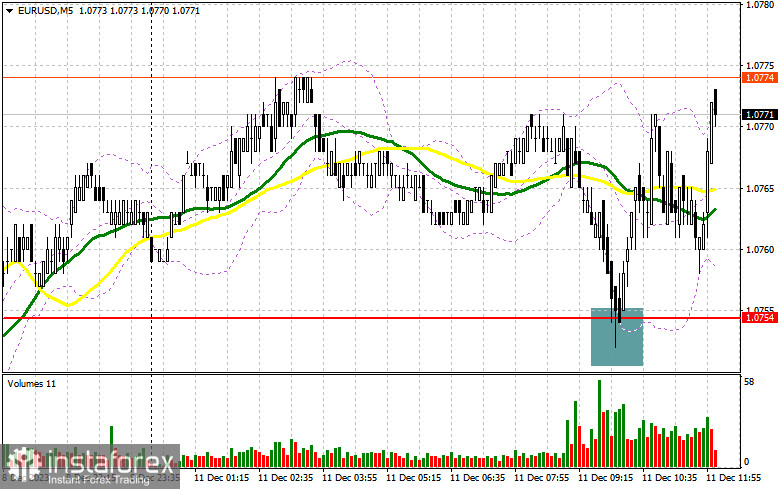

In my morning forecast, I drew attention to the level of 1.0754 and recommended making decisions on market entry based on it. Let's take a look at the 5-minute chart and analyze what happened there. The decline and the formation of a false breakout at 1.0754 led to a good entry point for buying the euro. At the time of writing this article, the pair has risen by about 15 points – the entire intraday volatility. The technical picture has not been revised for the second half of the day.

To open long positions on EUR/USD, the following is required:

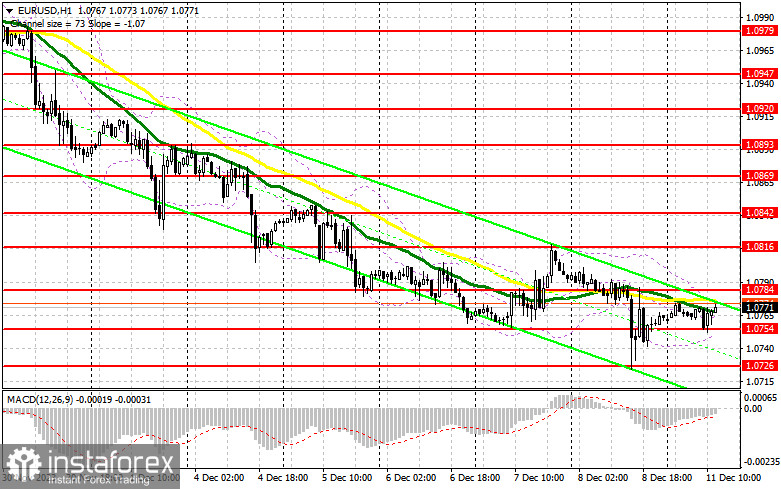

Considering the low volatility and trading volume, it is likely that the situation will repeat itself in the second half of the day since there are no significant statistics for the American session. However, it is essential not to forget the Friday scenario of the previous week, when the euro experienced a significant decline. So, it's better not to rush with purchases at the current local highs. I will act in line with the morning forecast: in the case of a decline in the pair, only the formation of a false breakout around 1.0754, similar to what I analyzed earlier, will provide an entry point into long positions, anticipating a recovery of EUR/USD and testing the resistance at 1.0784, formed at the end of last Friday. There, the moving averages, favoring sellers, are also located. Its breakout and update from top to bottom will signal a purchase opportunity and a chance for an update to 1.0816. The ultimate target will be the area of 1.0842, where I will make a profit. In the case of a decline in EUR/USD and the absence of activity at 1.0754 in the second half of the day, which is quite probable, we can talk about the continuation of the downtrend. In this case, I plan to enter the market only after the formation of a false breakout around 1.0726 – a new local minimum. I will open long positions immediately on the rebound from 1.0698 with a target of an ascending correction within the day by 30-35 points.

To open short positions on EUR/USD, the following is required:

Sellers tried, but nothing has worked out so far. To further develop the downtrend, it is necessary to defend 1.0784 and test this level. The formation of a false breakout at this level will signal a sale, with the nearest target at 1.0754 – the middle of the sideways channel, having an intermediate character. Only after breaking and consolidating below this range, as well as a reverse test from bottom to top, do I expect to receive another sell signal with an exit to 1.0726. The ultimate target will be the minimum of 1.0698, where I will take a profit. In the event of an upward movement of EUR/USD during the American session, as well as the absence of bears at 1.0784, buyers will try to stop the bearish market and restore balance. This will open the way to 1.0816. It is possible to sell there, but only after an unsuccessful consolidation. I will open short positions immediately on the rebound from 1.0842, with a target of a descending correction of 30-35 points.

Indicator Signals:

Moving Averages

Trading is carried out around the 30 and 50-day moving averages, indicating a sideways market.

Note: The author considers the period and prices of moving averages on the hourly chart H1, which differs from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands

In the case of a decline, the lower boundary of the indicator around 1.0750 will act as support.

Description of Indicators

- Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked on the chart in yellow.

- Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked on the chart in green.

- MACD indicator (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands. Period 20

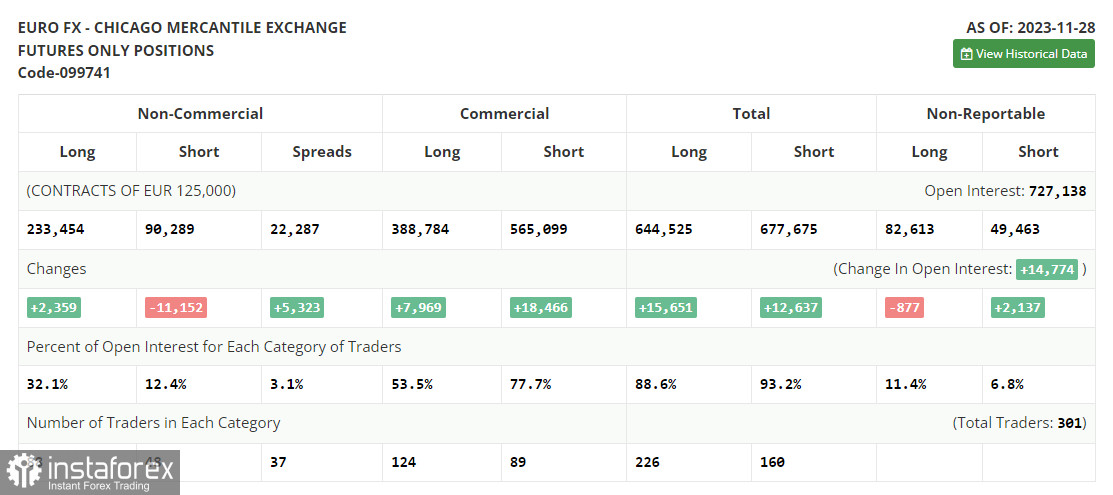

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română