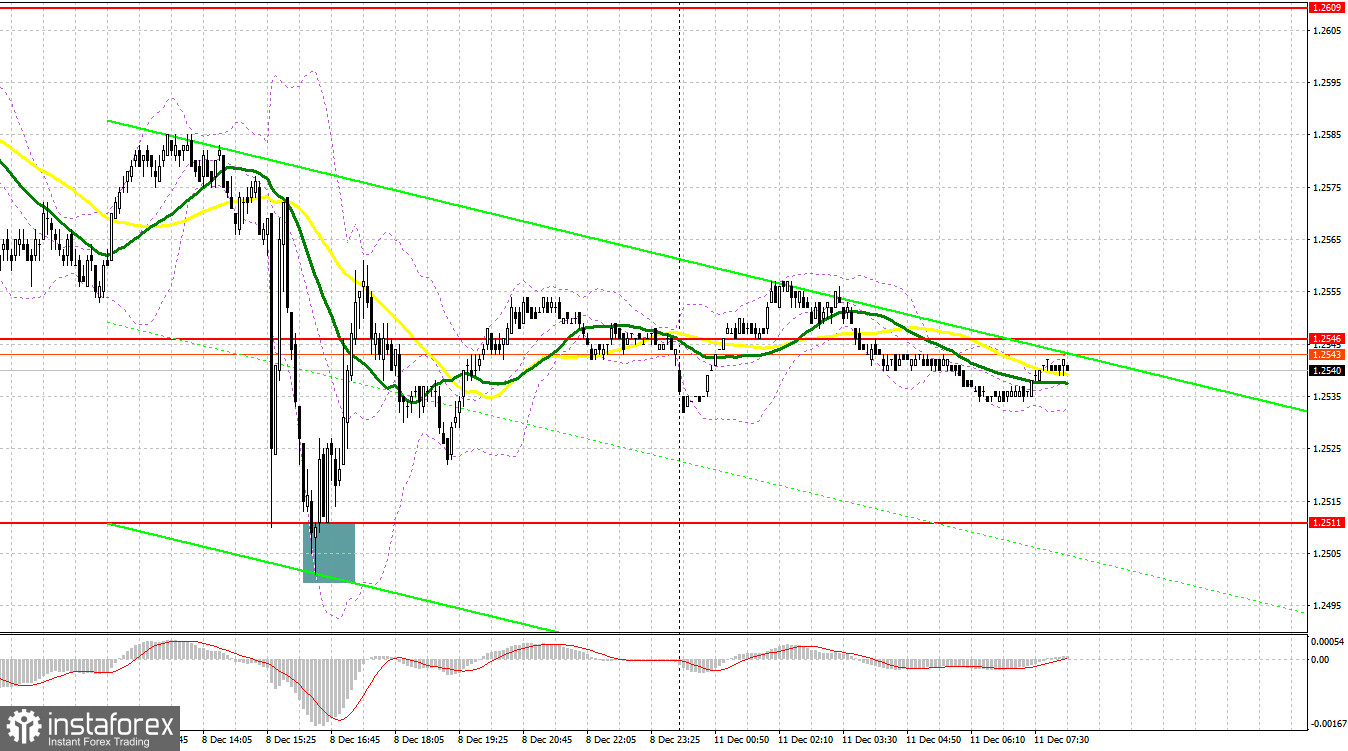

Last Friday, several signals were generated to enter the market. Let's look at the 5-minute chart and discuss what happened there. In my morning forecast, I paid attention to the level of 1.2573 and recommended making decisions on entering the market from there. A breakout and reverse test of this area from bottom to top produced a sell signal, but after moving down 20 pips, the selling pressure on the pair eased, so GBP/USD carried on trading within a sideways channel. In the afternoon, the pound sank significantly after the release of strong US statistics, but active defense and a false breakout at 1.2511 gave a good buy signal. As a result, the instrument rose by more than 40 pips.

What is needed to open long positions on GBP/USD

Strong data on the US labor market made investors wonder whether the Federal Reserve would actually cut interest rates in the first quarter of next year, or whether traders made hasty conclusions about possible rate cuts. We'll find out this week after the Federal Reserve meeting. In the meantime, in the absence of important fundamental statistics today, especially after Friday's strong report, I expect pressure on the pair to continue. For this reason, it is better not to rush into long positions, but wait for the decline and the false breakout at about the nearest support of 1.2533 which serves as the the middle of the sideways channel. Only this will provide an entry point into long positions with the aim of a recovery in GBP/USD. I expect the 1.2559 area formed last Friday to be updated. Moving averages are also there, playing on the side of the sellers. A breakout and consolidation above this range will strengthen demand for the pound and open the way to 1.2559. The highest target will be the area of 1.2583, where I will take profits. In the scenario of a decline and lack of activity of the bulls at 1.2533, nothing terrible will happen for the buyers. In this case, only a false breakout in the area of the next support 1.2506, which is the lower border of the side channel, will give a signal to open long positions. I plan to buy GBP/USD immediately at a dip only from 1.2478, bearing in mind a correction of 30-35 pips within the day.

What is needed to open short positions on GBP/USD

The sellers have every chance of building a further downtrend - especially after Friday's statistics on the US labor market, where unemployment fell to 3.7%. Today, the most optimal scenario, in my opinion, would be selling on rallies after protection and a false breakout in the resistance area of 1.2559, where the moving averages are located. Considering the empty economic calendar and the low trading volume expected throughout the day, you can't count on a sharp downward movement. However, support at 1.2559 will give a signal to open short positions and a chance to move down to the intermediate support at 1.2533. Only a breakout and a reverse test from the bottom to the top of this range amid the lack of important statistics for the UK will deal a more serious blow to the positions of the bulls, which will lead to the demolition of stop orders and will open the way to the lower border of the channel 1.2506. A lower target will be the area of 1.2478, where I will take profits. If GBP/USD grows and there is no activity at 1.2559 in the first half of the day, I will postpone short positions until a false breakout at 1.2583. If there is no downward movement even there, I will sell GBP/USD immediately at a rebound from 1.2609, but only in anticipation of a downward correction by 30-35 pips within the day.

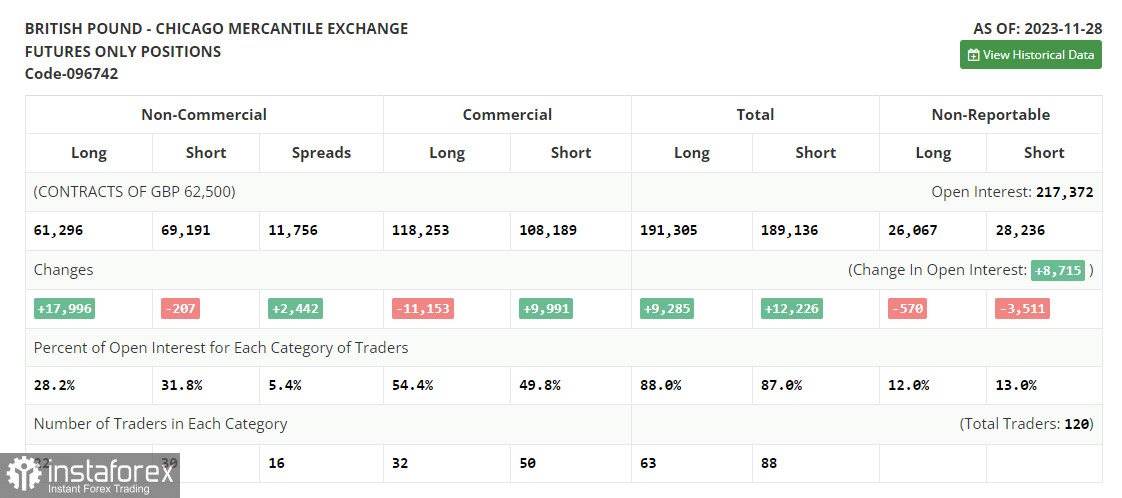

In the COT (Commitment of Traders) report for November 28, there was a sharp increase in long positions and a slight decrease in short positions. Demand for the British pound remains buoyant. Bank of England Governor Andrew Bailey stated that if the regulator does not continue to raise interest rates, it will at least keep them at current highs for quite a long period. Such rhetoric helps attract new buyers to the market. Add to everything else the dovish rhetoric of the Federal Reserve's policymakers, along with its Chairman Jerome Powell, and it becomes clear why the pound sterling may continue to rise shortly. Important statistics on US inflation will be released tomorrow, which will dot the i's. The latest COT report said that long non-commercial positions rose by 17,996 to 61,296, while short non-commercial positions fell by 207 to 69,191. As a result, the spread between long and short positions increased by 2,442. GBP/USD closed last week higher at 1.2701 versus 1.2543 a week ago.

Indicators' signals

Moving averages

The instrument is trading below the 30- and 50-day moving averages. It indicates a further decline of GBP/USD.

Note: The period and prices of the moving averages are considered by the analyst on the 1-hour chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case GBP/USD goes down, the indicator's lower border at about 1.2510 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română