The EUR/USD currency pair continued its downward movement on Friday, which fully met our expectations. Recall that the European currency had been falling for six days, so on Thursday and Friday, there were some doubts that the southward movement would continue. However, another set of US statistics, which market participants openly feared, turned out to be stronger than forecasts, triggering a new strengthening of the US currency.

First of all, it should be noted that most reports over the past 5–6 weeks from the US have failed. It is because of this that we saw a stronger upward correction in the pair than anticipated. Based on previous statistics, traders feared that the new package would again turn out to be weak. However, we have repeatedly said that the American economy continues to remain strong enough, given the current level of the Fed's interest rate. We also mentioned that traders interpret American reports as weak because they are below expectations, not "weak" in the literal sense of the word. Therefore, the dollar has been hostage to the market's inflated expectations for the past month and a half.

During this week, we also saw several reports from the US that turned out to be weaker than market expectations, which scared the dollar bulls even more. The ADP report on the number of new non-farm payrolls was weaker than forecast, and the JOLTs report on job vacancies was also weak. These reports do not correlate with non-farms and unemployment, so their weakness did not guarantee weakness in non-farms and unemployment. In practice, it turned out to be the case. Payrolls exceeded market expectations, and unemployment was 0.2% lower than forecast.

The dollar has every reason to continue strengthening.

Even though there were as many as four important reports on Friday, most attention was paid to non-farm payrolls, so let's analyze them in more detail. Some experts managed to find fault with it, stating that this indicator could have been much higher. However, we would like to remind you that the Fed's rate is higher than the ECB's or the Bank of England's rate. Thus, the American economy experiences a greater "cooling" effect than the economies of the EU or the UK. Moreover, despite all this, the US economy grew by 5.2% in the third quarter, unemployment is again decreasing, and new jobs are being created steadily. Macroeconomic indicators cannot help but decline when the Fed's rate is 5.5%. The economy is slowing down in some aspects, but what else can be expected from it during a period of high interest rates?

Therefore, we believe that American statistics are currently in good shape. Yes, November was not very successful, but December showed that everything is fine, so the dollar can continue to rise based on macroeconomic factors. Also, note that the European and British economies, with lower central bank rates, have essentially not been growing for five or six quarters. Unemployment in the UK and the EU is higher, and business activity indices are lower. In almost all indicators, the United States is winning. Thus, we still do not see any reason for the dollar to fall.

This week will see meetings of all three central banks. Although surprises are not expected this time, important information that can affect the pair's movement may be received. We do not expect "dovish" rhetoric from the Fed and Powell this time, as inflation remains high. However, no one knows yet how the dot-plot interest rate forecast will be changed, how the members of the Bank of England's monetary committee will vote, or what Christine Lagarde will say at her press conference with her 2.4% inflation.

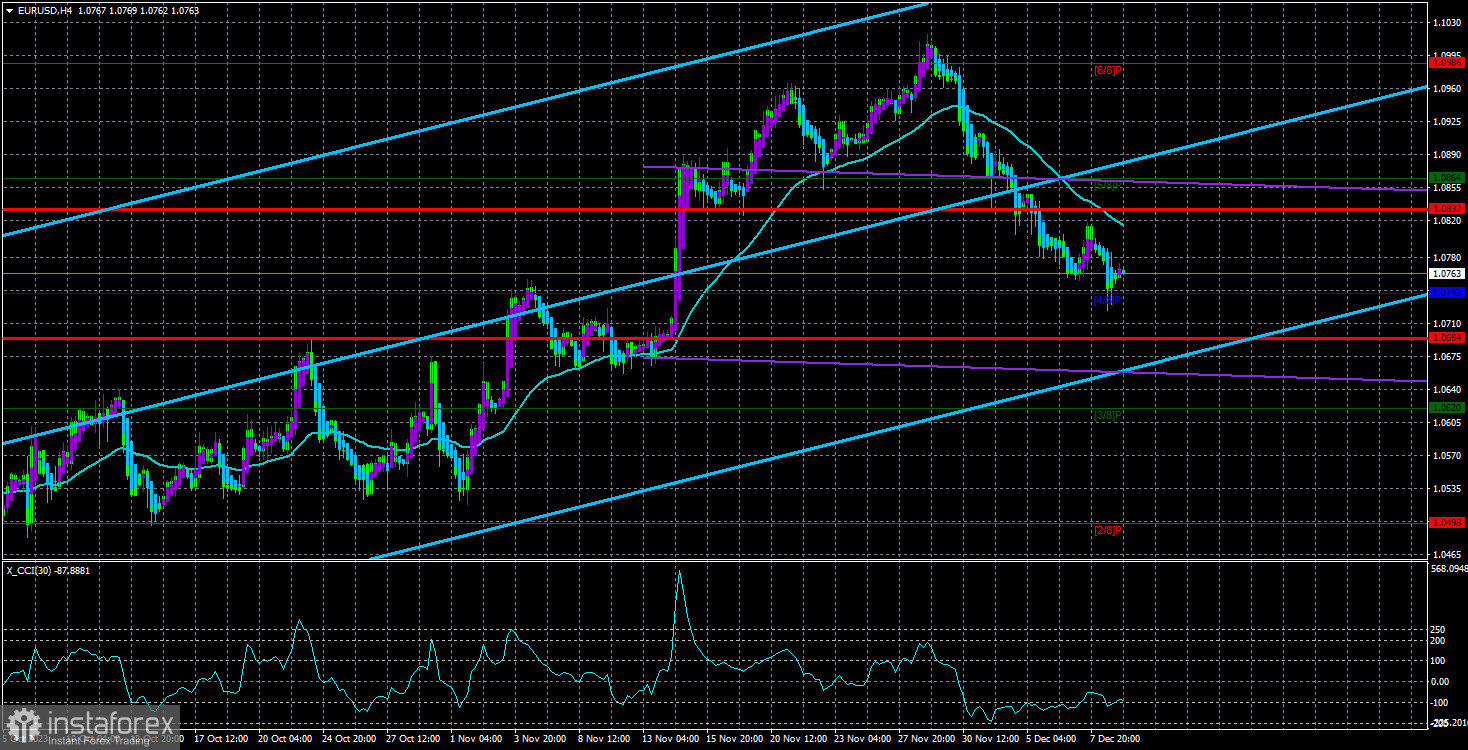

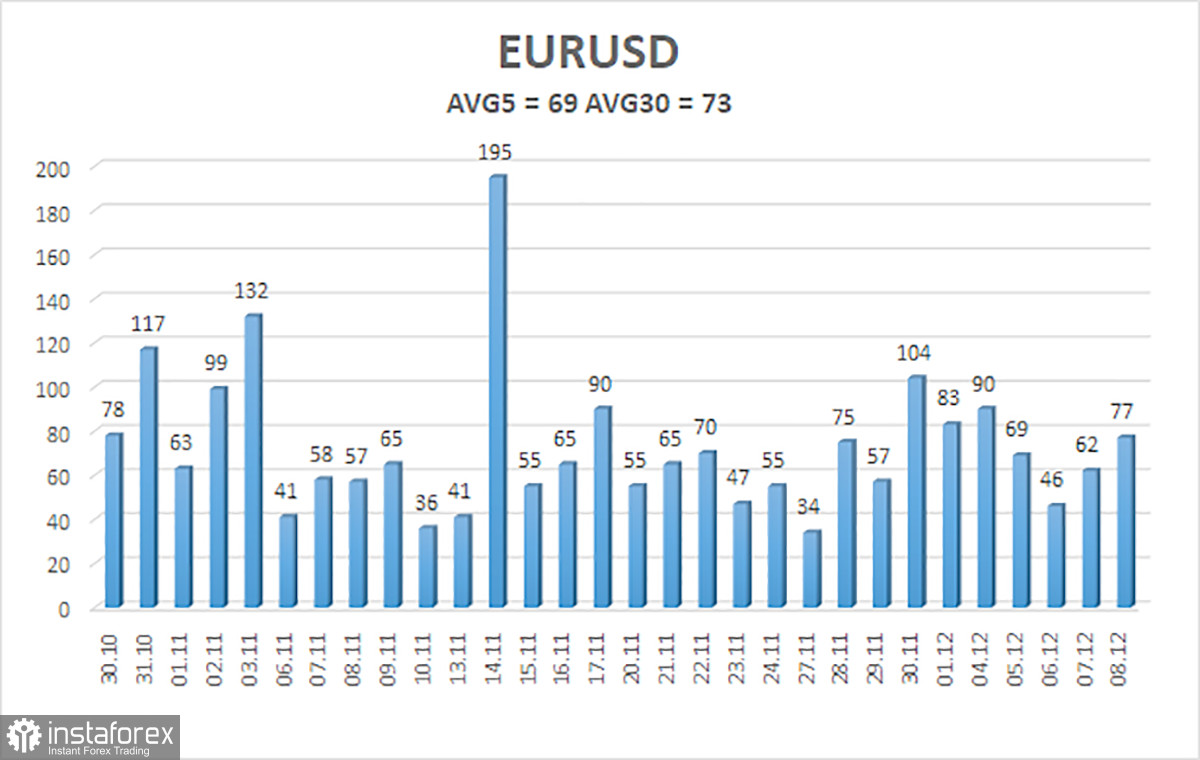

The average volatility of the euro/dollar currency pair for the last 5 trading days as of December 11 is 69 points and is characterized as "average." Thus, we expect the pair to move between the levels of 1.0694 and 1.0832 on Monday. A reversal of the Heiken Ashi indicator upward will indicate a new upward correction.

Nearest support levels:

S1 - 1.0742

S2 - 1.0620

S3 - 1.0498

Nearest resistance levels:

R1 - 1.0864

R2 - 1.0986

R3 - 1.1108

Trading recommendations:

The EUR/USD pair continues to be below the moving average line, allowing traders to continue considering short positions with targets at 1.0694 and 1.0620. For now, we see no reason for the pair's decline to stop. As for buying, they can be considered when the price consolidates above the moving average or when strong signals are formed on the 24-hour TF. Targets - 1.0864 and above. We believe that buying the pair now is risky, and any upward movement will be interpreted as a correction.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, it means the trend is strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which to trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates that a trend reversal is approaching in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română