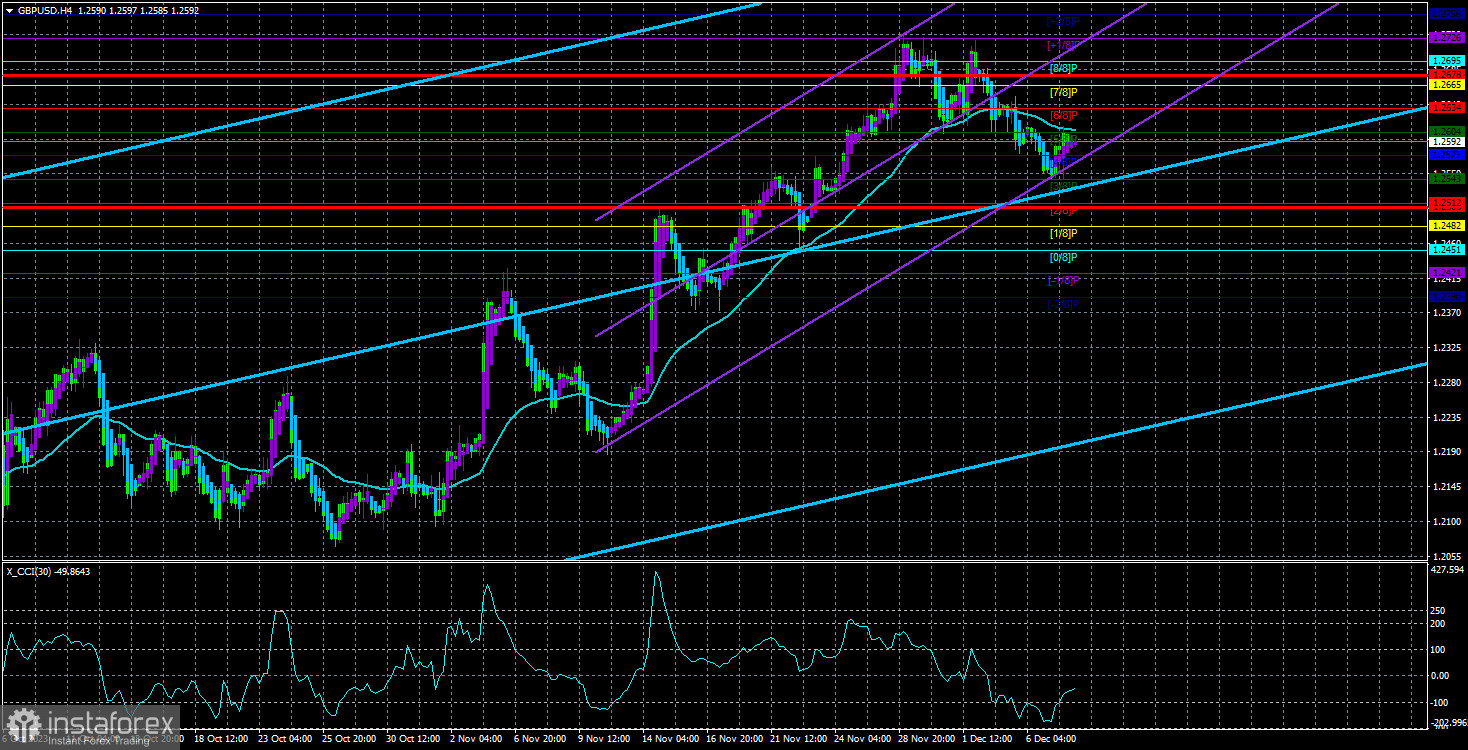

The GBP/USD currency pair also experienced a slight correction on Thursday, but the preceding downward movement was much weaker than the euro. Therefore, the technical picture for the pound looks different now. The pound is struggling to stay below the moving average and is moving downward with great difficulty, although seemingly all factors favor a decline. The British pound rose for over a month, covering a distance of 650 points. The CCI indicator entered the overbought zone three times during the corrective movement. There are no grounds for further growth of the pound. The CCI indicator did not enter the oversold zone. Thus, despite the sluggish decline in the past week, we expect the pair to move only downward.

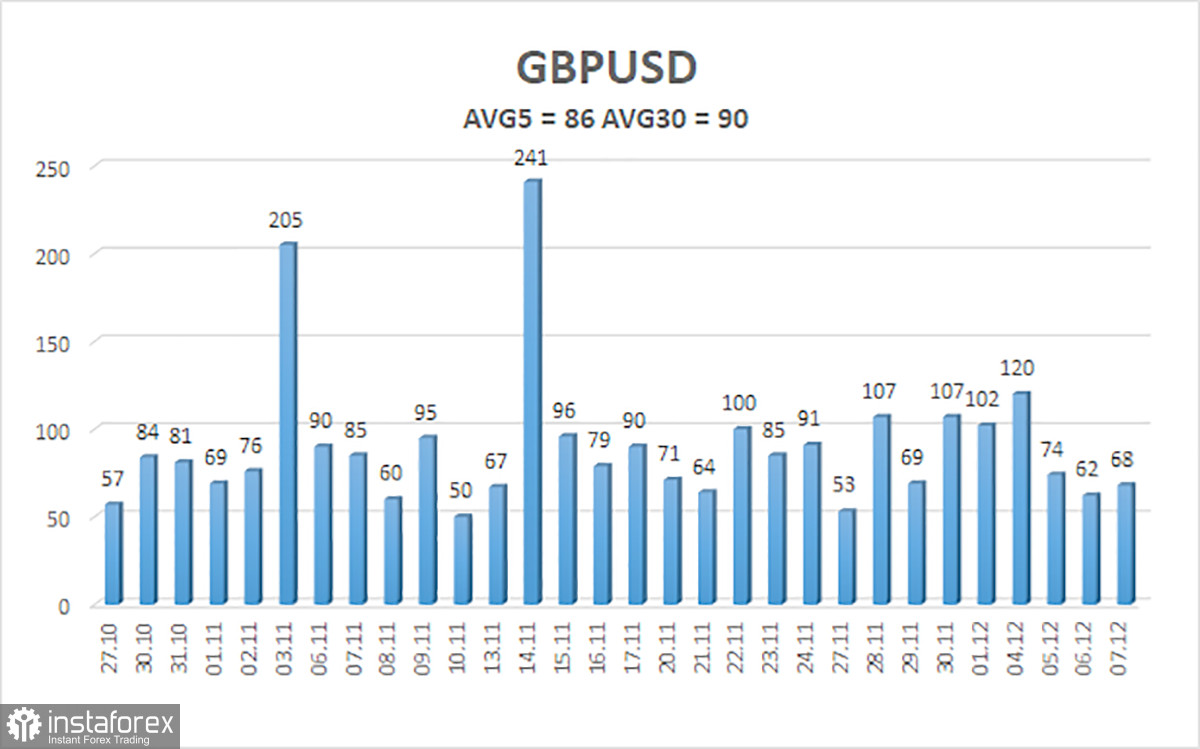

Yesterday was the most boring day for the pound and the dollar, explaining the relatively low volatility. 68 points for the pound is equivalent to 45 points for the euro. Essentially, this means that the pair stood still all day. Trading such a pair with such volatility is very challenging. Earlier this week, Andrew Bailey stated that an interest rate hike is not currently required, so another factor supporting the British pound's growth has been neutralized. The Bank of England continues to combat high inflation, but the recession problem is unlikely to pass. If the EU has an interest rate of 4.5%, implying less pressure on the economy, the UK's rate is 5.25%.

The British economy has been showing growth rates of -0.3% to +0.3% for the last six quarters. In essence, it is already on the brink of a recession. Shortly, interest rates will not be reduced, so pressure on the economy will persist. And if there are concerns about a recession in the United States with their economic growth in the last quarter at 5.2%, there is nothing to say about the UK.

The pound is still in contemplation

Meanwhile, it became known that most experts expect a rate cut from the Federal Reserve in 2024 and the Bank of England. They note that the softening of monetary policy is likely to start later in the UK than in the US (which is explained by higher inflation in the UK). Still, a reduction in the key rate is inevitable in any case. With a lower key rate, the market will have even fewer reasons to buy the pound. Of course, this does not mean that the pound will now fall every day. We want to say that neither the pound nor the dollar currently has a fundamental advantage.

But here, it is worth remembering that the market is not only a sum of traders and speculators who make deals to make a profit. These are also major players, banks, and companies that enter the market to buy a particular currency they need for their activities. Therefore, from time to time, we observe illogical movements that cannot be explained from the standpoint of macroeconomics or fundamentals.

The average GBP/USD pair volatility for the last five trading days is 86 points. For the pound/dollar pair, this value is considered "average." Thus, on Friday, December 8, we expect movements within the range limited by the levels of 1.2506 and 1.2678. A reversal of the Heiken Ashi indicator back down will indicate a resumption of the downward movement.

Nearest support levels:

S1 – 1.2573

S2 – 1.2544

S3 – 1.2512

Nearest resistance levels:

R1 – 1.2604

R2 – 1.2634

R3 – 1.2665

Trading recommendations:

The GBP/USD currency pair remains below the moving average line. Therefore, today, we advise traders to consider new short positions with targets at 1.2512 and 1.2482. There will be enough significant events and publications today to influence the pair's movement, so be prepared for any movement and sharp reversals. It will be reasonable to open long positions when the price consolidates above the moving average with targets at 1.2665 and 1.2678. In the medium term, we expect a much stronger decline in the pound than it is now.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, the trend is strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the overbought territory (below -250) or oversold territory (above +250) indicates an impending trend reversal in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română