EUR/USD

A day before the release of US employment data (yesterday), markets calmed down and brushed off crisis fears – the S&P 500 rose by 1.2%, regaining lost ground from Wednesday, the dollar index decreased by 0.48%, and bond yields slightly edged higher. Now we see the market reverting back to traditional links – deteriorating US economic data reports (of course, we mean today's employment data) may support counter-dollar currencies.

In fact, this only complicates the situation – which one should be considered a false signal – Wednesday's or Thursday's? The situation is also complicated by the Bank of Japan's behavior, which just hinted at the imminent end of negative interest rate policy.

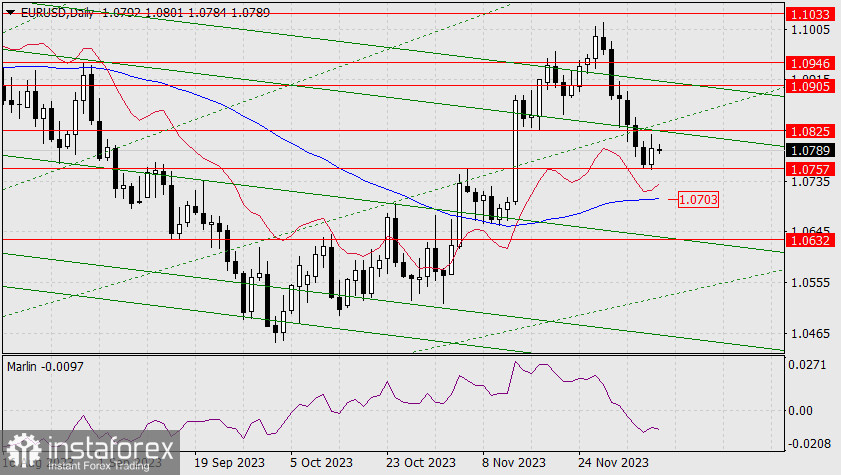

From a technical perspective, the euro remains under pressure. The Marlin oscillator weakly reacted to yesterday's growth, and the downtrend persists. Moreover, the price must consolidate above the level of 1.0825 (the November 17 low) and above the line of the price channel in order to overcome the Fibonacci ray so it can rise to 1.0905. The price no longer has time to consolidate either above resistance or below support (1.0757). A strong movement will take place. Also, technically, the goal is the MACD line at 1.0703. Breaking the support opens the target of 1.0632. If the price closes the day above 1.0825, it may climb towards 1.0905.

On the 4-hour chart, the signal line of the Marlin oscillator is on the neutral zero line. This is a sign that we are waiting for the main momentum. The price is freely wandering in the range of 1.0757-1.0825. We are waiting for the US reports.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română