As I mentioned in the previous review, the chances of seeing a tightening of the Bank of England's monetary policy after today's speech by Andrew Bailey are as likely as seeing an interest rate hike by the ECB or the Fed. In other words, zero. Bailey openly stated that there is no need for additional interest rate hikes. Inflation has dropped below 5%, which the regulator has been trying to achieve by the end of this year. Based on the understanding of this fact, the pound and the dollar are currently in equal conditions. In this case, wave analysis and economic statistics come to the forefront.

Economic statistics have not been pleasing lately, neither in the US nor the UK. The market understandably pays more attention to reports from America, so in the last month, demand for the US currency has predominantly declined. Based on this, the dollar has no chance of rising without strong statistics from America. And the current wave analysis implies an increase in the quotes of the American currency. It turns out that wave analysis and the news background contradict each other, so the pound cannot choose a direction.

In the second half of this week, almost everything will depend on news from the US. I want to remind you that we are still waiting for Nonfarm Payrolls, unemployment, and wage reports. Wages got on the list of important reports accidentally, although the Fed has repeatedly drawn attention to the importance of this indicator. Therefore, the market is waiting for payrolls and unemployment. If these reports show a negative trend again, demand for the US currency will decline even more, and wave 2 or b will become even more complicated.

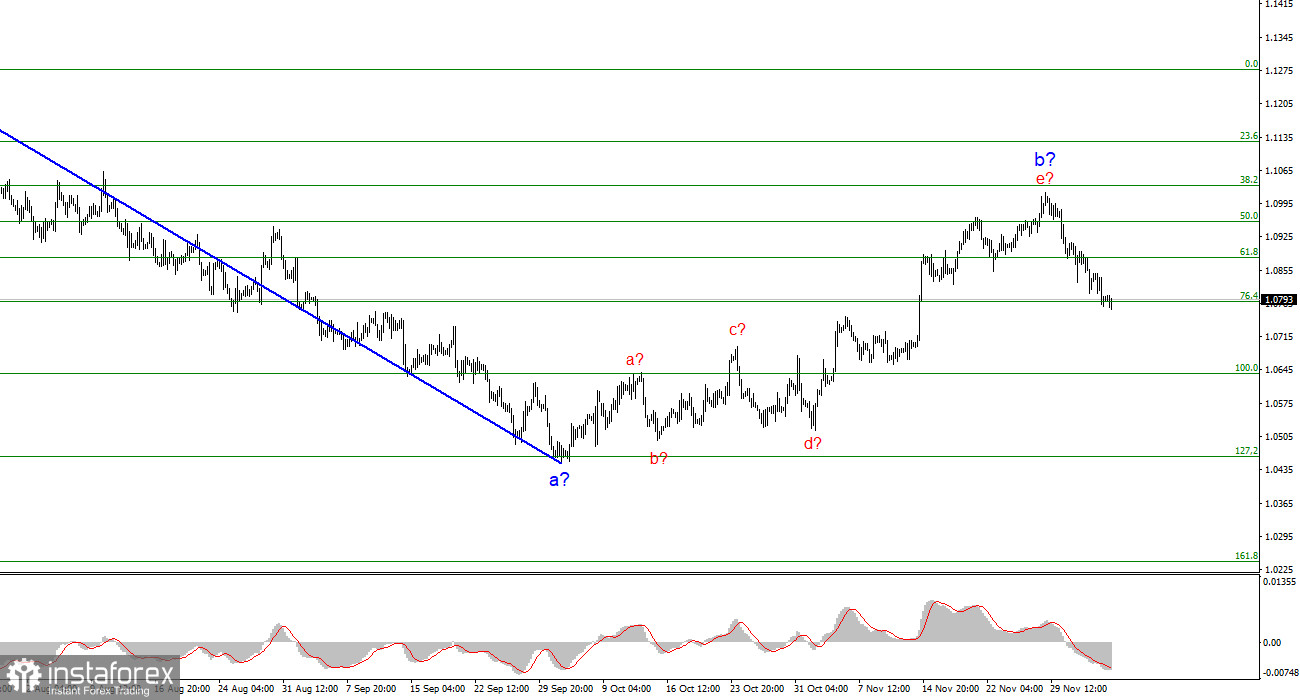

It is advisable to play the most straightforward wave structures, the forecast for which makes further movements relatively easy. If the wave structure of any trend segment constantly becomes more complicated, it brings no pleasure to sellers or buyers. Based on this, I recommend opening sales of the GBP/USD pair below important levels after unsuccessful attempts to break through significant levels. For example, now is a good moment – the pair closed below the 38.2% Fibonacci level, so a decline can be expected. Friday will be a key day this week.

Based on the analysis conducted, the construction of a bearish wave set continues. The targets around the 1.0463 level have been perfectly worked out, and the unsuccessful attempt to break through this level indicates a transition to the construction of a corrective wave. Wave 2 or b has taken on a completed form, so I expect the construction of an impulsive downward wave 3 or c soon with a significant decrease in the pair. I still recommend selling with targets below the low of wave 1 or a. At this time, wave 2 or b can be considered complete.

The wave pattern of the GBP/USD pair suggests a decline within the descending trend segment. At the moment, I recommend selling the pair with targets below the 1.2068 level because wave 2 or b should ultimately complete and may end at any moment. The longer it takes, the stronger the subsequent decline of the British pound will be. A narrowing triangle is a harbinger of the completion of the movement.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română