The S&P 500 and Nasdaq hit new all-time highs on Monday as investors looked ahead to fresh inflation data, comments from Federal Reserve Chairman Jerome Powell and the start of earnings season.

Nvidia (NVDA.O) jumped nearly 2%, Intel (INTC.O) added more than 6% and Advanced Micro Devices (AMD.O) rose 4%, lifting the Philadelphia Semiconductor Index (.SOX) 1.9%.

Traders are eyeing consumer price data on Thursday and producer prices on Friday to gauge how the Federal Reserve is progressing in its fight against inflation.

Investors worry that keeping interest rates high for too long could hurt the labor market and tip the economy into recession. They will be watching Powell's semi-annual testimony before the U.S. Senate and House committees on Tuesday and Wednesday.

Expectations for a rate cut as early as September have increased after the nonfarm payrolls report on Friday showed U.S. job growth slowed in June, pointing to weak labor market conditions.

Traders now see a more than 75% chance of a rate cut of at least 25 basis points by September, up from 60% last week, according to CME FedWatch data.

Citigroup (CN), JPMorgan Chase (JPM.N) and Wells Fargo (WFC.N) are set to kick off Wall Street's second-quarter earnings season on Friday. Citigroup shares rose 1.1%, while Wells Fargo shares fell 1%.

According to LSEG I/B/E/S, analysts expect the S&P 500 to increase its earnings per share by 10.1% in the second quarter, up from 8.2% in the first quarter.

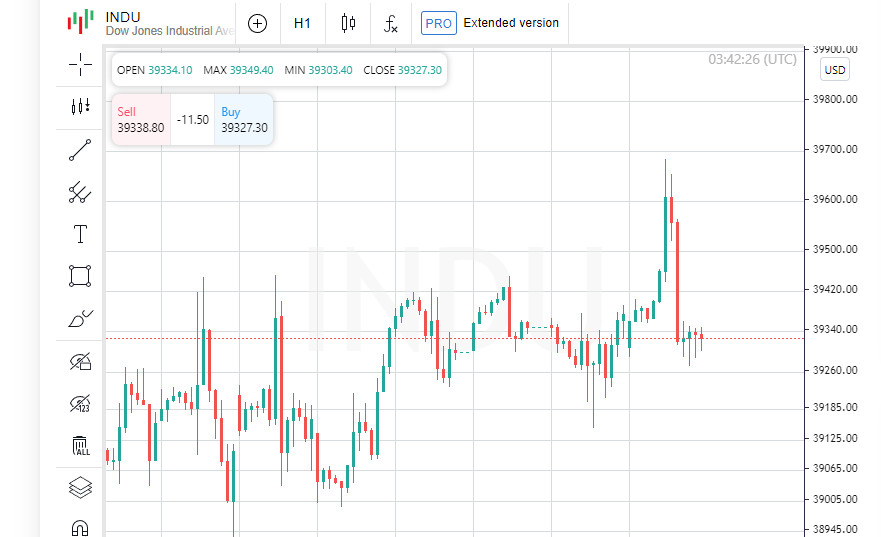

The S&P 500 rose 0.10% to close at 5,572.85. The Nasdaq gained 0.28% to 18,403.74, while the Dow Jones Industrial Average fell 0.08% to 39,344.79.

It was the fifth straight record close for the Nasdaq and the fourth for the S&P 500.

Of the 11 sectors in the S&P 500, six were lower, with the Communications Services Index (.SPLRCL) suffering the biggest losses, down 1.01%, followed by the Energy Sector (.SPNY) falling 0.59%.

Paramount Global (PARA.O) shares fell 5.3% after the company announced Sunday that it would merge with Skydance Media, opening a new chapter for one of Hollywood's oldest studios.

Boeing (BA.N) shares rose 0.55% after the planemaker agreed to plead guilty to a criminal conspiracy to commit fraud and pay a $243.6 million fine to settle a U.S. Justice Department investigation into two fatal 737 MAX crashes.

Advancing stocks outnumbered decliners in the S&P 500 (.AD.SPX) by 1.3-to-1.

Volume on U.S. exchanges was relatively light, with 10.1 billion shares traded, below the 20-session average of 11.6 billion shares.

MSCI's global equity index rose modestly on Monday, while benchmark U.S. Treasury yields rose. Investors were looking ahead to testimony from Federal Reserve Chairman Jerome Powell, as well as key inflation data and the start of corporate earnings season.

In currency markets, the euro lost ground after earlier hitting a multi-week high against the dollar, triggered by the surprise French election result.

Investors were looking to Powell's comments to Congress on Tuesday and Wednesday for clarity on whether the U.S. Federal Reserve will cut interest rates.

They were also awaiting the closely watched U.S. consumer price report on Thursday. Inflation is expected to slow to 3.1% year-on-year in June, down from 3.3% in May, with economists expecting the core rate to remain at 3.4%.

The week ends with the start of the second-quarter earnings season, with major U.S. banks Citigroup (C.N), JP Morgan (JPM.N) and Wells Fargo (WFC.N) due to report results on Friday.

Traders have increased bets that the U.S. Federal Reserve will cut rates for the first time in September, according to CME Group's FedWatch tool. The chance of a rate cut in September rose to 73.6%, up from 72.2% on Friday and 59.8% a week ago.

The small gain in the S&P 500 marked its fourth straight record close, while the tech-heavy Nasdaq hit its fifth straight record close on Monday.

The MSCI Worldwide Index (.MIWD00000PUS) finished 0.07% higher after four straight closes, hitting an intraday record earlier Monday. In Europe, the STOXX 600 (.STOXX) closed 0.03% lower.

In currency markets, the euro was slightly lower against the dollar after earlier hitting its highest since June 12.

In France, a left-wing alliance won a surprise victory in parliamentary elections on Sunday, defeating Marine Le Pen's nationalist and eurosceptic National Rally party.

"There was a small risk that France would actually start moving toward an exit from the eurozone if National Rally had won," said Helen Given, a currency trader at Monex USA in Washington. "People are just glad it's not on the table."

The dollar index, which measures the greenback against a basket of currencies including the yen and euro, rose 0.07% to 105.02. The euro was down 0.12% at $1.0823, while the dollar was up 0.05% at 160.8 against the Japanese yen.

U.S. Treasury yields were mixed as investors looked to guidance from the U.S. central bank and upcoming inflation data for June to determine the next steps for government bonds.

The benchmark 10-year yield rose 0.5 basis point to 4.278% from 4.273% late Friday, while the 30-year yield fell 0.6 basis point to 4.4628%.

The yield on the 2-year note, which typically responds to interest rate expectations, rose 3.4 basis points to 4.6327% from 4.599% late Friday.

In commodities, oil futures fell as Hurricane Beryl shut down U.S. refineries and ports along the Gulf of Mexico. Hopes for a ceasefire in Gaza also eased concerns about global crude supply disruptions.

U.S. crude fell 1%, or 83 cents, to $82.33 a barrel, while Brent ended the day at $85.75 a barrel, down 0.9%, or 79 cents.

In the precious metals market, gold prices fell as investors took profits after weak U.S. jobs data on Friday sent prices to their highest in more than a month amid hopes the Federal Reserve will begin cutting interest rates in September.

Spot gold lost 1.35% to $2,359.34 an ounce. U.S. gold futures fell 1.49% to $2,352.90 an ounce.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română