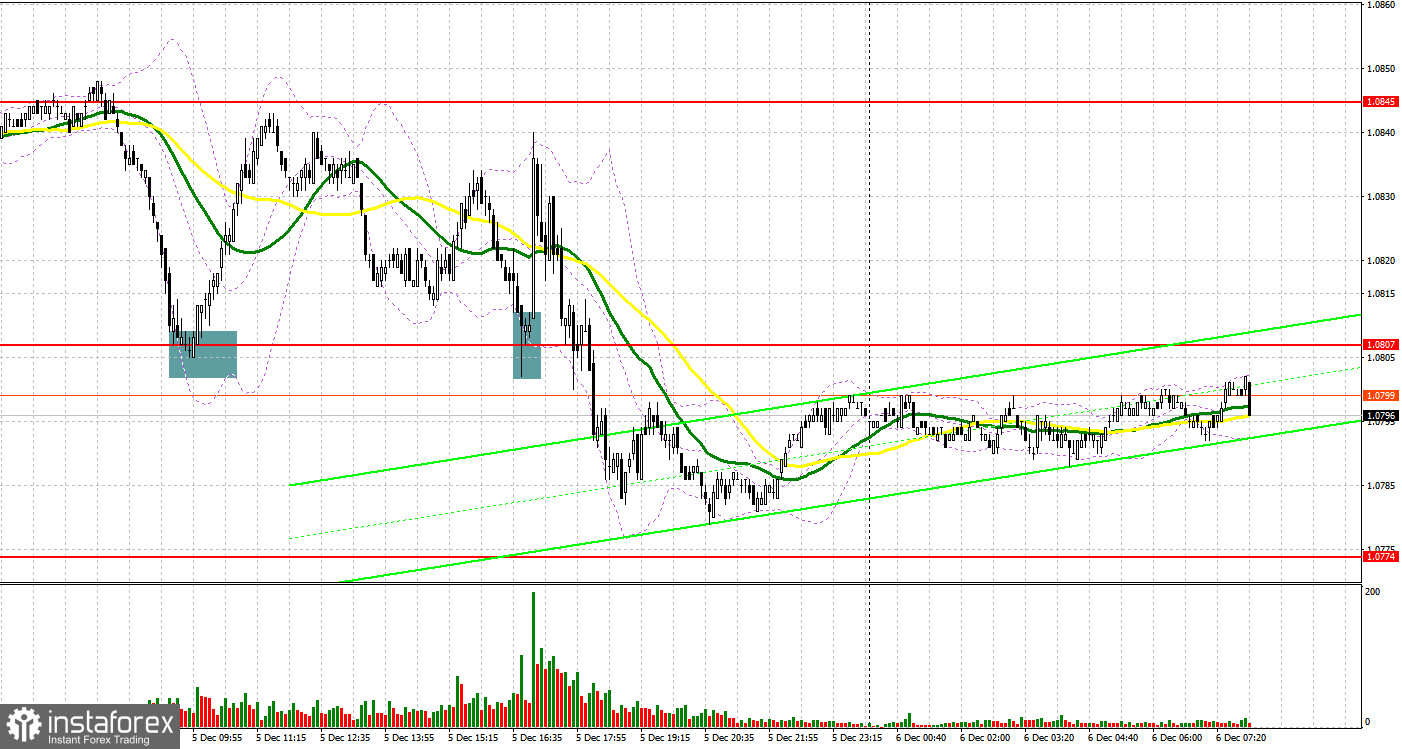

Yesterday, the pair formed some great entry signals. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0807 as a possible entry point. The decline and false breakout near this mark produced a good buy signal. As a result, the pair was up by more than 30 pips. In the afternoon, after falling to 1.0807, the bulls emerged, generating a buy signal that sent the pair up by 25 pips.

For long positions on EUR/USD:

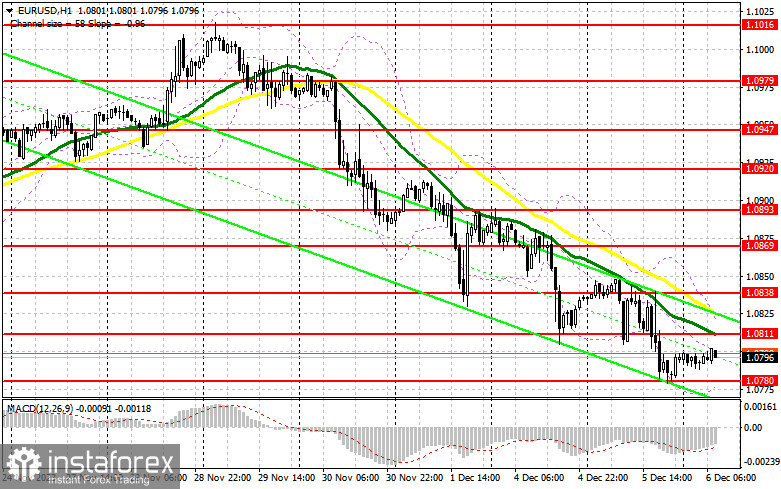

Yesterday's eurozone PMI data only provided temporary support for the single currency, afterwards the pair was under pressure again. The pair showed additional bearish bias after one of the European Central Bank officials said that inflation is actively moving towards the target value and there is no urgent need for high interest rates in the future. Meanwhile, in the futures market, traders also adjusted their expectations regarding the US interest rate cut in 2024 to later in the year, which in theory could lead to a stronger dollar. This morning, German factory orders and eurozone retail sales figures are scheduled for release. However, these are reports for October, so they are not important for the currency market at the moment. Investors may keep an eye on the speech of ECB board member Joachim Nagel, as he may confirm Isabel Schnabel's dovish stance, which I mentioned above. In case the pair falls, a false breakout near 1.0780 will generate a buy signal in anticipation of growth and a test of the new resistance at 1.0811, established yesterday. A breakout and a downward retest of this area will depend on the ECB officials' statements. This will produce a buy signal and a chance to update 1.0838, which is in line with the bearish moving averages. The highest target will be the area of 1.0869, where I will take profits. In the scenario of a decrease in EUR/USD and the absence of activity at 1.0780 in the first half of the day, the downtrend will persist, which will create more problems for the bulls. In such a case, it will be possible to enter the market after forming a false breakout near 1.0752 - a new local low. I will open long positions immediately on a rebound from 1.0722, bearing in mind an upward correction of 30-35 pips within the day.

For short positions on EUR/USD:

Sellers are in control of the market. To support the downward correction, it is necessary to keep the pair below 1.0811, and form a false breakout at this level. Slightly above this level, we have the moving averages. This will generate an excellent sell signal in anticipation of supporting the bearish market. The nearest target will be the support at 1.0780, established yesterday. Only after a breakout and consolidation below this range, amid weak eurozone data, as well as an upward retest, do I expect another sell signal at 1.0752. The lowest target will be the low of 1.0722, where I will take profits. In case of an upward movement of EUR/USD during the European session, as well as the absence of the bears at 1.0811, the bulls will try to stop the bear market and regain equilibrium. This will open the way for the pair to reach 1.0838. There, selling is also possible but only after a failed consolidation. I will open short positions immediately on a rebound from 1.0869 aiming for a downward correction of 30-35 pips.

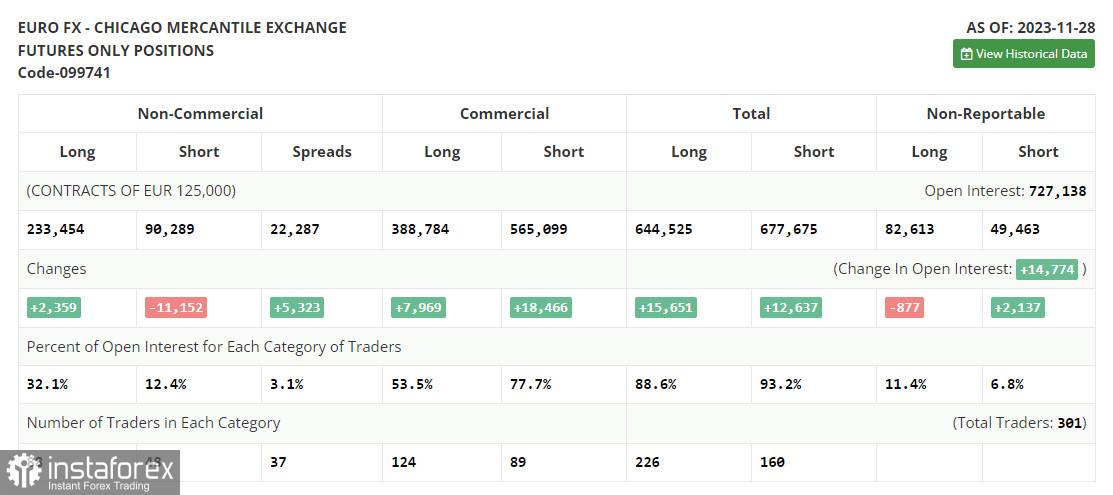

COT report:

In the COT report (Commitment of Traders) for November 28, there was an increase in long positions and another significant decline in short positions. Obviously, it appears absurd for ECB policy makers to make statements regarding high interest rates while the eurozone economy sees a contraction, and both the market and traders are laying on quite different, softer steps on the part of the central bank next year. Dovish statements of the Federal Reserve officials also affect the USD's positions, which boosts the euro. This week, the US will release a lot of important reports related to the US labor market, which will help determine the pair's direction in the medium-term. The COT report indicated that long non-commercial positions grew by 2,359 to 233,454, while short non-commercial positions decreased by 11,152 to 90,289. As a result, the spread between long and short positions increased by 5,323. EUR/USD closed higher at 1.1001 compared to 1.0927.

Indicator signals:

Moving averages:

The instrument is trading below the 30 and 50-day moving averages. It indicates that EUR/USD is likely to decline lower.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border near 1.0780 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română