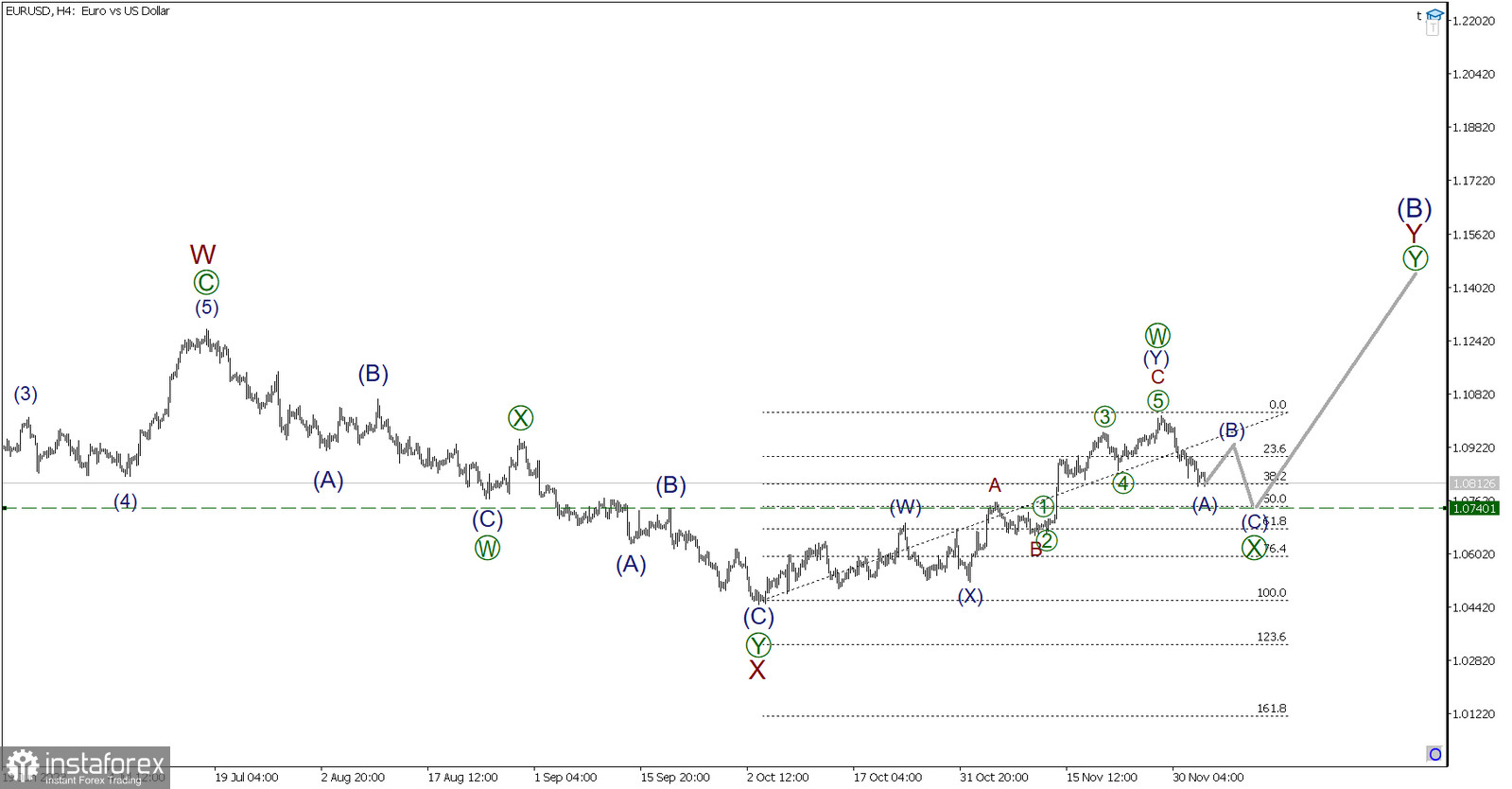

According to Elliott Wave theory, an upward wave is forming on the recent segment of the EUR/USD chart, taking the shape of a double zigzag. This is referred to as wave Y.

There is a high probability that within the ongoing wave Y, the active wave [W] has already completed, appearing as a harmonious double zigzag (W)-(X)-(Y). Following this, the market started moving downward. Presumably, a combination wave [X] is being formed. We observed a rapid decline in the first impulse sub-wave (A), and now market participants might expect a slight rise in the correction (B), followed by the final decline in the second impulse sub-wave (C).

Using Fibonacci lines, it is possible to identify the potential end of the entire corrective movement. It is possible that [X] will constitute 50% of [W], and therefore, its completion could be seen in the area of 1.0740.

This week, a series of crucial reports will be published in the United States, which will be of paramount importance for the dollar's prospects.

Upon confirmation of this scenario, it is recommended to consider opening short positions at the end of correction (B) with the target of taking profits at the end of the impulse (C).

Trading recommendation: Sell at 1.0812, take profit at 1.0740.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română