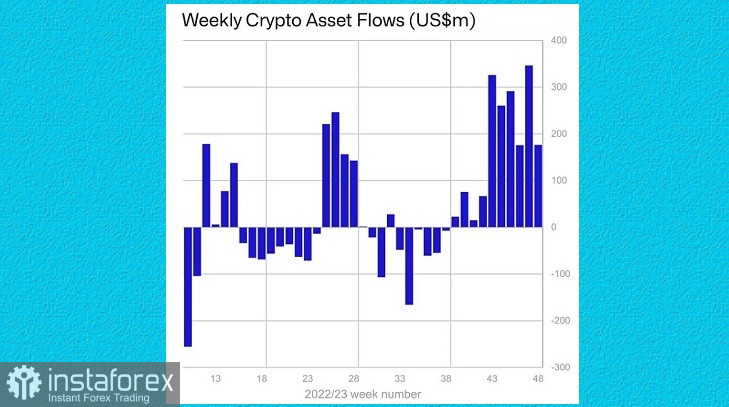

Capital inflow into digital asset investment products continued for another week, albeit at a slower pace than a week ago. According to CoinShares data, capital inflow increased by $1.76 billion in the past week, marking the eleventh consecutive week of net capital inflow. This is the longest inflow streak since October 2021, when the first Bitcoin futures-based ETF was launched in the United States.

James Butterfill, CoinShares head of research, stated that the $1.76 billion of inflows represents 4% of the total investment volume, which has increased by 107% this year.

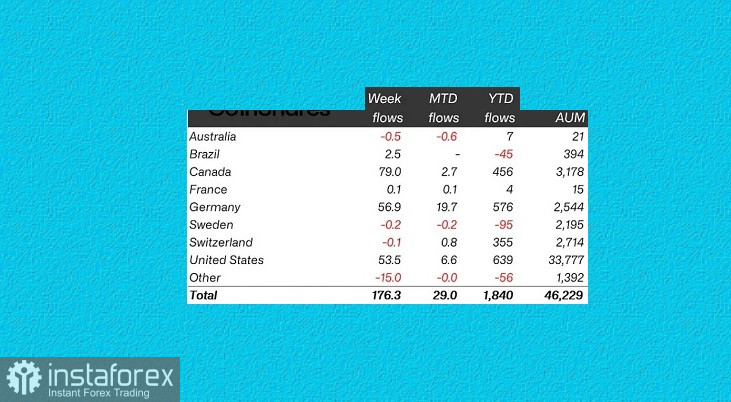

Despite more than doubling to $46.22 billion, the current volume remains significantly below the historical peak of $86.6 billion recorded in 2021. Canada saw the largest percentage of inflows, with $79 million. Products registered in Germany received an inflow of $57 million, while products registered in the United States saw a growth of $54 million.

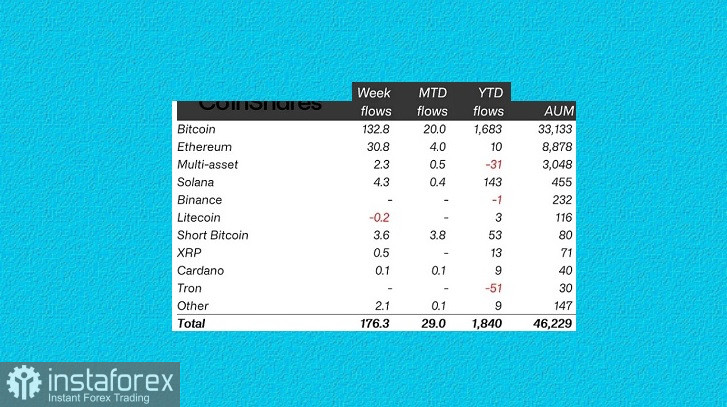

The report noted a minor capital outflow from Hong Kong totaling $15 million. However, Bitcoin remains a focal point for investors in Asia, with an inflow of $133 million.

The capital inflow observed last week, amounting to $3.6 million after a three-week outflow, suggests that a Bitcoin pullback may occur after its rise since mid-October.

Capital inflow into Ethereum has continued for five weeks, increasing by $134 million. Net flows are now $10 million in the positive for the first time this year, following an extended period of negative sentiment.

Solana saw an inflow of $4.3 million, bringing its total to $143 million since the beginning of the year.

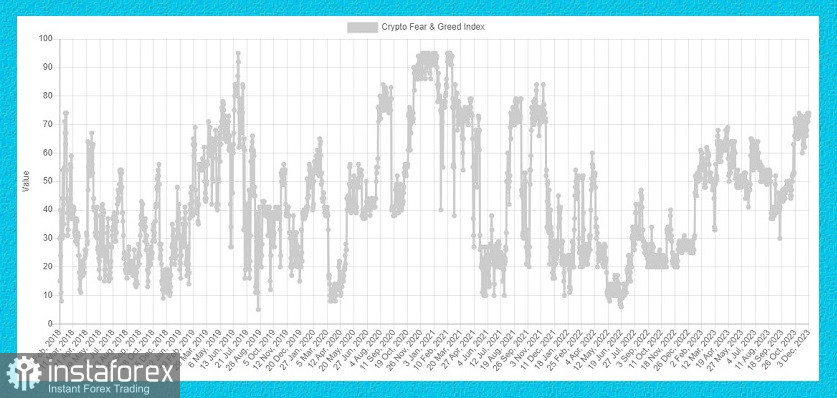

According to the Crypto Fear & Greed index, sentiment is currently in the greed territory, registering at 74 out of 100, the highest level since November 2021, when Bitcoin reached a record high of $68,790.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română