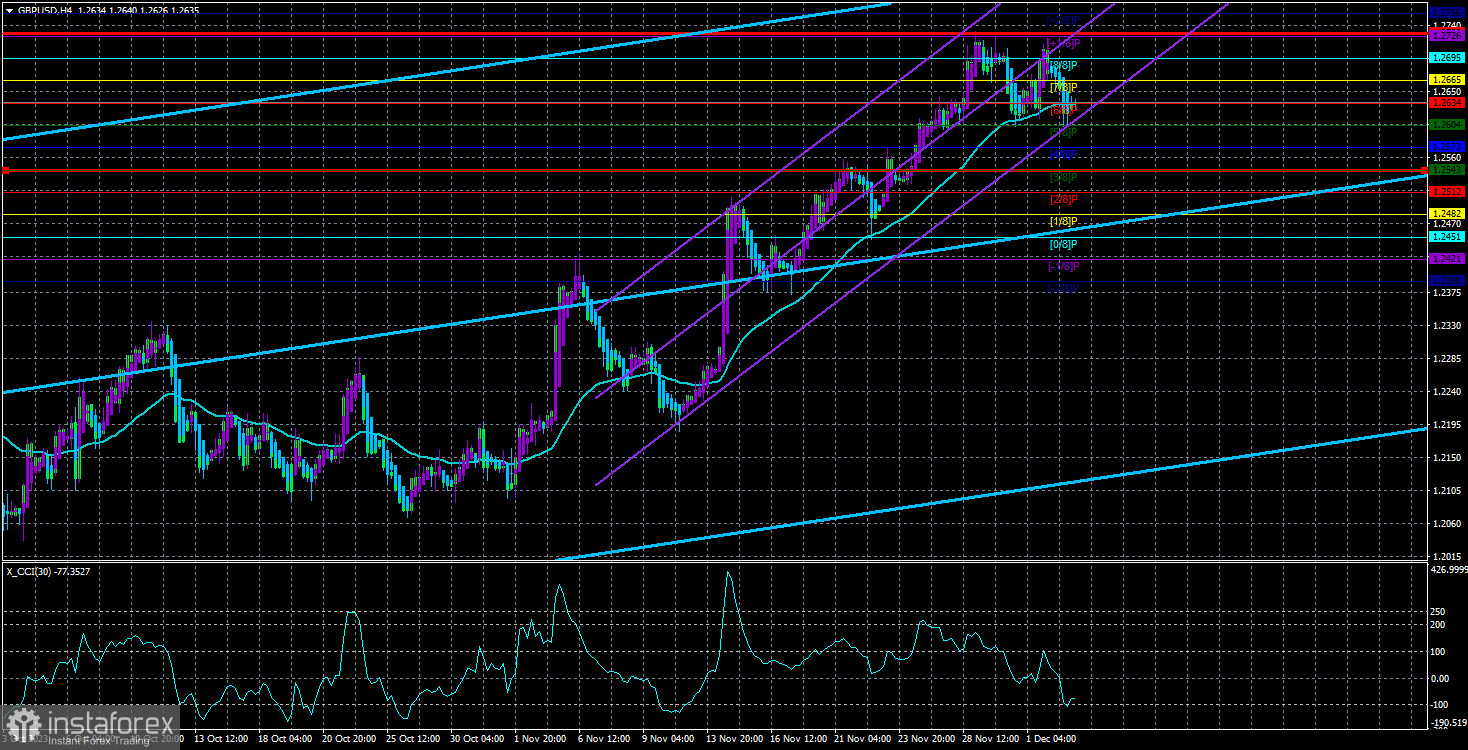

The GBP/USD currency pair again descended towards Monday's moving average. Although the price hardly corrected downward after a 650-point rise, the CCI indicator is already near the oversold zone. This is nonsense. The triple-strong overbought condition of the indicator did not even lead to a small correction, and now it is already signaling oversold conditions. However, the pound is not moving downward at all. It is evident to everyone that such behavior of the pair and the indications of the indicator are illogical. And we have been talking about this for several weeks in a row.

The British pound is currently rising almost for no apparent reason. Many analysts and experts try to invent reasons and justifications for such a movement, mentioning geopolitical conflict in the Middle East, Powell's statements, and the likelihood of tightening monetary policy in the UK and the US. All these factors now not only do not matter but are also not the reasons driving the pound and the dollar. Let's delve into this further. The geopolitical conflict in the Middle East has been ongoing for over a month, during which the dollar has been actively falling. Remember that geopolitical tension usually increases the world's reserve currency, not vice versa. There is already a discrepancy.

Furthermore, the Bank of England's rate is lower than the Fed's rate, and the likelihood of tightening policies in the UK and the US is currently zero. Despite inflation in the UK being at 4.6%, the Bank of England has not raised the rate for several months, and many of its representatives only talk about the need to keep the rate at the maximum level for an extended period. In the US, the probability of a new tightening is zero, as indicated by the FedWatch tool. Therefore, if we rely solely on facts, neither the BoE nor the Fed will raise the rate soon. Accordingly, neither the dollar nor the pound currently has an advantage based on these factors.

But the pound has been actively rising in recent weeks, and among the supporting factors for such a movement, only US statistics can be highlighted. Once again, we remind you that British statistics are not only not better than American ones but are also worse. Market participants are accustomed to the fact that despite all expectations of a recession in the US economy, each subsequent report shows excellent results. Some indicators, such as business activity, may decline, but unemployment is still low, the labor market is strong, and GDP is growing like yeast. Therefore, when weak values in important reports appear, the dollar becomes a hostage to high market expectations.

The recent decline in the US currency was unjustified, so a downward movement should follow. Unfortunately, the market often follows its own views and conclusions, and it cannot be blamed. For example, a BoE's Monetary Committee member, Dave Ramsden, states that he allows for a new rate hike. Can this factor support the pound? Theoretically, yes, but in practice, it isn't very meaningful.

The recent breakdown of votes on the rate at regulator meetings shows that the number of officials supporting new tightening is steadily decreasing. At the last meeting, there were only three out of nine. Therefore, no matter what Ramsden and his colleagues say, the majority supports keeping the rate at the current level. If so, what difference does it make how "hawkish" the comments of one or another official are if the majority supports keeping the rate at the current level? It is also important to remember that the British economy has not been growing for several quarters, and additional tightening would mean it will start contracting. The Bank of England is struggling with high inflation as best it can, and its toolkit could be more effective and diverse.

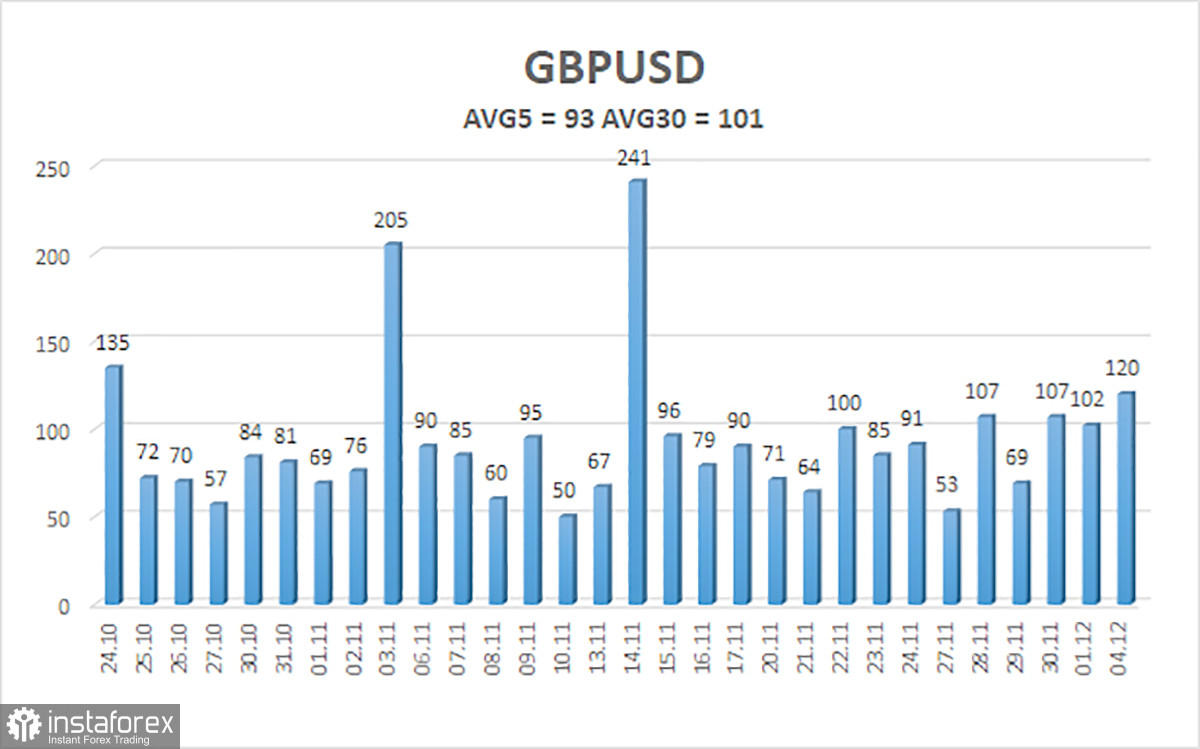

The average volatility of the GBP/USD pair for the last five trading days is 93 points. For the pound/dollar pair, this value is considered "average." Therefore, on Tuesday, December 5th, we expect movement within the range limited by the levels of 1.2543 and 1.2729. A reversal of the Heiken Ashi indicator upwards will indicate a new upturn in the uptrend.

Nearest support levels:

S1 – 1.2634

S2 – 1.2604

S3 – 1.2573

Nearest resistance levels:

R1 – 1.2665

R2 – 1.2695

R3 – 1.2726

Trading recommendations:

The GBP/USD currency pair continues to stay above the moving average. Therefore, today, we can advise traders to open new long positions with targets at 1.2695 and 1.2729 if the price bounces off the moving average again. There will be interesting reports in the US today, so one can expect a good movement during the day. It will be reasonable to consider opening short positions if the price consolidates below the moving average with targets at 1.2573 and 1.2543. From this perspective, we expect a much stronger decline in the pound.

Explanations for illustrations:

Linear regression channels help determine the current trend. If both are directed in the same direction, it means that the trend is currently strong.

The moving average line (settings 20.0, smoothed) determines the short-term trend and the direction in which trading should be conducted.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the probable price channel for the pair to spend the next day, based on current volatility indicators.

CCI indicator - its entry into the overbought area (below -250) or the oversold area (above +250) indicates that a trend reversal towards the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română