Although ECB President Christine Lagarde did not say anything new yesterday, euro continued to decline, dragging pound with it. However, much of the downward movement happened even before the speech of Lagarde, so it may be due to dollar's recent impressive rise, which could eventually trigger a rebound. For that, the upcoming data on producer prices could be a reason, especially since analysts expect to see growth in the eurozone from -12.4% to -9.5%. Such a scenario reduces the likelihood of a rate cut in the ECB this month, and the anticipation of this caused the surge in dollar demand.

EUR/USD hit 1.0800 during the correction from the resistance level of 1.1000. The scale of its movement indicates the oversold condition of the pair, so the level of 1.0800 serves as support at the moment. If the price stabilizes below 1.0800, the correction will continue.

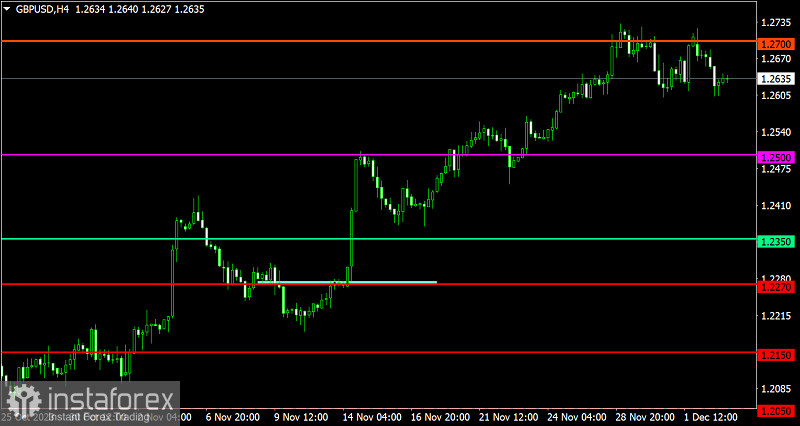

GBP/USD bounced off the resistance level of 1.2700 again, resulting in a surge in short positions. This brought the quote back to 1.2600, extending the sideways movement in the range of 1.2600/1.2700.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română