European Central Bank President Christine Lagarde didn't reveal anything interesting yesterday, except for the heart-wrenching story about how her son lost his investments in cryptocurrency. But this is not something new, as she has been using this narrative for about three weeks now. Nevertheless, despite the lack of any new developments, the single currency continued to decline. What is interesting about this is that this mainly happened before Lagarde spoke. To be more specific, it is the ongoing movement towards the US dollar's growth. However, over the past few days, the euro has been distinctly getting weaker to the point that the market would need some kind of rebound. It is quite possible that today's eurozone producer price index data, which is expected to grow from -12.4% to -9.5%, could be a reason for it. On a monthly basis, it is expected to increase by 0.1%, and this could somewhat reduce the likelihood of a rate cut this month. Such expectations have been one of the reasons why the euro has fallen so much.

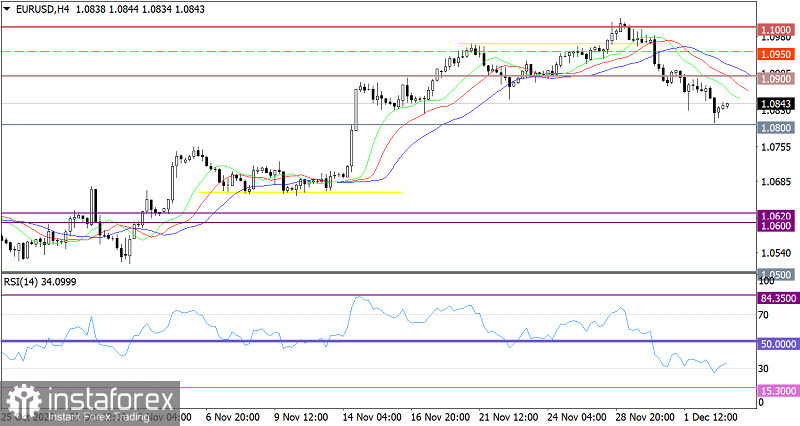

The volume of short positions on the EUR/USD pair has increased around the 1.0900 level. As a result, a new downward movement started, pushing the quote to test the local low of the correction cycle.

On the four-hour chart, low RSI levels indicate the euro's oversold conditions within the intraday period.

On the same chart, the Alligator's MAs are headed upwards, which corresponds to the corrective cycle.

Outlook

During the downward movement, the quote approached the support level of 1.0800, where the volume of short positions decreased, leading to a slowdown in the downward cycle. In order to support the corrective phase, the price must settle below the 1.0800 level. Otherwise, the euro may start a recovery process from the recent decline.

Comprehensive indicator analysis indicates a rebound from the 1.0800 level in the short-term period. Meanwhile, indicators are pointing to a corrective cycle in the intraday period.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română