EUR/USD

Higher Timeframes

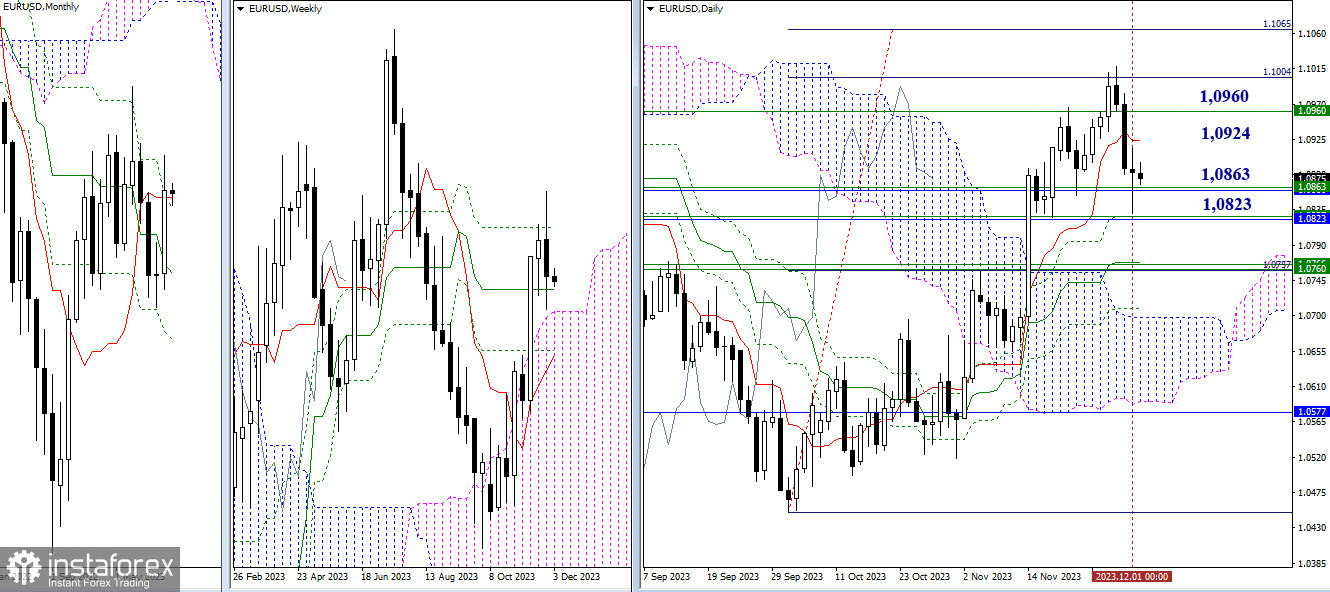

Bears tested supports on Friday, uniting weekly and monthly levels in the areas of 1.0863 and 1.0823. They could not consolidate and maintain positions, so these levels continue to serve as the nearest bearish targets. Just below lies a cluster of weekly levels and the daily medium-term trend (1.0760). Consequently, the potential for bearish sentiment development in the current market segment is tied to overcoming 1.0863 – 1.0823 – 1.0760 and securely consolidating below, allowing for consideration of new perspectives. Conversely, bulls may begin to rebuild their positions, gradually recovering the lost 1.0924 (daily short-term trend) and 1.0960 (final level of the weekly Ichimoku death cross), then focusing on achieving the daily target for breaking through the Ichimoku cloud (1.1004 – 1.1065).

H4 – H1

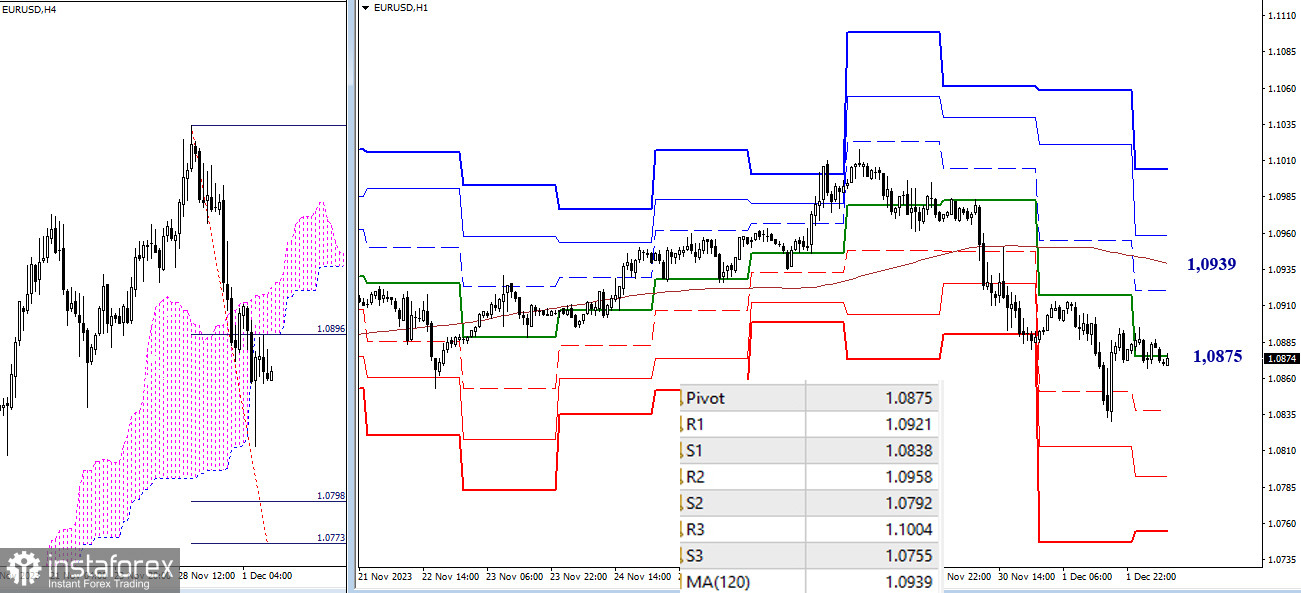

As of writing, the main advantage on lower timeframes belongs to the bears. The path to the support levels of the classic pivot points (1.0838 – 1.0792 – 1.0755) is open for them, and a bearish target for breaking through the H4 cloud is formed (1.0798 – 1.0773). The tasks for bullish players on lower timeframes now involve holding the support of the central pivot point of the day (1.0875) and realizing the ascent to the weekly long-term trend (1.0939). A breakout and reversal of the moving average will help change the current balance of power, opening up new perspectives for bulls. Today, further upward targets can be noted at 1.0958 – 1.1004 (resistances of classic pivot points).

***

GBP/USD

Higher Timeframes

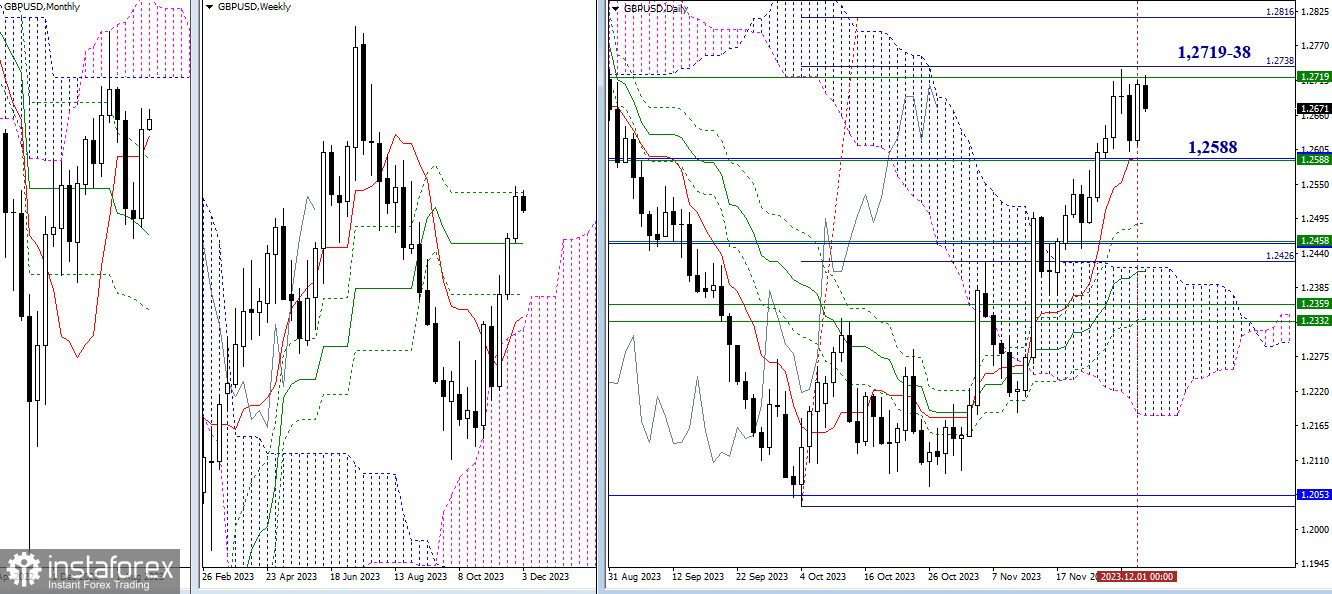

At the closing of the previous week, bulls returned to the area of important resistances 1.2719 – 1.2738 (final level of the weekly Ichimoku death cross + the first target reference of the daily target). Breaking through these levels will allow working out the daily target (1.2816) by 100%. Failure will bring bearish sentiments back into the market, and their interests will include overcoming such important support levels as 1.2588 (monthly short-term trend + weekly medium-term trend + daily short-term trend) and 1.2458 (monthly Fibonacci Kijun + weekly Fibonacci Kijun).

H4 – H1

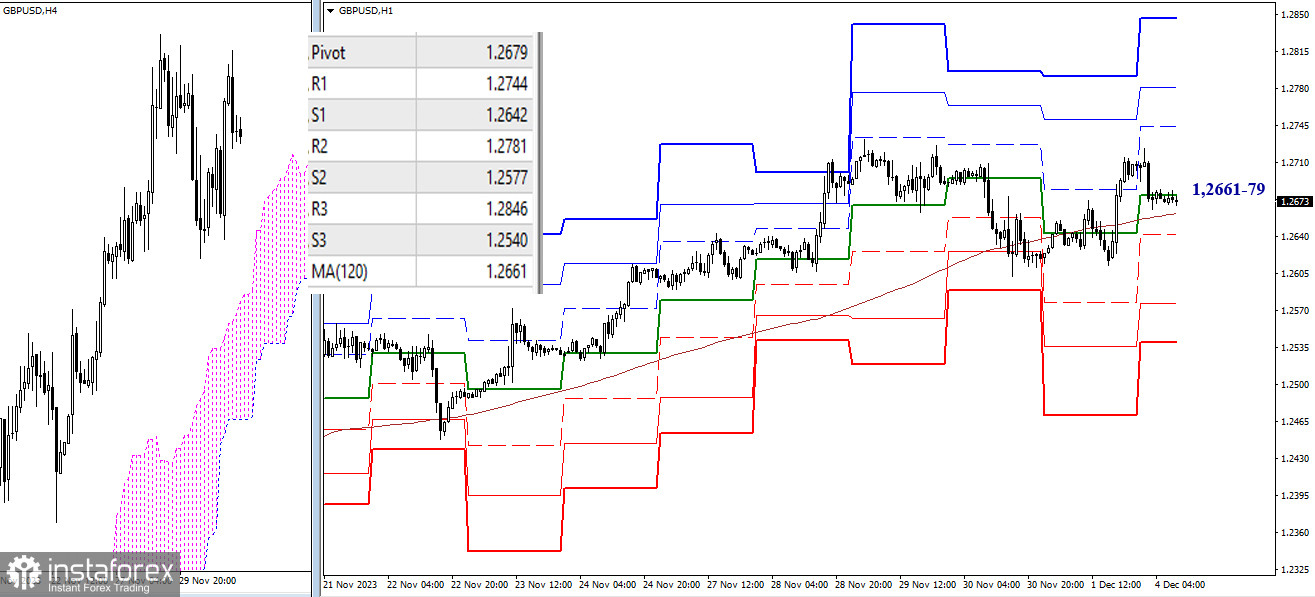

On lower timeframes, bulls are now close to losing the main advantage. To do this, the opponent needs to pass through the area of key levels, combining their efforts today in the range of 1.2661 – 1.2679 (central pivot point of the day + weekly long-term trend), firmly consolidate below, and reverse the trend. Trading above key levels maintains the advantage on the bulls' side, with intraday targets being the resistances of classic pivot points (1.2744 – 1.2781 – 1.2846). Trading below key levels will give the advantage to bearish players, with intraday targets at 1.2642 – 1.2577 – 1.2540 (supports of classic pivot points).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română