The upcoming week promises to be much more interesting than the last two. The start of the month means that the United States will publish data on the labor market, unemployment, and wages. As always, these reports will come out on the first Friday of the month. So what can we say about them now, and what should we expect?

In order to understand the dynamics of payrolls, let's look at their values for the past two years. From January 2022 to January 2023, the average payroll value was 350,000. This is a very high value, surpassed only during the post-COVID economic recovery. From January 2023, the indicator sharply dropped, and throughout this year, its average value has been just over 200,000. Three out of the last five months closed with values below 200,000. The previous month saw 150,000. The forecast for November is 180,000. As we can see, in the long term, the U.S. labor market is contracting, so we might see an unsatisfactory value at the end of November. However, payrolls tend to "jump." If the previous month was weak, the next one could be strong.

The unemployment rate is currently causing the least concern. Despite rising from 3.4% to 3.9% over the last six months, experts still consider this a "low" value. It may continue to increase as the trend is heading downwards. Still, the Federal Reserve has not raised interest rates for several meetings in a row, which could slow down the rise in unemployment.

Wages – the least important indicator. In annual terms, the growth rate of wages is decreasing, standing at 4.1% in October. The downtrend signals a slowdown in inflation, which is more of a bad thing than a good one for the U.S. currency. In the end, the first two reports are stronger, but they might present a pleasant surprise on Friday. Wages are a secondary report; the market will focus on unemployment and Nonfarm Payrolls.

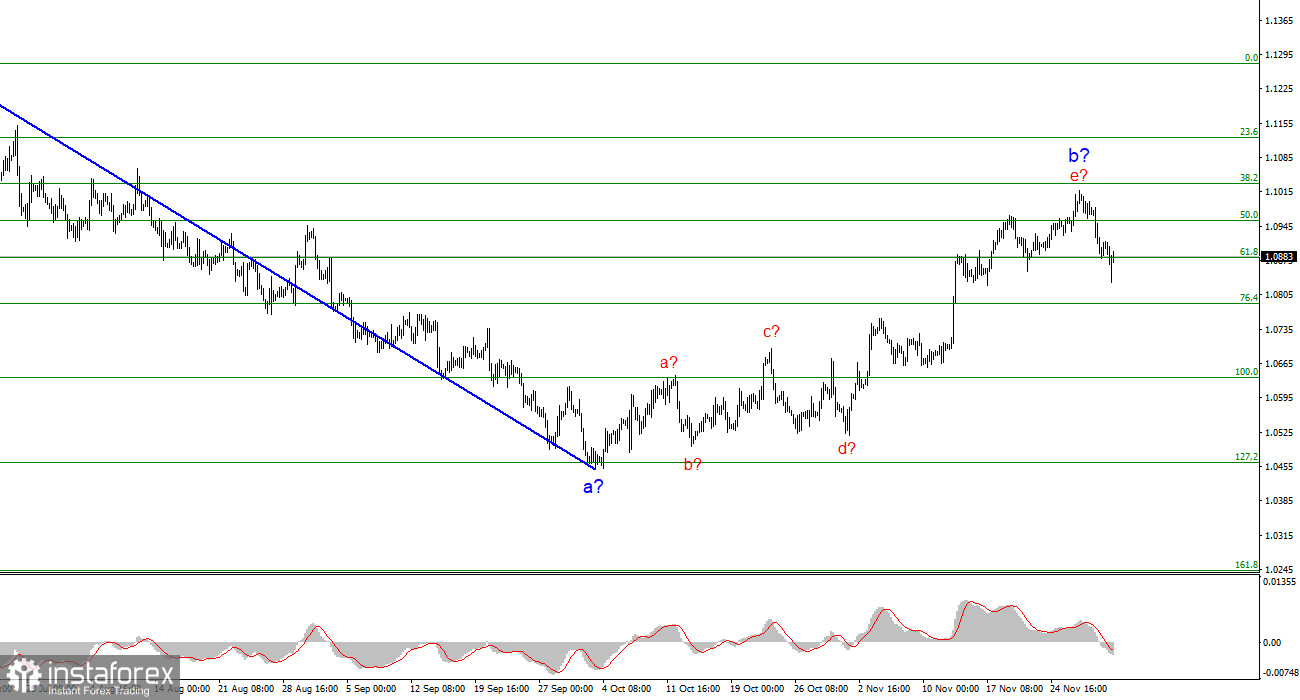

Based on the analysis, I conclude that a bearish wave pattern is still being formed. The pair has reached the targets around the 1.0463 mark, and the fact that the pair has yet to breach this level indicates that the market is ready to build a corrective wave. It seems that the market has completed the formation of wave 2 or b, so in the near future I expect an impulsive descending wave 3 or c with a significant decline in the instrument. I still recommend selling with targets below the low of wave 1 or a. But be cautious with short positions, as wave 2 or b may take a more extended form. A successful attempt to break the 1.0851 level could signal a decline in the instrument.

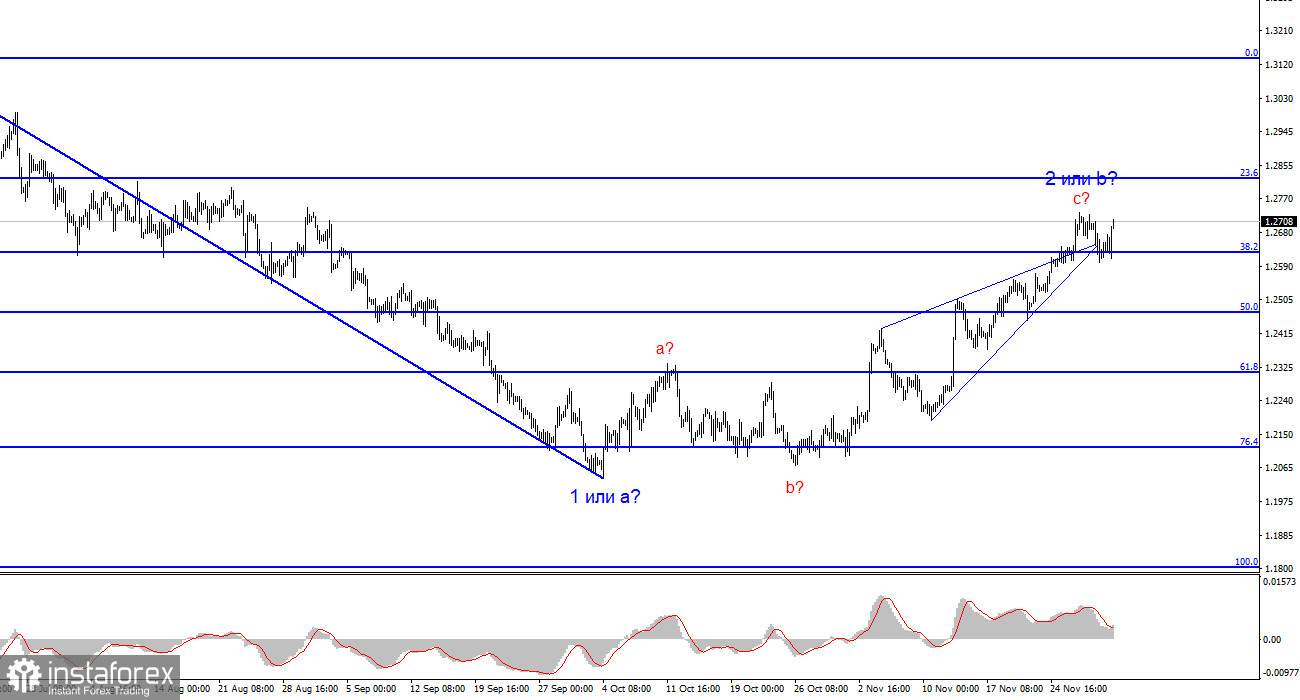

The wave pattern for the GBP/USD pair suggests a decline within the downtrend. The most that we can count on is a correction. At this time, I can recommend selling the instrument with targets below the 1.2068 mark because wave 2 or b will eventually end and at any time, and it could happen at any moment. The longer it takes, the stronger the fall. The narrowing triangle is a harbinger to the end of the movement.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română