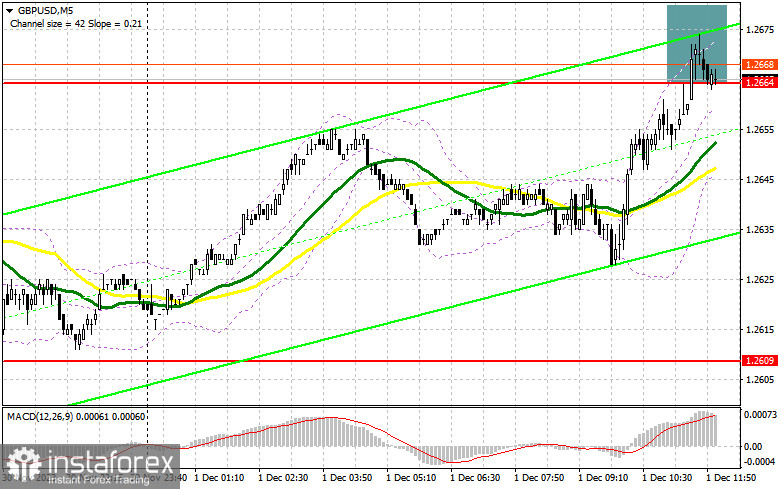

In my morning forecast, I drew attention to the level of 1.2664 and recommended making decisions on market entry based on it. Let's look at the 5-minute chart and analyze what happened there. The rise towards 1.2664 occurred, but we have not reached a false breakout so far, although all signs suggest that it may occur soon. It is crucial now for bears to show activity. The absence of it will lead to a continuation of the upward correction after yesterday's decline in the pair. Considering that the rise in the pound did not significantly affect the technical picture, I decided not to reconsider it for the second half of the day.

To open long positions on GBP/USD, the following is required:

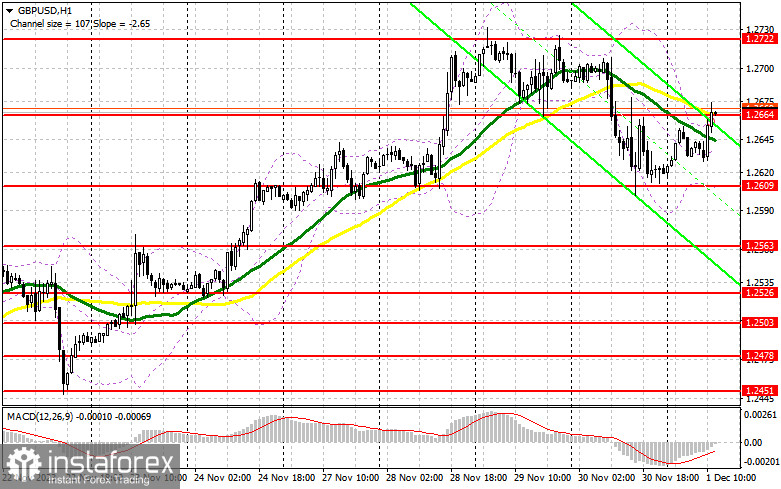

Ahead of us are a series of important statistics from the United States, which could lead to a decent rise in the pound. The ISM Manufacturing Index and its reduction will result in the continuation of the upward correction. On the contrary, the speech of the Federal Reserve Board Chairman, Jerome Powell, may return pressure on the pound, leading to a more significant sell-off with the renewal of the morning support level at 1.2609, where I plan to act for now. Only a false breakout at 1.2609 will provide an entry point for long positions with the goal of another recovery in GBP/USD and testing resistance at 1.2664, where the moving averages supporting the sellers are located. If, in the second half of the day after the data release, there is a breakthrough and consolidation above 1.2664, you can buy the pound to update the monthly maximum of 1.2722. The ultimate target will be the area of 1.2761, where I will make profits. Things will go badly for buyers in the scenario of a pair decline and no activity from the bulls at 1.2609 during the American session. In this case, only a false breakout in the area of the next support at 1.2563 will signal the opening of long positions. I plan to buy GBP/USD immediately on the rebound, only from 1.2526, to correct within the day by 30-35 points.

To open short positions on GBP/USD, the following is required:

A false breakout at 1.2664 will keep trading within the range in the second half of the day, allowing a return to 1.2609. However, the decline from 1.2609 should be rapid after the signal is formed. The hawkish speech by Federal Reserve Chairman Jerome Powell should help sellers push the pound to this level. Only a breakout and a bottom-up retest of 1.2609 will strike a more serious blow to buyer positions, leading to the removal of stop orders and opening the way to 1.2563. A more distant target will be the area of 1.2526, where I will take profits. With GBP/USD rising and no activity around 1.2664 in the second half of the day, bears will again lose control of the market, continuing the upward trend. In this case, I will postpone selling until a false breakout at 1.2722. If there is no downward movement, I will sell GBP/USD immediately on the rebound from 1.2761, but I am only counting on a pair correction down by 30-35 points within the day.

Indicator Signals:

Moving Averages:

Trading is around the 30- and 50-day moving averages, indicating market confusion in direction.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differs from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands:

In case of a decrease, the lower boundary of the indicator, around 1.2609, will act as support.

Description of Indicators:

• Moving Average (MA) is a trend indicator, smoothing volatility and noise. Period 50. Marked on the chart in yellow.

• Moving Average (MA) is a trend indicator, smoothing volatility and noise. Period 30. Marked on the chart in green.

• Moving Average Convergence/Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of an asset's price. Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands is an indicator that defines the current price volatility and the relative price position within the channel. Period 20.

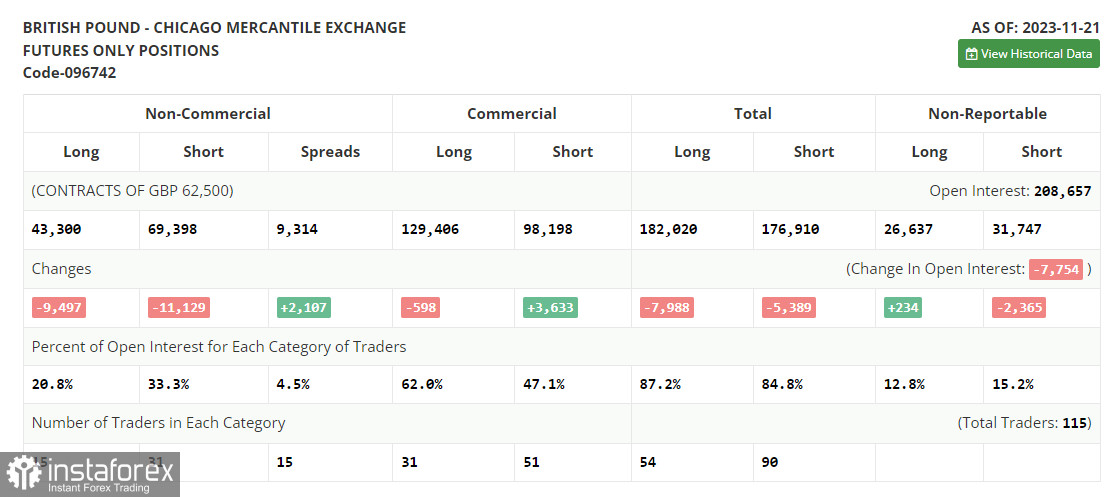

• Non-Commercial Traders - speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet certain requirements.

• Long Non-Commercial Positions represent the total long open positions of non-commercial traders.

• Short Non-Commercial Positions represent the total short open positions of non-commercial traders.

• The total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română