Analysis of EUR/USD 5M

EUR/USD finally started a downward movement on Thursday. We cannot say that this movement was good and stable, but it was fully justified. Recall that the euro (as well as the pound) had been firmly rising in recent weeks, often without any particular reasons. Although the U.S. reports have been more likely to disappoint than show good values lately, the dollar clearly did not deserve such a sharp decline. Yesterday, the eurozone and the U.S. released several interesting reports. The most significant one was the eurozone inflation data. Its value did not come as a surprise to us; inflation fell to 2.4%, lower than what experts predicted. Now the European Central Bank has absolutely no grounds to even talk about raising the interest rate in the near future. The euro fell after this report. And the single currency pulled the pound down with it, as often happens.

Speaking of yesterday's trading signals, they were not the best, but it was still possible to make a profit. The first sell signal formed when the price crossed the critical line and the level of 1.0935. After that, the pair fell by about 15 pips, which was enough to set the Stop Loss at breakeven. Thus, the Stop Loss trade was closed. Next, there was a bounce from the 1.0935-1.0956 range, so traders could open short positions again. This time the price dropped to the nearest target level of 1.0889, which was about 30 pips.

COT report:

The latest COT report is dated November 14. Over the past 12 months, the COT report data has been consistent with what's happening in the market. The net position of large traders (the second indicator) began to rise back in September 2022, roughly at the same time that the euro started to rise. In the first half of 2023, the net position hardly increased, but the euro remained relatively high during this period. Only in the last three months, we have seen a decline in the euro and a drop in the net position, as we anticipated. However, in the last few weeks, both the euro and the net position have been rising. Therefore, we can draw a clear conclusion: the pair is correcting higher, and the corrective phase has not yet ended.

We have previously noted that the red and green lines have moved significantly apart from each other, which often precedes the end of a trend. This configuration persisted for over half a year, but ultimately, the lines have started moving closer to each other. Therefore, we still stick to the scenario that the upward trend is over. During the last reporting week, the number of long positions for the "non-commercial" group increased by 8,700, while the number of short positions fell by 11,100. Consequently, the net position increased by 19,800. The number of BUY contracts is still higher than the number of SELL contracts among non-commercial traders by 109,000. In principle, it is now evident even without COT reports that the euro is set to extend its weakness. However, the corrective phase has not yet ended.

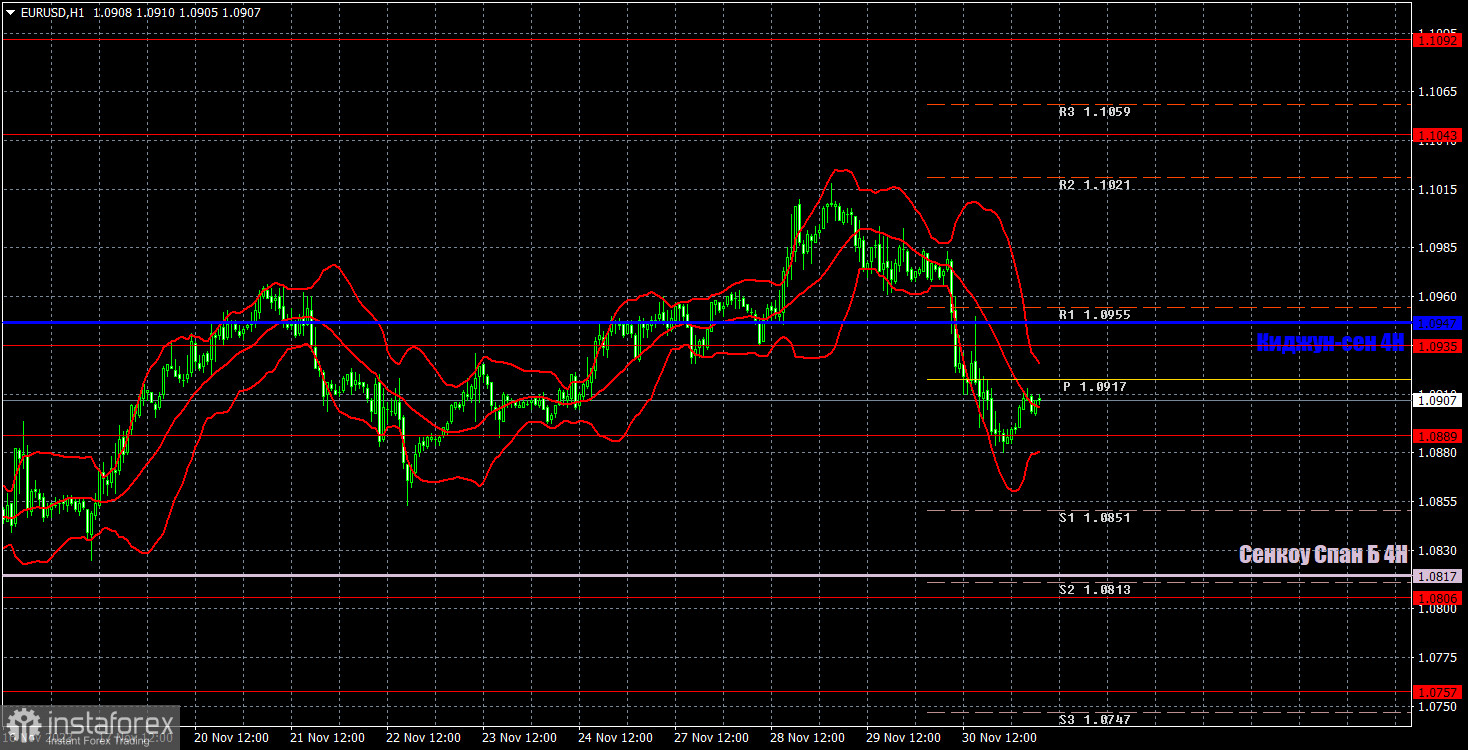

Analysis of EUR/USD 1H

On the 1-hour chart, the pair has finally started to decline and has even crossed the Kijun-sen line. Therefore, the most logical scenario would be for the pair to drop to the Senkou Span B line. In the long term, we still expect the euro to fall towards the 2nd level.

On December 1, we highlight the following levels for trading: 1.0530, 1.0581, 1.0658-1.0669, 1.0757, 1.0806, 1.0889, 1.0935, 1.1043, 1.1092, 1.1137, as well as the Senkou Span B line (1.0817) and the Kijun-sen (1.0947) lines. The Ichimoku indicator lines can shift during the day, so this should be taken into account when identifying trading signals. There are also auxiliary support and resistance levels, but signals are not formed near them. Signals can be "bounces" and "breakouts" of extreme levels and lines. Don't forget to set a breakeven Stop Loss if the price has moved in the right direction by 15 pips. This will protect against potential losses if the signal turns out to be false.

On Friday, ECB President Christine Lagarde and Federal Reserve Chair Jerome Powell will speak. Market participants will focus on the U.S. ISM Manufacturing Purchasing Managers' Index. Therefore, there will be enough events to keep the price from standing still. We believe that the euro should continue to fall with any fundamental background.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română