Not only did inflation in Europe slow down from 2.9% to 2.4%, which turned out to be stronger than expected, but European Central Bank President Christine Lagarde may have hinted that amid such a rapid and steady slowdown in consumer price growth, the ECB may consider the possibility of a rate cut. This definitively buries any prospect that interest rates in Europe will be higher than in the United States. Therefore, there are no significant reasons for the euro's growth in the long-term. On the contrary, we probably saw the beginning of a trend reversal towards the US dollar's growth.

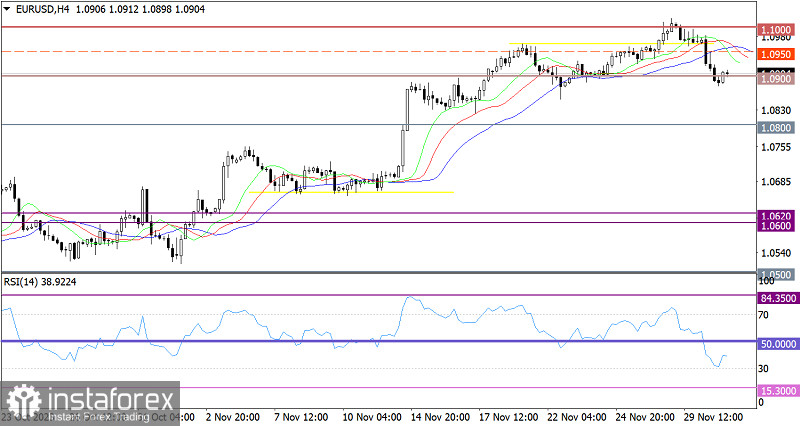

The EUR/USD pair has entered a phase of a full-fledged correction from the resistance level of 1.1000. As a result, there was an increase in the volume of short positions, and the price moved towards the level of 1.0900.

If we look at the RSI indicator, on the 4-hour chart, there is a convergence of the indicator line with the oversold level of 30. This isn't a signal of an excessive amount of short positions in the market, but everything is heading in that direction.

As for the Alligator indicator, on the same time frame, the MA lines have changed direction, indicating a slowdown in the upward cycle. In the daily period, the indicator ignores temporary corrective movements, and the MA lines are directed upward.

Outlook

In order to support the corrective move, it is necessary for the price to settle below the level of 1.0900 during the day. In this case, the price could move towards the values of 1.0850-1.0800. Otherwise, the area around the level of 1.0900 may act as support, leading to a gradual increase in the volume of long positions towards the control level of 1.1000.

Comprehensive indicator analysis indicates a corrective move in the short-term and intraday periods. Meanwhile, indicators point to the euro's recovery in the medium-term period.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română