Gold prices have slightly lost ground compared to the earlier peak above $2,050 per ounce. The market is reacting to stronger-than-expected economic activity in the third quarter.

According to the Bureau of Economic Analysis on Wednesday, the second publication of the GDP for the third quarter showed that the economy grew by 5.2%, compared to the previous estimate of 4.9%.

The report states that, primarily, the update reflected a revision towards an increase in investments in non-residential fixed capital, as well as government spending at the state and local levels, which was partially offset by a revision towards a decrease in consumer spending.

Since consensus forecasts assumed a growth of 5.0%, the activity turned out to be slightly higher than expected. In the third quarter, government spending stimulated economic growth, so this growth cannot be considered a long-term sustainable trend.

The increase in inventories and government spending explains the higher GDP revisions. At some point, when government spending slows down, this growth will be reversed, but inventories will become less predictable.

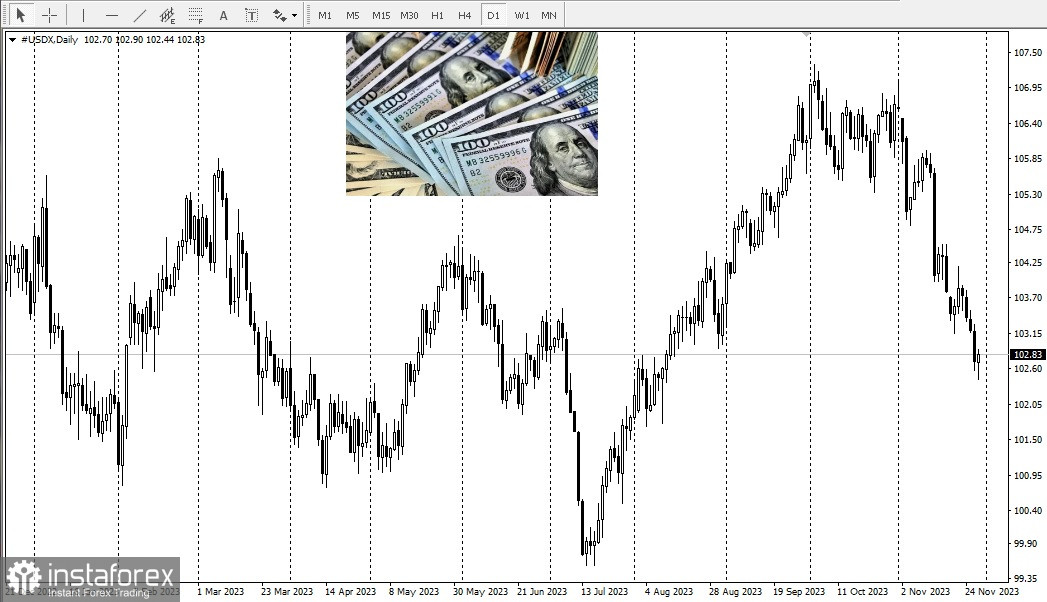

In percentage terms, the strength of the dollar is roughly three times greater than the current percentage decline in gold. Currently, the dollar has risen by 0.09%, pushing the index above yesterday's closing to the current value of 102.83. This indicates that purchases are happening incrementally, and the modest strength of the dollar has created obstacles for gold that can be easily overcome by buying gold.

While yesterday's changes in gold prices can best be characterized as moderate, key fundamental factors that initially drove gold during the last stage of this rally remain.

The widespread opinion that the Federal Reserve has likely completed an aggressive cycle of interest rate hikes that began in March 2022 persists. The next FOMC meeting is set to begin in 14 days, and currently, despite stronger than expected data, according to the CME FedWatch Tool, there is a 95.8% chance that the Federal Reserve will maintain its current interest rates. At the same time, a minor minority of 4.2% predicts a rate hike by a quarter percentage point.

However, in the last few days, a significant statement was made by a Federal Reserve member with significant voting weight—Governor Christopher Waller. Waller hinted that if the decline in inflation continues and approaches the target of 2%, the Federal Reserve may begin a cycle of rate cuts as early as the second quarter of next year. Accordingly, gold will increase its profits.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română