EUR/USD

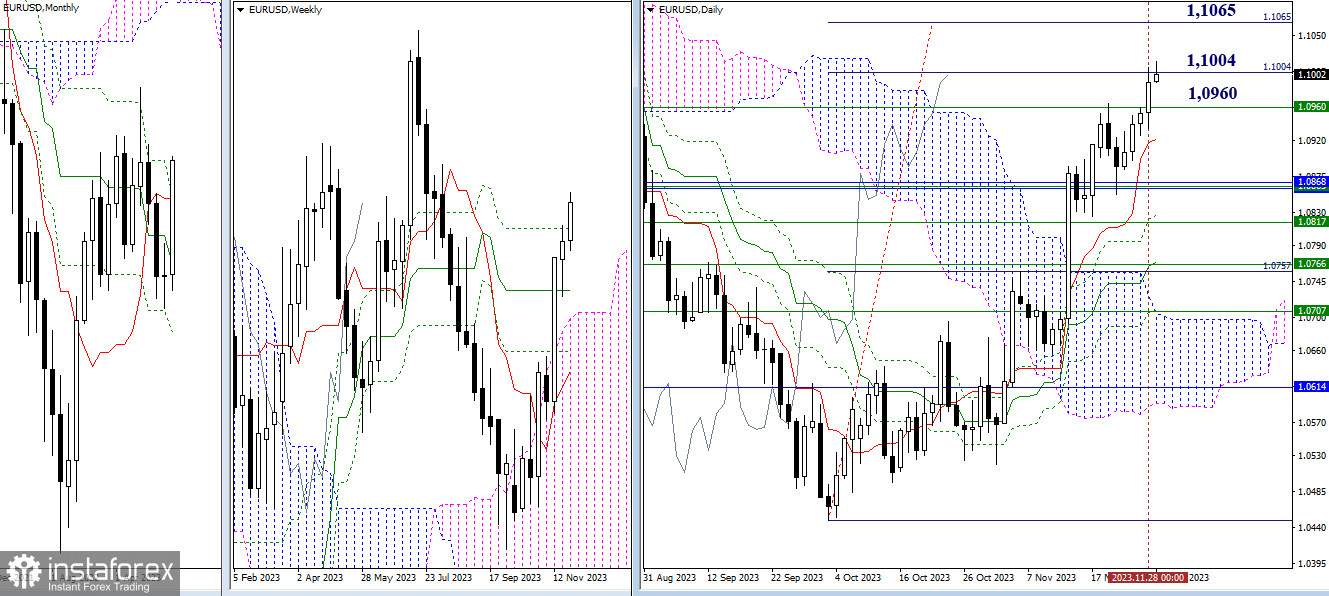

Higher Timeframes

Yesterday, bulls broke through the weekly Ichimoku cloud boundary (1.0960) and achieved the daily target for the first reference point (1.1004). Overcoming these benchmarks will likely redirect bulls' attention to a 100% fulfillment of the target of breaking through the daily Ichimoku cloud (1.1065). Failure to do so will bring the pair back into the attraction zone and influence of the final level of the weekly death cross (1.0960), and a correction to the daily short-term trend (1.0921) is also possible. Further decline could create a rebound from encountered resistances and change market sentiment.

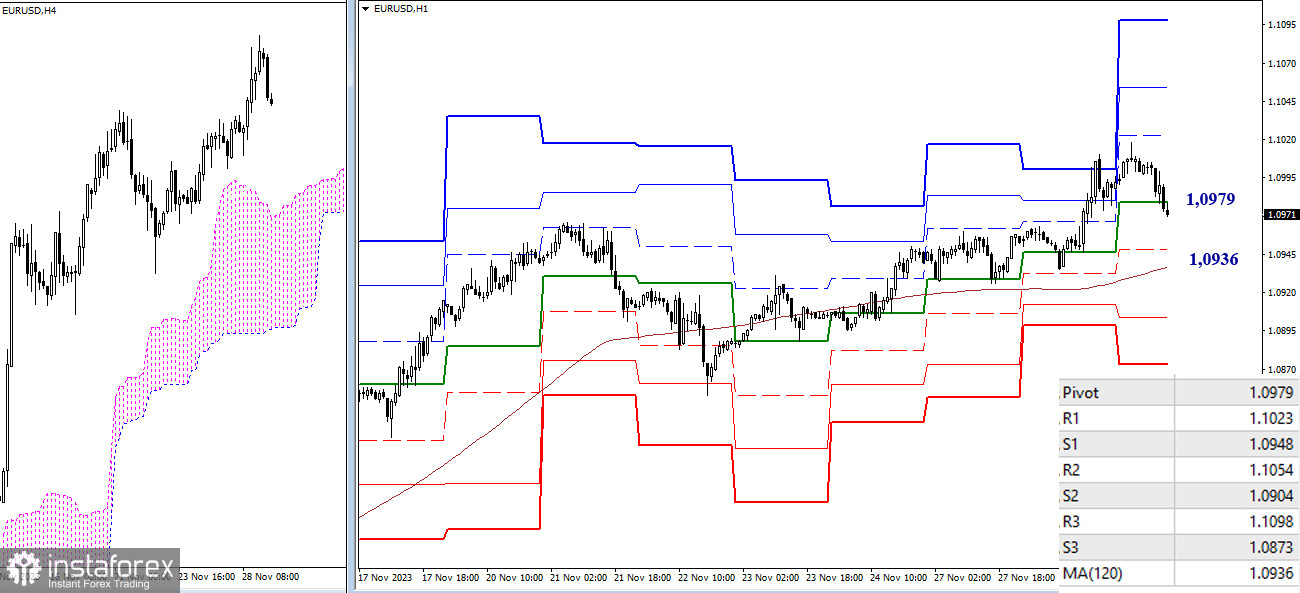

H4 – H1

On lower timeframes, bulls still have the advantage; however, opponents are currently insisting on a deeper corrective decline. The central pivot point of the day (1.0979) is currently being tested, and attention will then shift to the key level responsible for the current balance of power, located today at 1.0936 (weekly long-term trend). A breakout and reversal of the moving average will signal a possible change in sentiments for a longer period. Additional supports today may come from S2 (1.0904) and S3 (1.0873).

***

GBP/USD

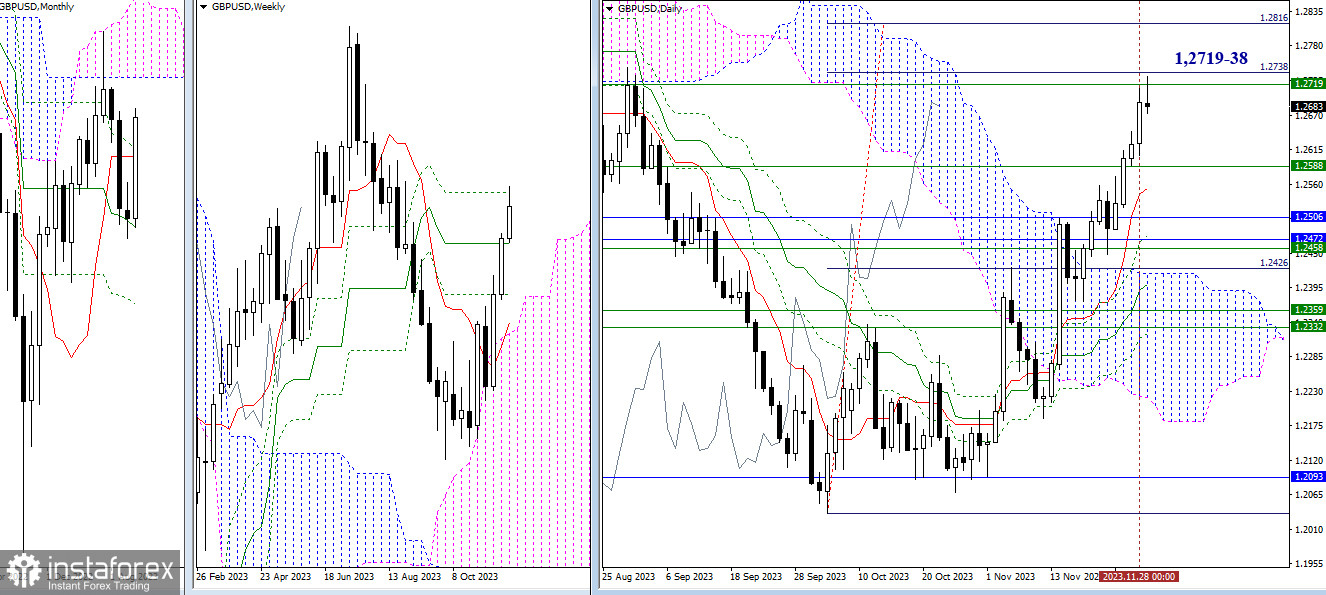

Higher Timeframes

The pound tested the attraction zone of 1.2719 – 1.2738, combining the final level of the death cross of the weekly Ichimoku cloud and the first reference point for the daily target of breaking through the Ichimoku cloud. Breaking these resistances will set the task of fully achieving the target (1.2816). If, as a result of interaction, a rebound is formed, bearish players may return to the levels passed yesterday, at 1.2588 (weekly medium-term trend) and 1.2506 – 1.2472 (monthly levels), with intermediate support on this path possibly provided by the daily short-term trend (1.2553).

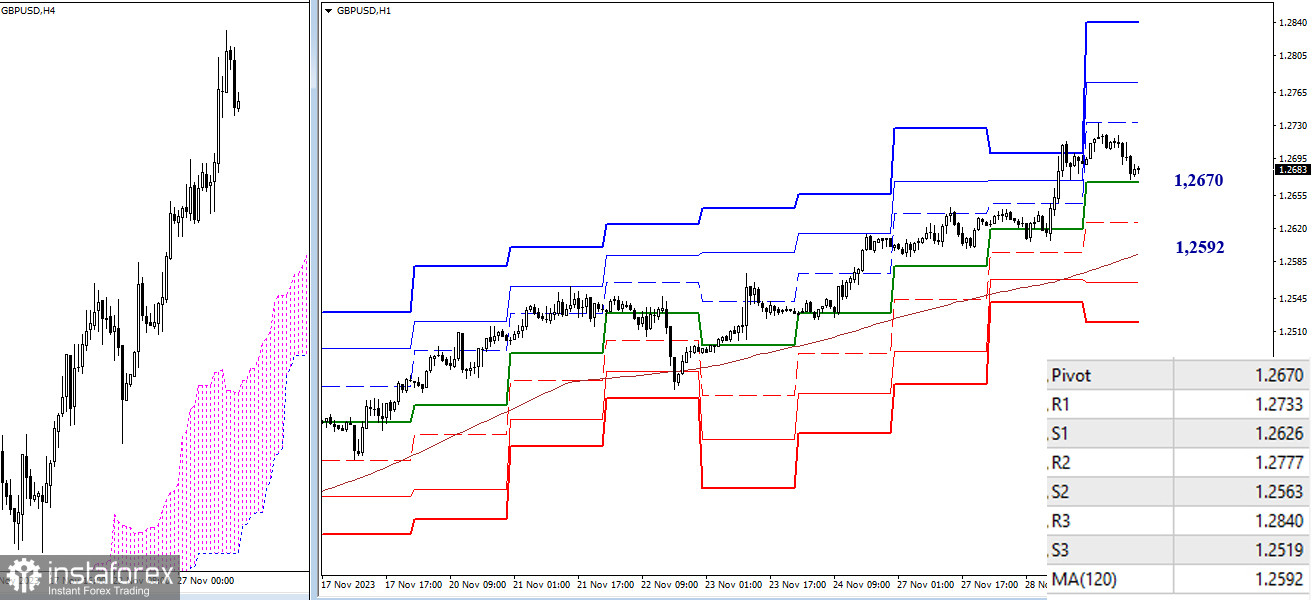

H4 – H1

On lower timeframes, the pound is currently in a downward correction zone. The central pivot point of the day (1.2670) is being tested. Bearish sentiments will intensify further on a breakdown of support S1 (1.2626), but the most significant will be the breakdown and reversal of the weekly long-term trend, which in the current situation is located at the boundary of 1.2592. Additional intraday benchmarks today are support levels S2 (1.2563) – S3 (1.2519) and resistances R1 (1.2733) – R2 (1.2777) – R3 (1.2840).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română