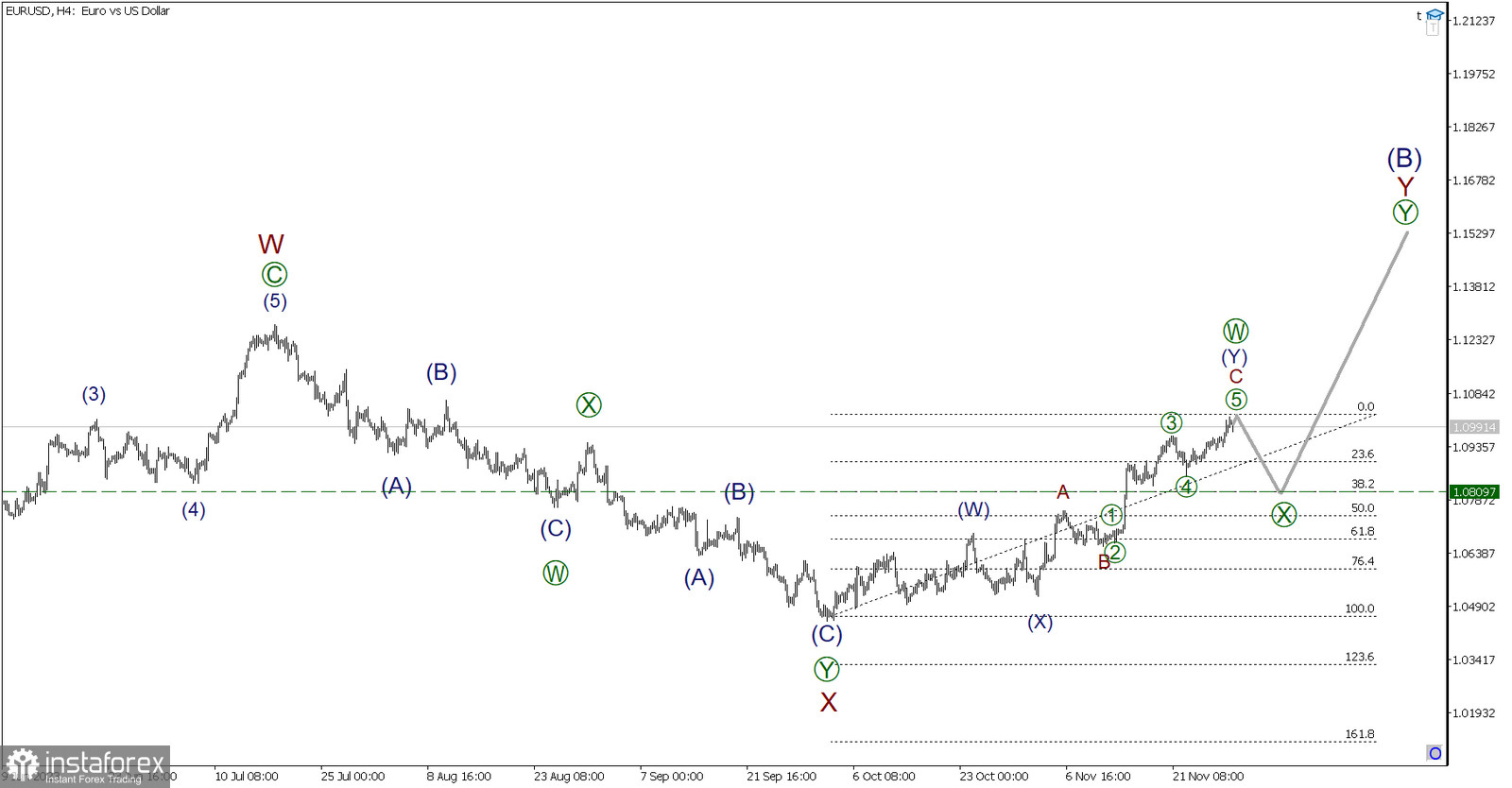

The situation in the currency pair is being analyzed from the perspective of wave analysis on a four-hour timeframe. In the medium-term outlook for the EUR/USD pair, a large corrective wave (B) is likely forming with a complex internal structure. It could well take the form of a double zigzag W-X-Y.

The first active wave W is completed in the form of a standard zigzag, after which the price corrected in a connecting wave X, which has a complex structure. Wave [X] appears to be a double zigzag [W]-[X]-[Y].

As of writing, the market is likely in the active wave Y, more precisely at its very beginning. Presumably, the current active wave [W] is being constructed, consisting of sub-waves (W)-(X)-(Y). It is possible that [W] is about to end, and market participants will witness a decrease in price in the connecting wave [X]. Today's news with GDP and crude oil inventory data could accelerate the start of the bearish wave.

In the current situation, with confirmation of the downward wave [X], opening short positions with a take-profit at the level of 1.0809 can be considered. At this price level, the magnitude of wave [X] will be 38.2% of [W]. Correction waves of this magnitude are often encountered in double zigzags.

Trading recommendations: Sell at 1.0991, take profit at 1.0809.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română