The market stood still while the economic calendar was basically empty. The scale of movement was extremely insignificant, and they led to nothing, as the day ended at the same values as it began. Today, the U.S. will release a report on housing prices, which will likely push the euro higher, as the pace of growth is expected to slow from 5.6% to 5.3%. This suggests further decline in inflation, convincing investors that the Federal Reserve will likely start easing its monetary policy in the near future.

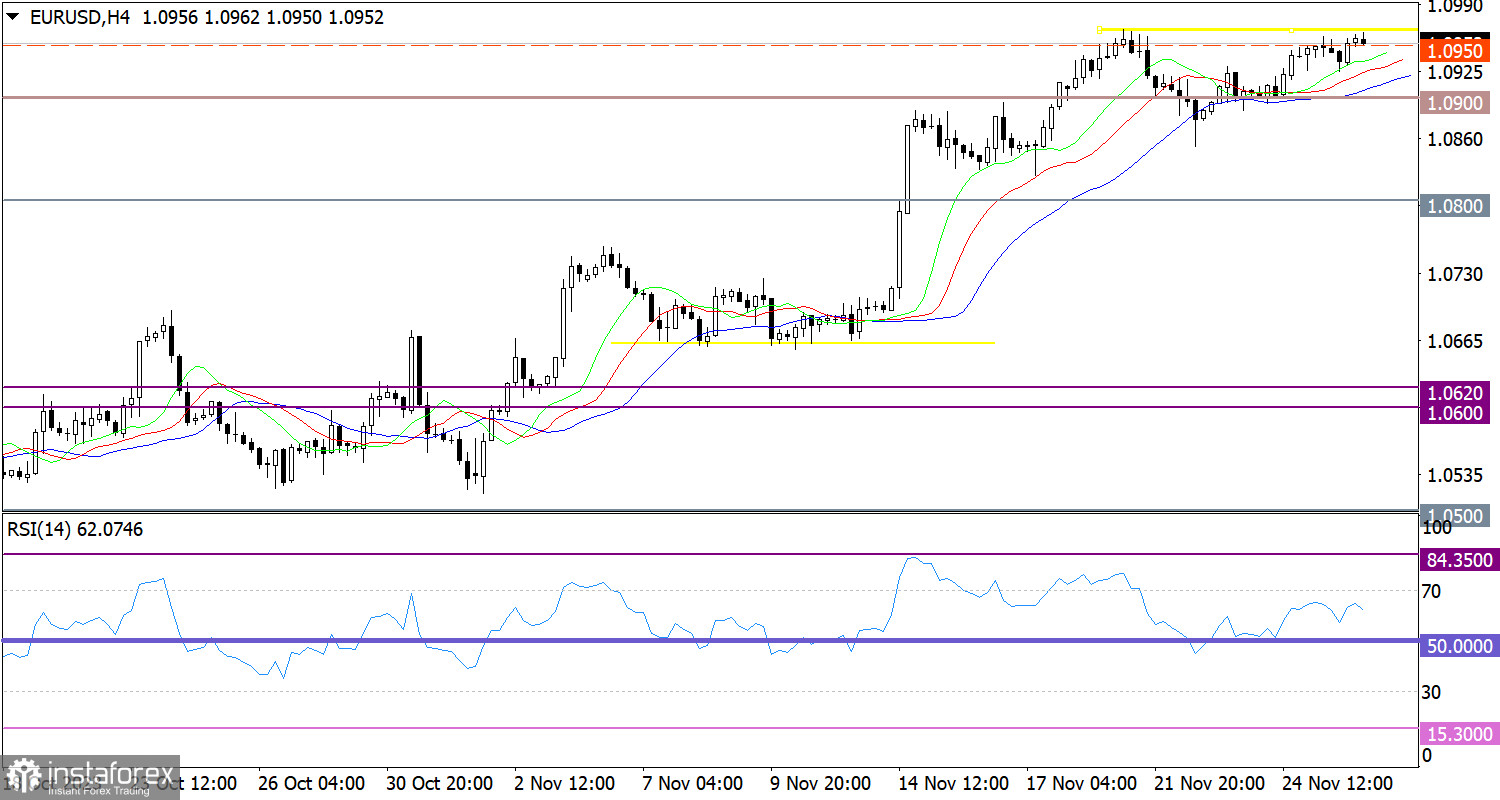

The EUR/USD pair has come close to the local peak of the upward cycle. As a result, the volume of long positions has slightly decreased, while the bullish sentiment persists.

On the four-hour chart, the RSI technical indicator is hovering in the upper area of 50/70, which points to the bullish sentiment.

On the same time frame, two out of three Alligator's MAs are directed upwards, corresponding to the price's direction.

Outlook

In this situation, keeping the price above the level of 1.0950 could lead to a test of the local high. In perspective, this movement could strengthen the euro towards the range of 1.1000/1.1050.

The complex indicator analysis revealed that in the short-term period, indicators point to stagnation, while there is a bullish signal in the intraday and medium-term periods.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română