The release of the CFTC report, due to the U.S. holiday, was moved from Friday to Monday, so we will review the speculative positioning in the futures market for major currencies on Tuesday.

Global business activity indices from S&P in the U.S., shifted from Thursday to Friday due to Thanksgiving, became the main economic data and showed a slight decrease in manufacturing and an increase in the services sector compared to expectations. Manufacturing fell back into contraction territory from 50.0 to 49.4, while the services sector rose just above 50 to 50.8 from 50.6. Since services make up about 90% of U.S. economic activity, these are more important data, but final conclusions should be reserved until the release of the ISM on Thursday and Friday. Initial data on retail sales in the holiday season were positive; some major online retailers reported sales growth of about 6% compared to last year, although, obviously, much of this growth is due to higher prices.

Commodities are trading in different directions; iron ore continues to rise further, adding about 4% for the week, while oil is currently stable amid some disagreements in OPEC+ regarding quotas for African countries. OPEC+ will meet on Thursday, and some movement is expected following the meeting.

The dollar also looks weak, and this is currently the main risk for the markets. If incoming data is also unimpressive, investors are likely to insist on a bearish bias regarding the dollar's prospects. European stock markets were trading in the red on Monday, and global yields are also declining.

EUR/USD

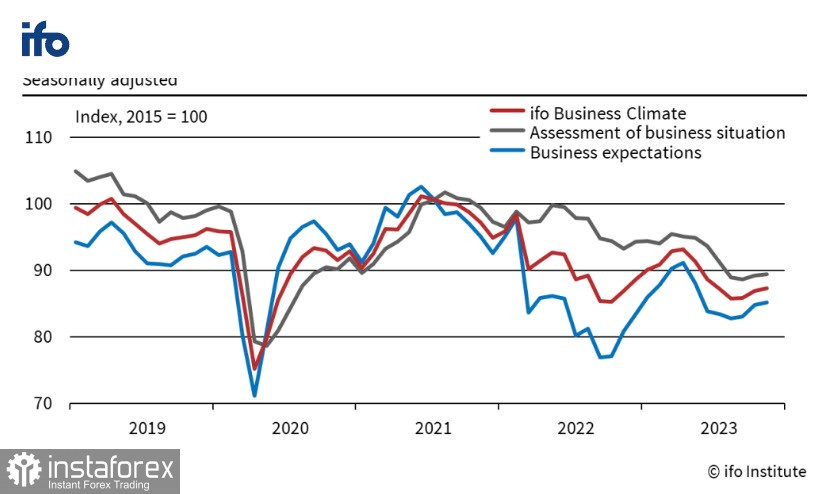

The IFO index, assessing the business climate in Germany, showed a slight increase in all three components, giving reason to hope that the economy, at least, is not declining as rapidly as before, although, in any case, it is far from the peak of 2021, and the dynamics of the last four years, as seen from the chart, have been negative.

Germany's final GDP for the third quarter coincided with the preliminary estimate, showing a decline of -0.1%, which is not yet a recession but is very close to it. European Central Bank President Lagarde confirmed that the current position of the Governing Council is to observe and wait, noting that "we have already done a lot on rates" and that "given the amount of ammunition we have used, we can observe very attentively the components of our lives like salaries, profits, like fiscal, like geopolitical developments and certainly the way in which our ammunition is impacting our economic life to decide how long we have to stay there and what decision we have to make — up or down." In other words, "I have nothing to add to what was said earlier."

On Thursday, the eurozone Consumer Price Index will be published, and a decrease in both overall and core inflation is expected.

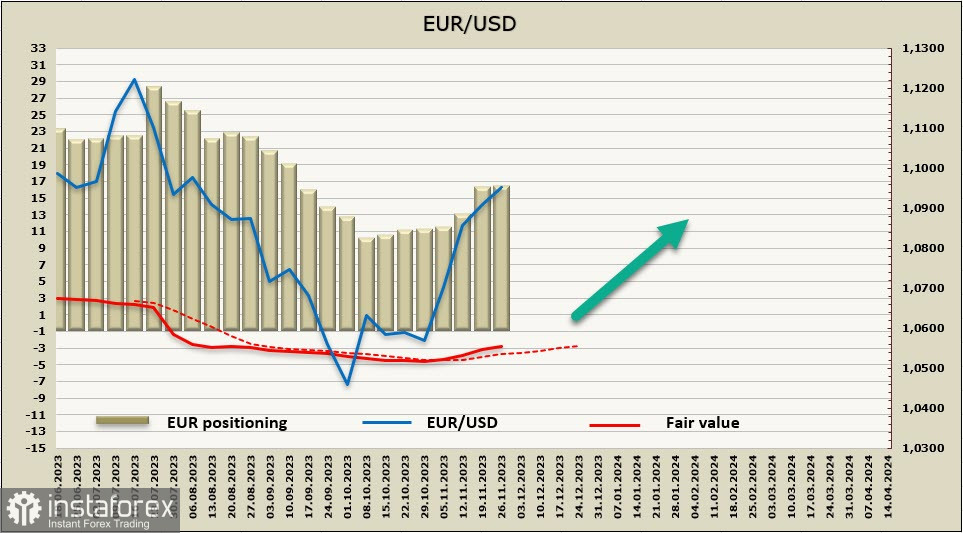

In the absence of new data from the CFTC, we primarily rely on the dynamics of the debt and equity markets. The price is still above the long-term average and is headed upward.

The euro is currently unable to develop a bullish momentum and consolidates just below the local high of 1.0966. The chances of further growth appear more substantial than a correction, with the nearest target at 1.1030/50 and support at 1.0910/20. Buying opportunities seem justified if the price falls to this level. The long-term target is 1.1276; however, the likelihood of reaching it in the short term is low. Seasonal price increases for energy sources in Europe will worsen the trade balance and exert strong pressure on the euro.

GBP/USD

The Chief Economist of the Bank of England, Huw Pill, gave an interview to FT, the essence of which was that the BoE will not yield in the fight against inflation, despite signs of the UK economy getting weaker. Internal inflationary pressures, such as wage growth and inflation in the services sector, remain "at a very high level," Pill said. He then made a rather strange statement, declaring that "... any signs of a slowdown in economic activity are caused not by a decrease in demand but by a lack of supply." In other words, according to Pill (and with a high probability, according to the BoE's Monetary Policy Committee), demand remains as strong as ever, suggesting that monetary policy tightening could still continue. Such a remark supports the pound and allows it to attempt further upward movement.

Overall, the UK economy has been more resilient than expected, and has even managed to avoid a recession. However, the Treasury, in its budget forecast presented to Parliament, revised its inflation forecasts to 3.6% in 2024 and 1.8% in 2025 and expects the economy to grow even more slowly over the forecast period, with real GDP growing by just 0.5%.

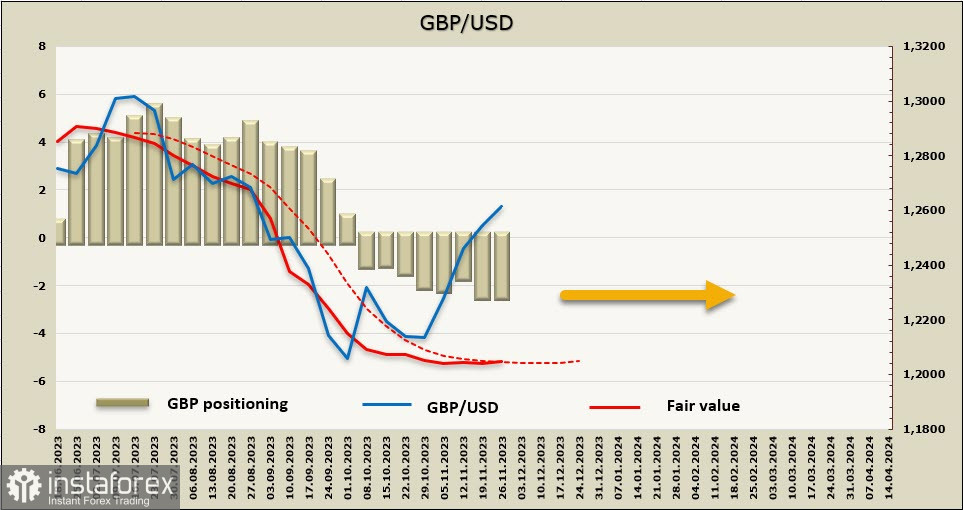

In the absence of new CFTC data, we can say that the price has completely lost momentum and has no direction.

The pound is trying to turn the corrective growth after the decline in July-September into a full-fledged bullish momentum and build on the success, but this movement has rather dubious grounds if we look at fundamental data and is mostly a reaction to the weakening prospects of the dollar. Resistance is the technical level of 1.2718 (61% extension from the fall), the pound can rise to this level in development of the current momentum, a more likely scenario looks like a consolidation and transition to the sideways range.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română