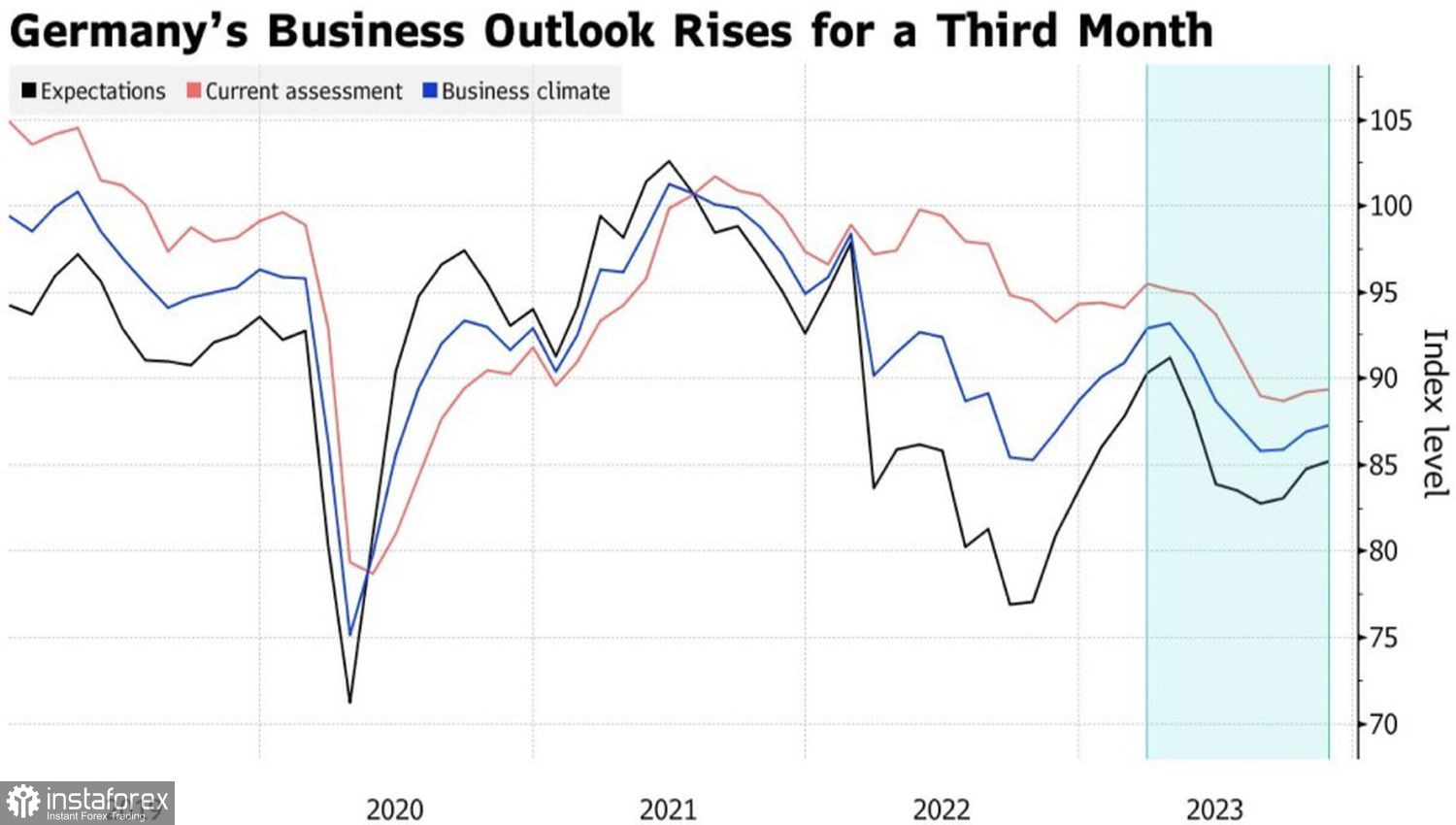

Improvements in business climate indices in Germany and the risk-friendly statement from Christine Lagarde that ECB rates will remain at a plateau for an extended period allowed EUR/USD to consolidate above 1.09. However, without the support of U.S. stock indices closed for Thanksgiving, the main currency pair is not in a hurry to move up. It's time to assess the situation and consider whether there are too many paradoxes in the Forex market.

Dynamics of German Business Climate Indicators

In November, U.S. stocks and bonds rose, and the U.S. dollar weakened. This is happening as the futures market incorporates the idea of a reduction in the federal funds rate in 2024. Investors' focus is on the idea of a soft landing. Supposedly, the Fed will manage to reduce inflation to 2% without a recession. The problem is that if monetary policy does not restrain economic growth, it is not tight enough.

This can lead to either accelerated GDP growth or an increase in the inflation rate. In both cases, the Federal Reserve will be forced to resume the cycle of monetary restriction, providing support for "bears" on EUR/USD. Both scenarios, whether it be an overheated economy or a potential recession due to an excessively high federal funds rate, are good for the U.S. currency. According to the dollar smile theory, the USD index rises when things are going well with the United States or, conversely, amid a decline as a safe-haven currency.

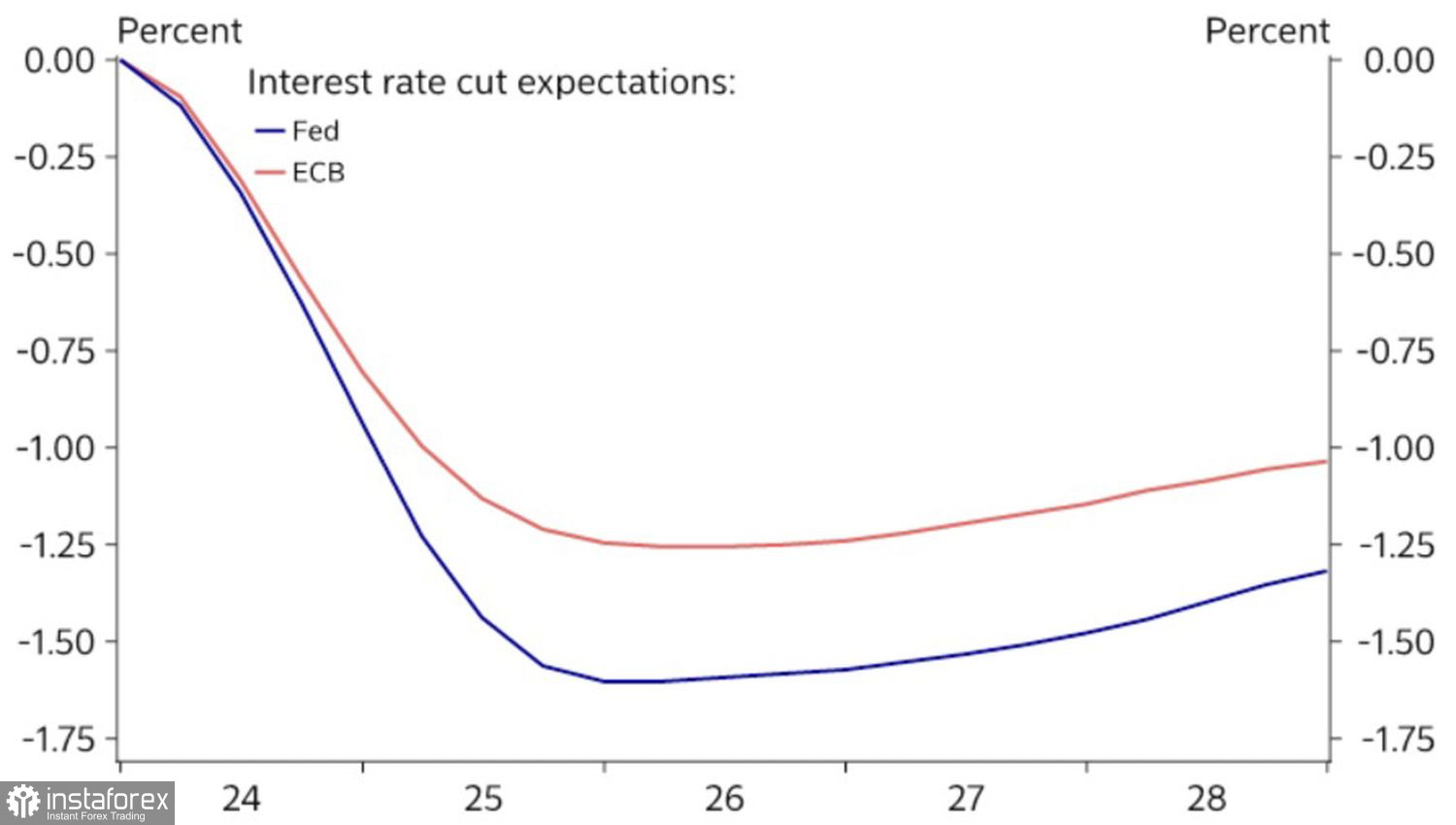

Thus, the idea of reducing borrowing costs due to a soft landing looks paradoxical. The second paradox is the approximately equal estimates of the pace of monetary expansion by the Federal Reserve and the ECB. Derivatives expect the first sharp cut in the federal funds rate in May and the deposit rate in April. By the end of the year, both will decrease by 100 basis points—to 4.5% and 3.5%, respectively.

Market Expectations for Fed and ECB Rates

However, the European economy looks significantly worse than the American one. It likely entered a technical recession in the second half of 2023. In contrast, the U.S. GDP expanded an impressive 4.9% in the third quarter. Economic weakness also points to weaker inflation. In the Eurozone, it has already fallen below 3%. If the trend continues, the ECB will start the cycle of monetary expansion faster than the Federal Reserve. And this is bad news for EUR/USD.

Thus, the rise of the main currency pair due to expectations of monetary stimulus from the world's leading central banks and the associated global risk appetite raises questions. There are chances that investor greed will push the euro even higher; however, it may need to slow down.

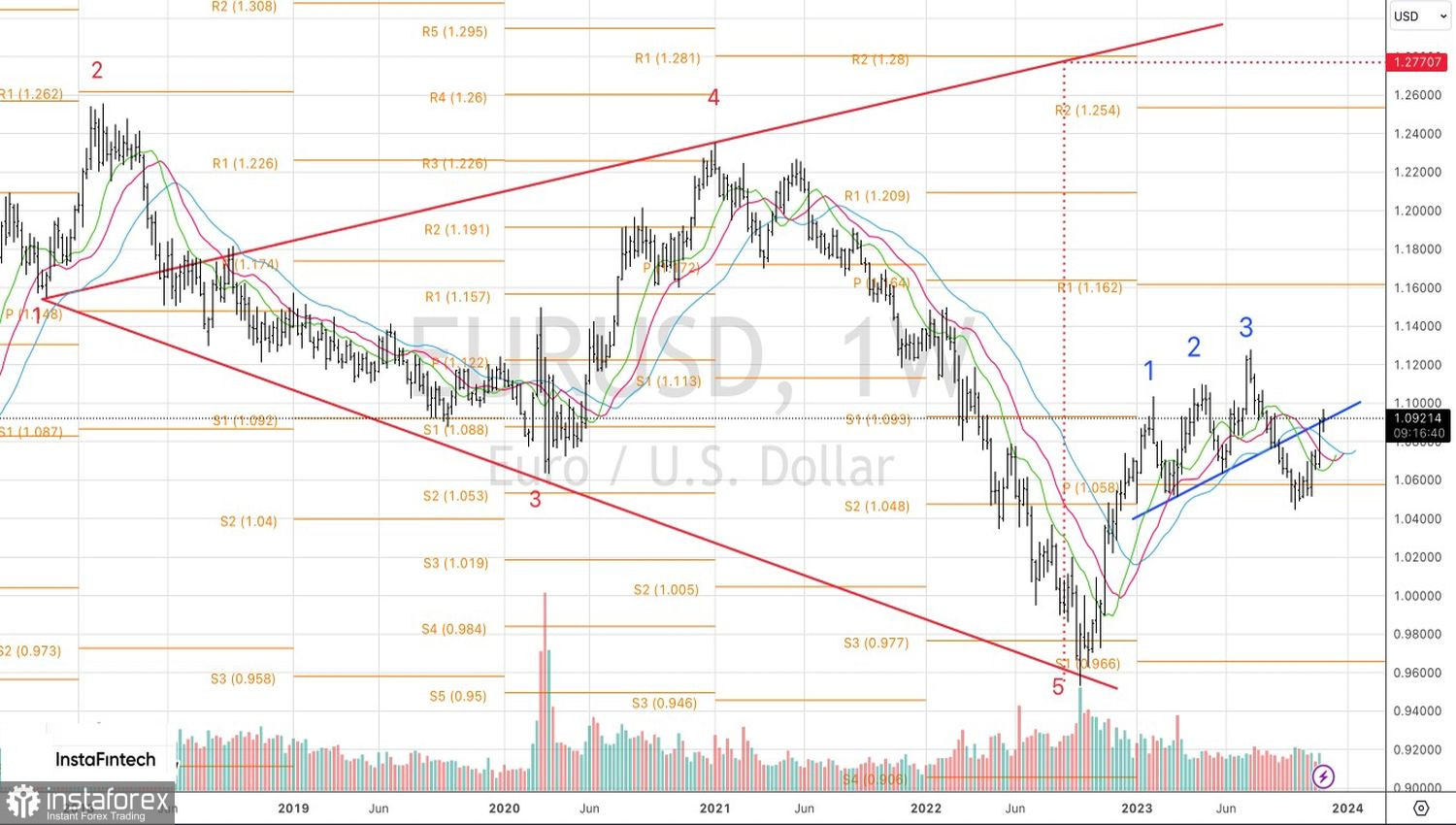

Technically, on the weekly chart of EUR/USD, events are unfolding within the framework of Price Action patterns. Three Indians have already played out, but a rebound from resistances at 1.094 and 1.113 will form another—1-2-3. After that, a pullback down will follow, which should be used to open long-term longs according to Wolfe Waves.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română