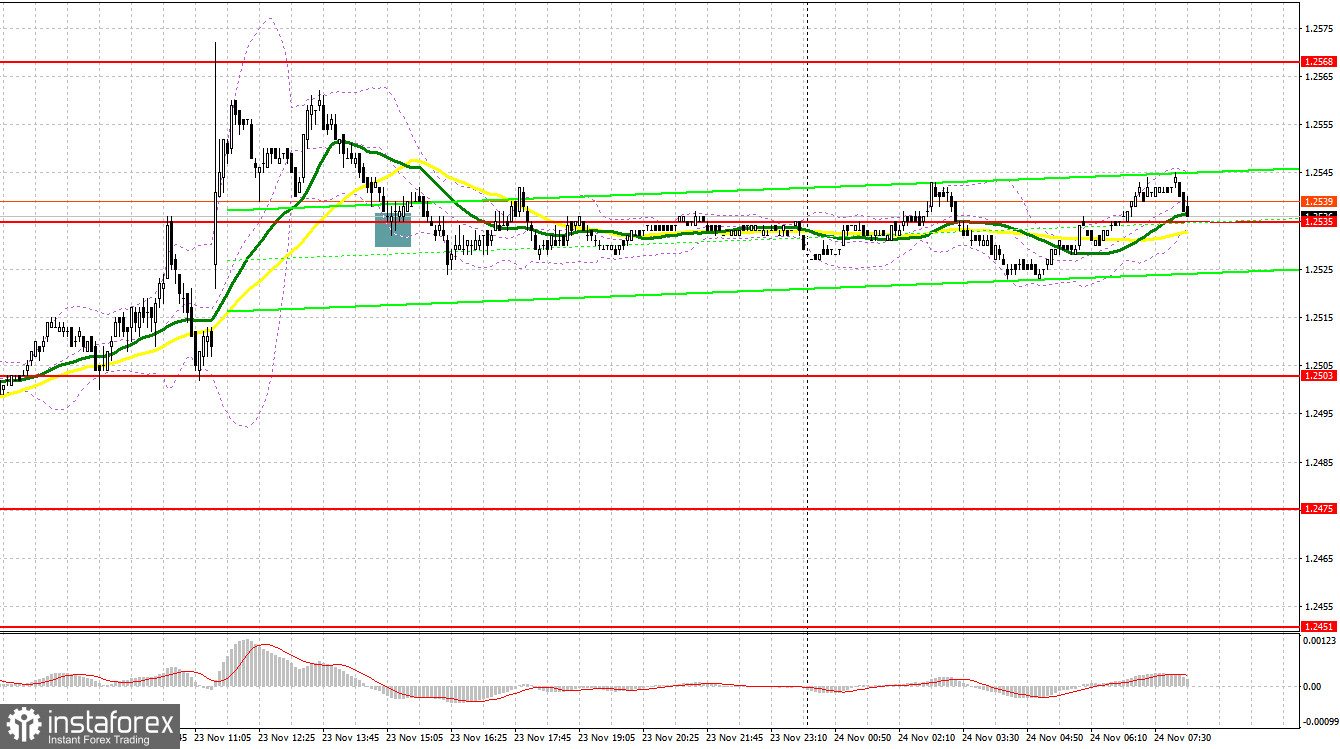

Yesterday, the pair formed several entry signals. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.2524 as a possible entry point. A rise and false breakout at this mark produced a sell signal, sending the pair down by about 20 pips. However, it did not come to a major sell-off. In the afternoon, a test and false breakout at 1.2325 generated a good buy signal to build a bullish market, but the pair did not actively rise due to low volatility.

For long positions on GBP/USD:

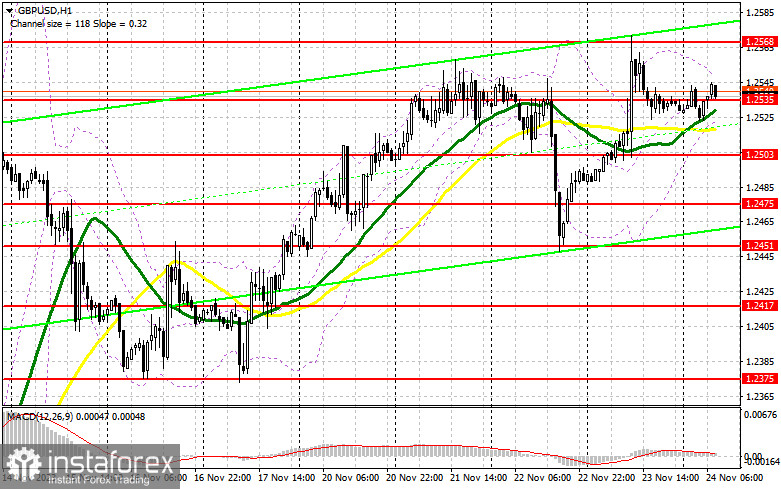

Today, the UK economic calendar is practically empty, so I expect the pair to trade within the channel with the bulls trying to extend the upward movement at the end of the week. In this case, the objective is to defend the nearest support at 1.2535, established yesterday. Only a false breakout there will provide an entry point for long positions to develop the upward trend and retest the resistance, as well as the monthly high at 1.2568. A breakout and consolidation above this range will lead to a new signal for opening long positions with a target at 1.2604. The ultimate target will be the 1.2638 area, where I plan to take profits. If the pair falls and there is no buying activity at 1.2535, which is also in line with the bullish moving averages, the pressure on the pair will definitely increase, and bears will regain control. In this case, only a false breakout around the next support at 1.2503 will signal opening long positions. I plan to buy GBP/USD immediately on a rebound from 1.2475, aiming for an intraday correction of 30-35 pips.

For short positions on GBP/USD:

Sellers are currently adopting a wait-and-see position. For a better balance, it would be beneficial to revisit the level of 1.2535, but judging by the trend, most likely the bears need to defend the monthly high of 1.2568 in the first half of the day. Forming a false breakout at that mark, which will give bears a chance to move the price down to the support at 1.2535, just below which the bullish moving averages are located. In the absence of important UK data, only a breakout and a retest from below will deal a more serious blow to the buyers' positions, leading to the removal of stop orders and opening the way to 1.2503. The ultimate target will be the 1.2475 area, where I will take profits. If GBP/USD rises and there is no activity at 1.2568 in the first half of the day, the uptrend will continue. In such a case, I will postpone sales until the price performs a false breakout at 1.2604. If there is no downward movement there, I will sell GBP/USD immediately on a rebound from 1.2638, considering a downward correction of 30-35 pips within the day.

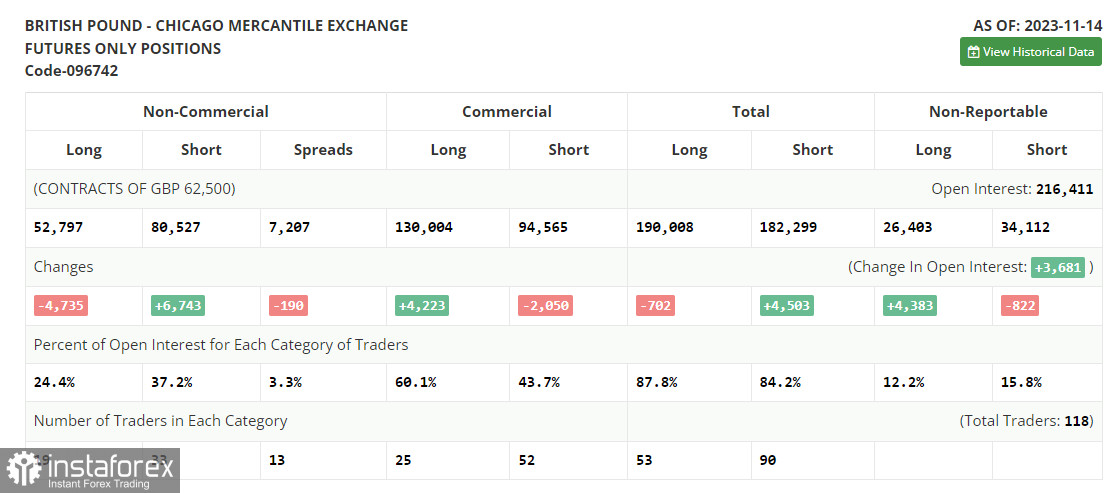

COT report:

The Commitments of Traders (COT) report for November 14 showed a decrease in long positions and an increase in short ones, but this did not significantly alter the balance in the market. Pressure on the pound is gradually decreasing, which is not surprising given the rapid fall in inflation in both the UK and the US. The chances that the Bank of England will continue to raise interest rates are almost zero. This is aiding risk assets and weakening the position of the US dollar. Ahead of us is the November minutes of the Federal Reserve meeting, which could clarify many uncertainties, potentially leading to another wave of strengthening of the British pound and its consolidation at monthly highs. The more discussions there are about the possibility of US rates remaining unchanged in December, the greater the pressure on the US dollar and, consequently, the stronger the pound. The latest COT report indicates that non-commercial long positions decreased by 4,735 to 52,797, while non-commercial short positions increased by 6,743 to 80,527. As a result, the spread between long and short positions narrowed by 190. The weekly closing price rose to 1.2503, up from the previous value of 1.2298.

Indicator signals:

Moving Averages

The instrument is trading above the 30 and 50-day moving averages. It indicates that GBP/USD is likely to rise further.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If GBP/USD declines, the indicator's lower border near 1.2520 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română