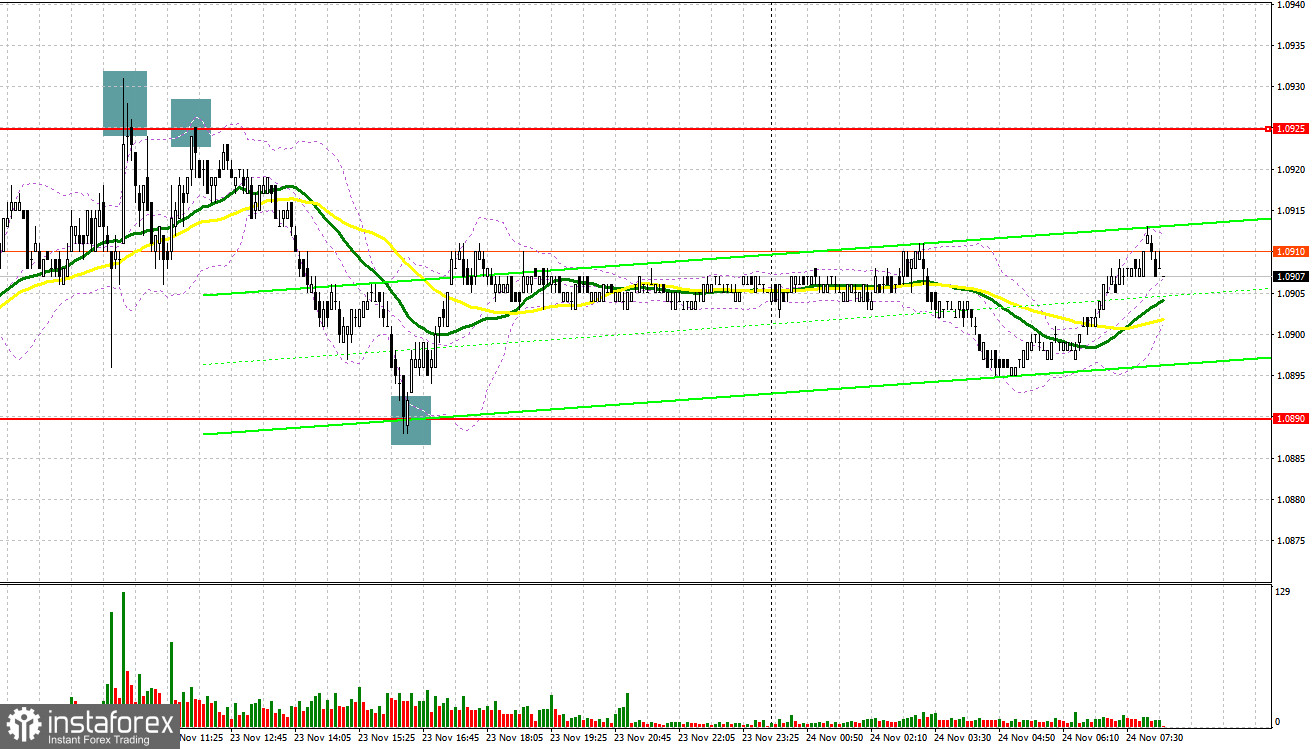

Yesterday, the pair formed several entry signals. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0925 as a possible entry point. A rise to this level and its false breakout formed a sell signal, sending the price down by about 20 pips. After that, the selling pressure on the pair eased. In the afternoon, another false breakout at 1.0925 intensified selling activity leading to a decline of more than 30 pips. Strong presence at the support of 1.0890 and a new buy signal generated another 20 pips of profit.

For long positions on EUR/USD

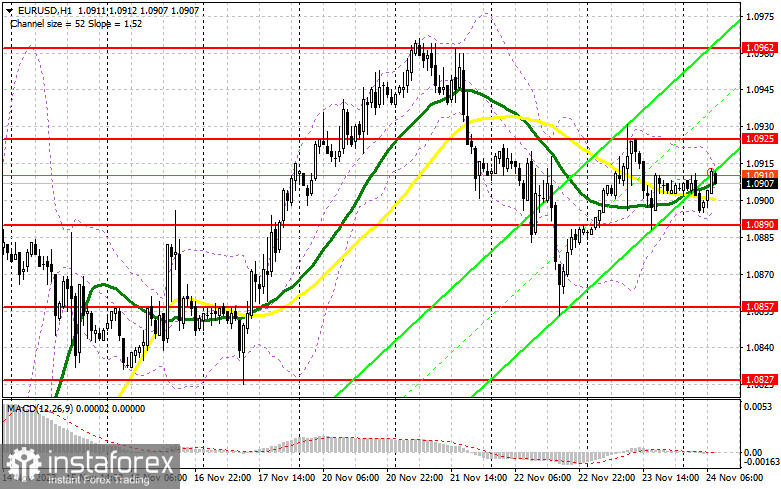

Today, the trajectory of the euro largely depends on the upcoming German economic data. We are anticipating a somewhat subdued GDP report for the third quarter, but this could be balanced by positive indicators in the business environment, current situation assessments, and economic expectations from the IFO. If these indicators disappoint the market, we might see renewed pressure on the EUR/USD pair. A key opportunity for buyers could emerge if there is a false breakout at the 1.0890 level, echoing previous patterns I've discussed. This would be a strong indication of a bullish presence in the market, offering a prime entry point for long positions. The goal here would be to ride the pair's rise and challenge the 1.0925 resistance. A successful breach of this range, especially with supportive German data, could signal a further buying opportunity, potentially refreshing the monthly high near 1.0962. The target to watch for profit-taking would be around 1.1004. Conversely, if we see the EUR/USD pair decline and lack momentum at 1.0890 in the first half of the day, it could spell trouble for euro buyers. In such a scenario, entering the market after a false breakout near the 1.0860 support level could be a strategic move. Immediate long positions could be considered on a rebound from 1.0827, aiming for an upward correction of 30-35 pips within the day.

For short positions on EUR/USD

Yesterday's market activity showed sellers maintaining control within a sideways channel. Should the pair rise again, it is crucial for sellers to make a stand around the 1.0925 resistance. A false breakout at this level would be a clear signal to sell, targeting a downward correction and a test of the 1.0890 support, where significant buyer activity is anticipated. A decisive break and consolidation below this range, followed by a bottom-up retest, would further confirm a sell signal, with an aim towards the 1.0860 mark. The ultimate target for profit-taking in this scenario would be around the 1.0827 low. If, however, EUR/USD trends upward during the European session without resistance at 1.0925, the market sentiment could turn bullish. This shift would pave the way for buyers to target a monthly high of 1.0962. Here, selling could be considered, but only after careful observation of market consolidation. Immediate short positions might be viable on a rebound from 1.1004, with a focus on a downward correction of 30-35 pips.

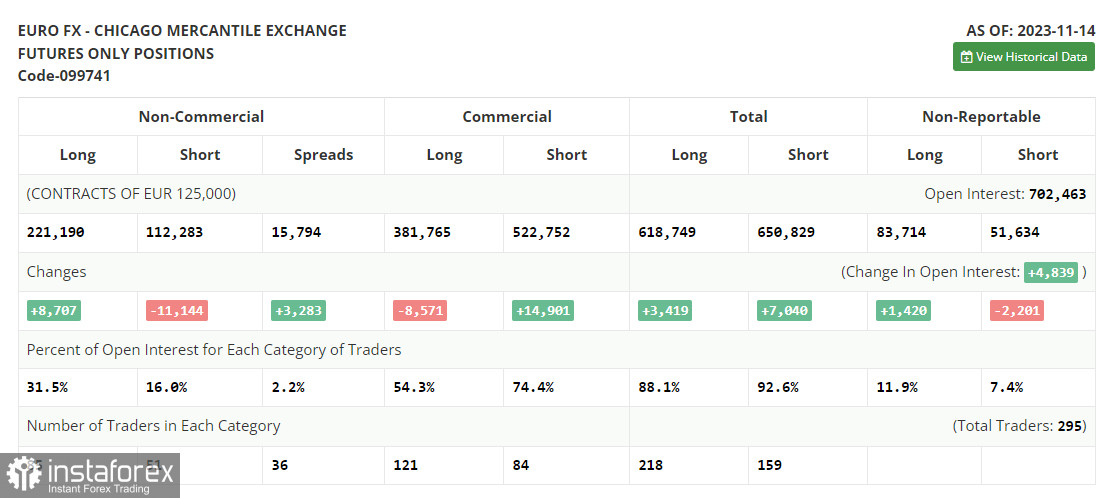

COT report

The Commitments of Traders (COT) report for November 14 indicated a notable increase in long positions and a significant reduction in short positions. The recently released inflation data clearly indicated that the current cycle of interest rate hikes in the US has reached its peak, significantly impacting the US dollar and reducing short positions on the euro, thereby reviving demand for it. The upcoming publication of the minutes from the Federal Reserve's November meeting is anticipated, where traders will seek answers to remaining questions. However, it is already apparent that rates have peaked and a reduction is expected next year. According to the COT report, non-commercial long positions increased by 8,707 to 221,190, while non-commercial short positions decreased by 11,144 to 112,283. Consequently, the spread between long and short positions increased by 3,283. The closing price saw a sharp rise, settling at 1.0902 compared to the previous value of 1.0713.

Indicator signals:

Moving Averages

Trading around the 30- and 50-day moving averages indicates market uncertainty.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair declines, the lower band of the indicator at 1.0890 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română