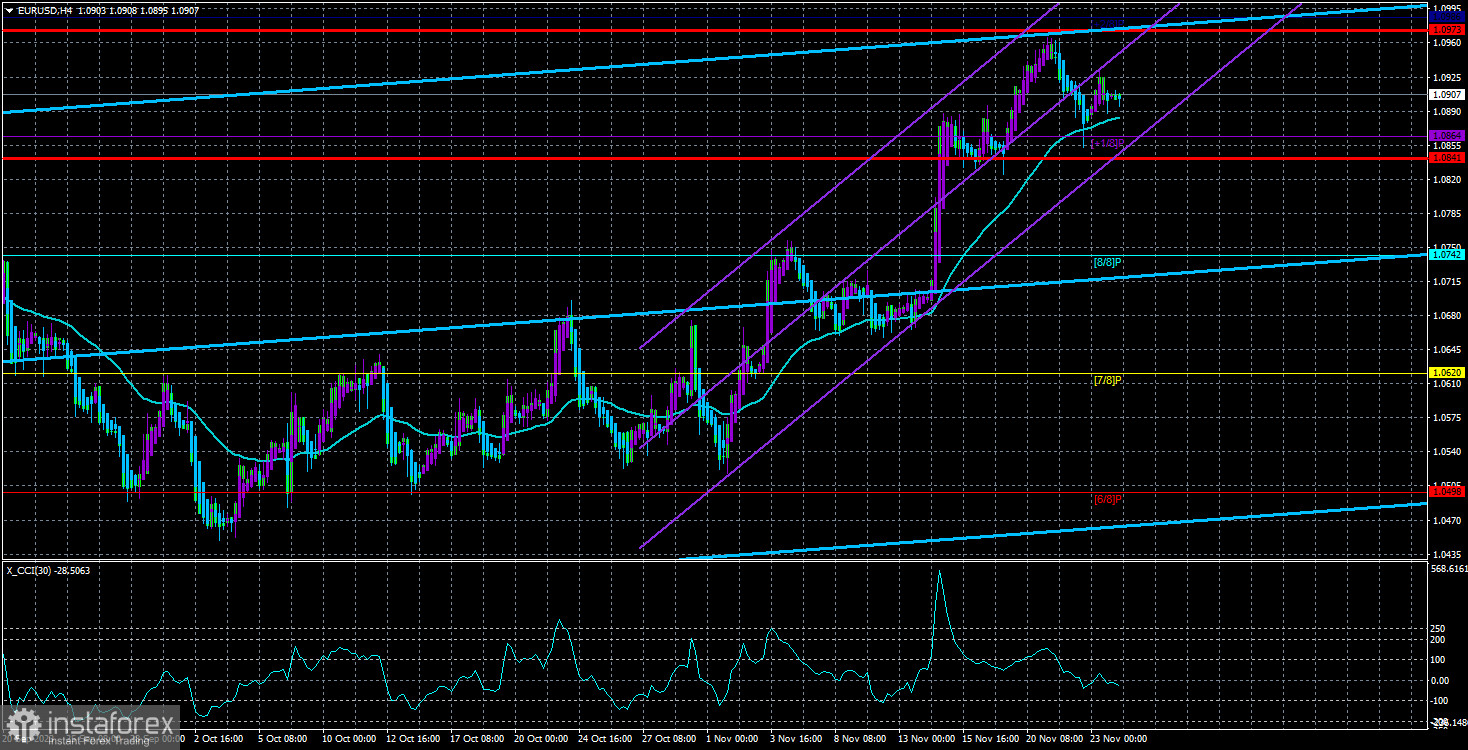

The EUR/USD currency pair failed to initiate a downward correction on Thursday. Recall that we expect a resumption of the decline in the European currency, but there is no hint of a correction at the moment. Yesterday, the price dropped to the moving average line but failed to overcome it and immediately bounced back up. It bounced back not far, but the upward trend persists, and the euro remains near its local highs. Yesterday, the euro was supported by business activity indices in the European Union and Germany. We cannot say that these are super-important indices, and their values turned out to be mega-resonant, but all six indices exceeded both forecast and previous values. Thus, the euro once again received small macroeconomic support, and the expected resumption of the downtrend is once again postponed.

It is also worth noting that yesterday was a holiday in the United States – Thanksgiving Day. Many platforms were closed, and there was almost no movement during the American trading session. Perhaps the situation will change slightly today.

Despite the continued rise of the European currency, we still need to understand what it is growing on in the medium term. The Federal Reserve and ECB interest rates, which will be discussed shortly, have become tedious. What do we have in fact? Inflation in the European Union fell to 2.9%, and in the United States, it fell to 3.2%. With such inflation, there is no reason for either central bank to tighten monetary policy. Yes, in the European Union, they say that inflation may start to accelerate. In the United States, inflation accelerated this fall. But in any case, current CPI values are not critical, and central bank rates are at their peak. Very weighty reasons are needed to return to a tightening policy in such conditions.

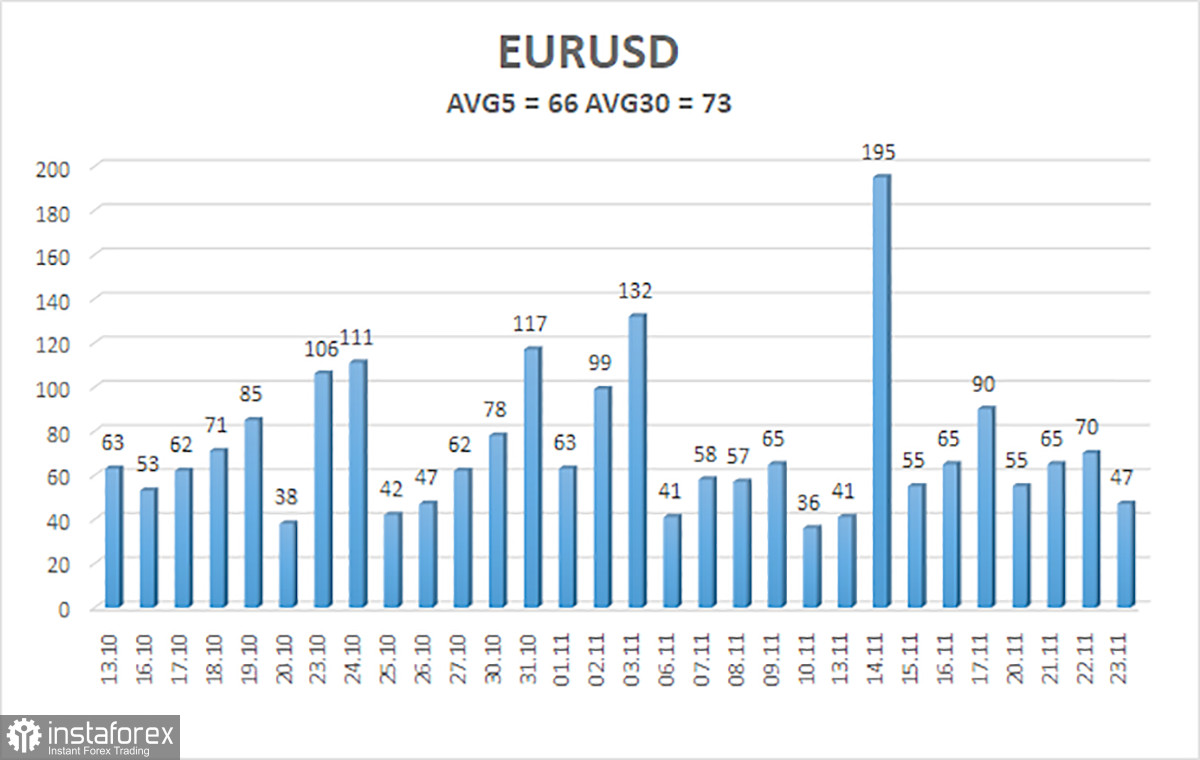

We also want to point out the relatively low volatility of the pair. Currently, it is about 66 points per day. Below, we refer to such a value as "average," and a value below 45 points is considered "low." But trading is simply impossible with volatility below 45 points, which makes no sense. Therefore, 66 points are a low value, making trading the pair difficult.

Also, let's remind you that the triple overbought condition of the CCI indicator still needs to be worked out. The unfortunate 100 points the pair passed down in the last leg of the fall are simply a mockery of the market.

The ECB's tone changes every week. Yesterday, Christine Lagarde spoke again. And we will soon start advising traders to close their eyes and ears to any statements from European regulator representatives. All because now, each new statement only confuses traders. The rhetoric of ECB representatives is changing almost every week. Or it is changing, but it remains unchanged and quite vague. Just this week, several ECB representatives stated that the cycle of tightening monetary policy is not 100% complete, and inflation may still start to rise. Earlier, more than half of the committee stated that additional tightening of monetary policy is not required. Christine Lagarde announced yesterday that it is "too early to declare victory over inflation" but refrained from mentioning the need for a new rate hike.

The best conclusion may be as follows: the ECB does not know what it will do with interest rates in a month, two, or three. It is unknown because this question entirely lies in the field of macroeconomic statistics, as all central bank representatives are saying. Therefore, we suggest stopping speculating on coffee grounds. No ECB official has stated that the rate needs to be raised. No one has said that the tightening cycle is complete, and that's it. Everyone gives quite vague comments that can be interpreted in any direction.

The average volatility of the EUR/USD currency pair over the last five trading days as of November 24 is 66 points and is characterized as "average." Thus, we expect movement in the pair between the levels of 1.0841 and 1.0973 on Friday. A reversal of the Heiken Ashi indicator back down will indicate a possible new downward correction.

Nearest support levels:

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest resistance levels:

R1 – 1.0986

Trading recommendations:

The EUR/USD pair continues a new upward movement and is located above the moving average. At this time, buying should be considered, but we still doubt that the pair's growth will continue, considering the triple overbought condition of the CCI indicator. Considering the pure technical analysis, initiating long positions with targets set at 1.0973 and 1.0986 is recommended, given that the price has rebounded from the moving average. Selling the euro will become relevant after the price consolidates below the moving average with a target of 1.0742.

Explanations for illustrations:

Linear regression channels help determine the current trend. The trend is currently strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) determines the short-term trend and direction for trading.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) indicate the likely price channel in which the pair will move the next day based on current volatility indicators.

CCI indicator – its entry into oversold territory (below -250) or overbought territory (above +250) indicates that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română