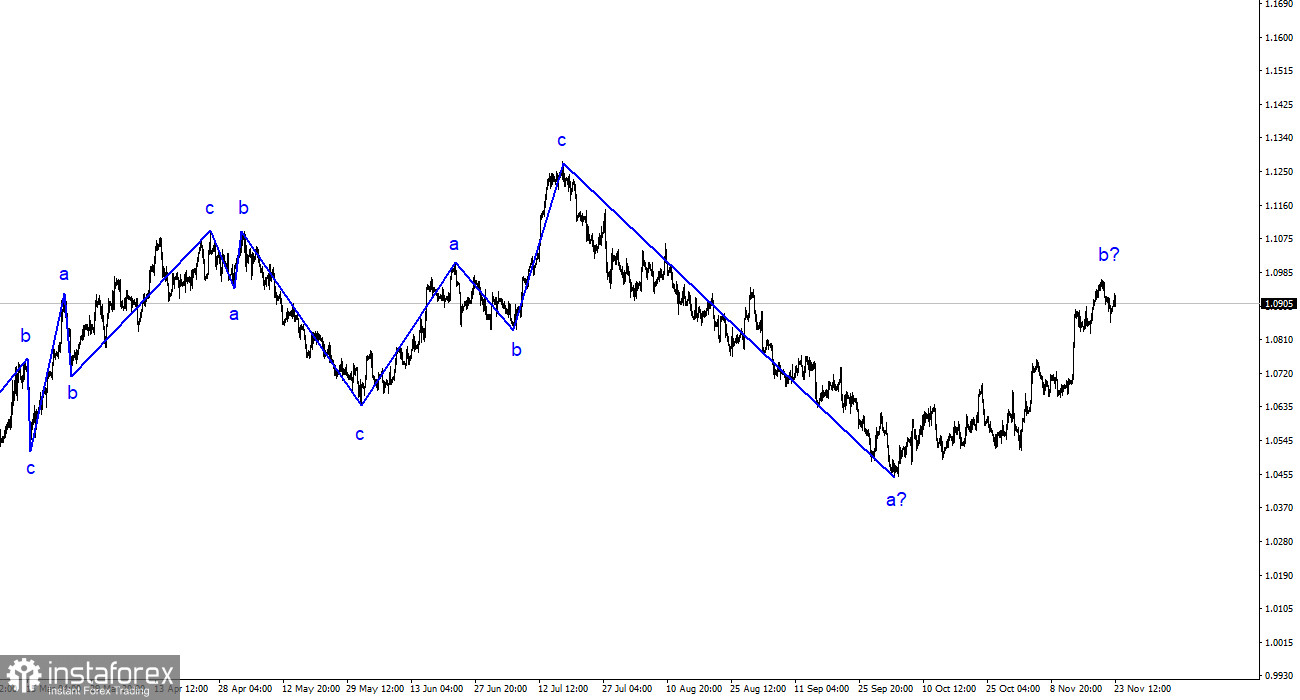

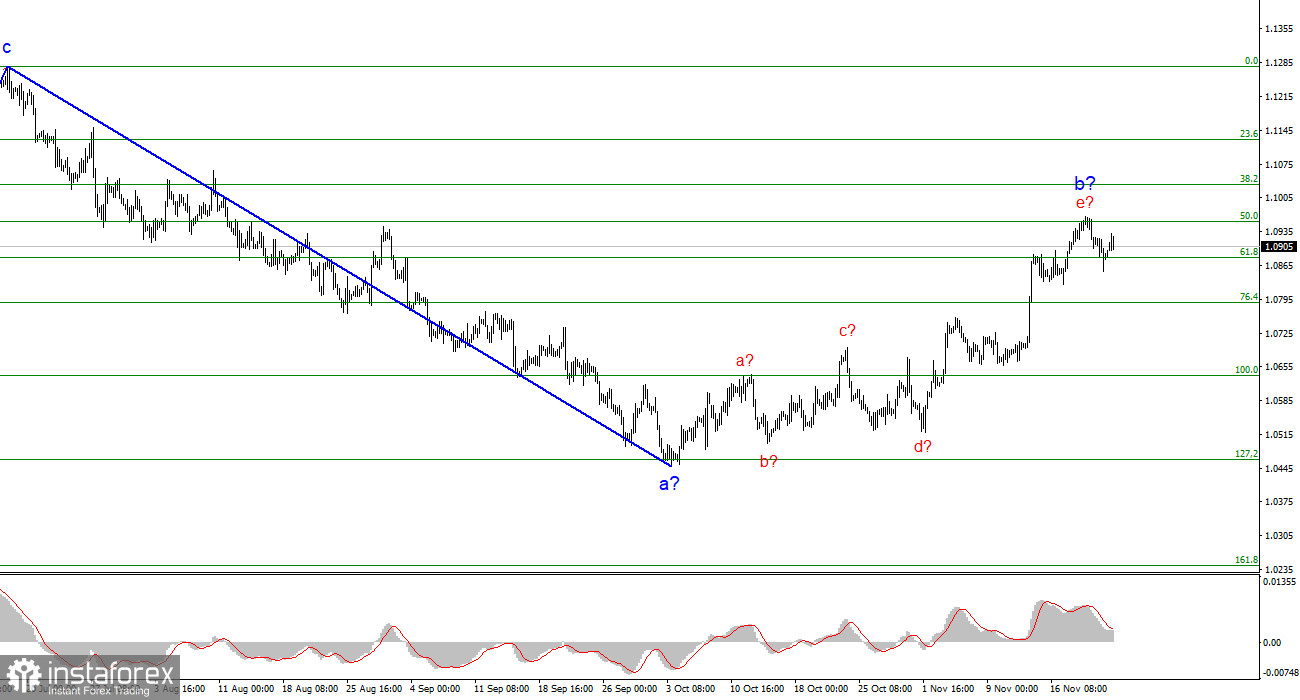

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. Over the past year, we have seen only three wave structures that constantly alternate with each other. Throughout 2023, I regularly mentioned that I expect the pair to be near the 1.5 figure, from where the construction of the last upward three-wave structure began. This target was achieved after the decline in July-October. After reaching this target, the construction of corrective wave 2 or b predictably began, which has already taken a clear five-wave form. However, the inflation report in the United States led to this wave taking an even more complex form. Nevertheless, the working scenario remains the same – wave 3 or c construction.

Regardless of the ultimate form of wave 2 or b (I warned that it could be much more complicated), the overall decline of the European currency will not be completed, as, in any case, the construction of the third wave of the downtrend is required. Most likely, wave e in 2 or b takes a five-wave form, after which the quote rise will end.

The news background from the European Union once again postpones the decline. The Euro/Dollar exchange rate has slightly increased, but I still do not observe significant price changes overall. Today is a holiday in the United States – Thanksgiving Day. However, during the American trading session, the price did not stand still, indicating that enough participants remained in the market. In the morning, movements were more active due to the news background. In the European Union and Germany (as well as in some other European countries), business activity indices for the services and manufacturing sectors and composite business activity indices were released. There were six of them in total, and all six exceeded market expectations. They exceeded slightly, so expecting a strong appreciation of the European currency was pointless. But this was enough to prevent an increase in demand for the American currency, so we did not see a significant decrease again, and wave 2 or b still does not have the completed status.

The business activity index in Germany's manufacturing sector showed the strongest growth, and overall, all indices increased by 0.5-1.0 points. All six indices remain below the key level of 50.0, where any value is considered negative. Therefore, the European currency did not have much chance of a strong increase today. The market reacted exactly as it should. The end of the week will be quite dull, although Germany's GDP will be released tomorrow, Christine Lagarde will speak, and three business activity indices will be released in the United States.

General conclusions.

Based on the analysis, the construction of a downward set of waves continues. The targets around the 1.0463 level have been perfectly worked out, and the unsuccessful attempt to break through this level indicated a transition to the construction of a corrective wave. Wave 2 or b has taken a completed form, so I expect the construction of an impulsive downward wave 3 or c with a significant decrease in the pair soon. I still recommend selling with targets below the low of wave 1 or a. As long as wave 2 or b takes on a more prolonged form, sales should be cautious or even better to wait for signals of the wave's completion.

On a larger wave scale, the upward trend's wave analysis has taken an extended form but is likely completed. We have seen five waves up, most likely a structure of a-b-c-d-e. Next, the pair built four three-wave structures: two down and two up. Now, it has moved on to building another extended downward three-wave structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română