If on Tuesday, the pound simply stood still while the euro clearly lost ground due to a simple technical rebound, then yesterday, the sterling caught up with its neighbor. Again, strictly for technical reasons. This partly happened due to the empty economic calendar. Whereas today, PMIs will be published, but it is unlikely that they will have any strong impact. After all, the United States will be celebrating the Thanksgiving Day holiday. And when the U.S. market is closed, the global market freezes in place. Nevertheless, the forecasts are quite good. For instance , the Services PMI is expected to grow from 49.5 points to 49.6 points, and the Manufacturing PMI from 44.8 points to 45.1 points. As a result, the composite PMI may rise from 48.7 points to 49.0 points. And theoretically, the pound should strengthen its positions somewhat. This is quite possible, but the scale of the growth will clearly be symbolic.

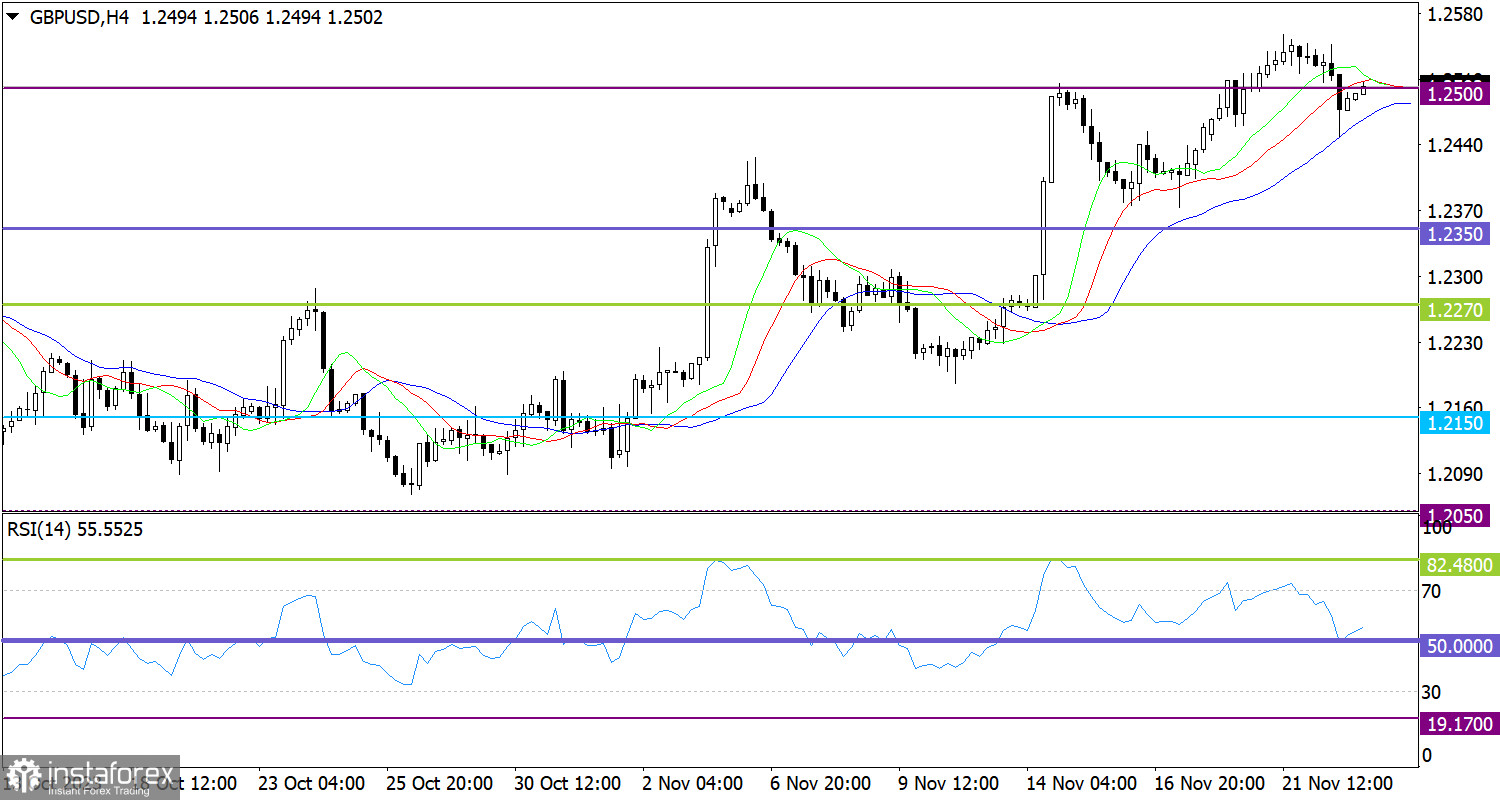

During a technical retracement, the GBP/USD pair temporarily dropped below the 1.2450 level but later returned to the vicinity of the 1.2500 level. The ongoing retracement fits into the structure of an upward cycle, and there is no observed shift in trading interests.

On the four-hour chart, the RSI indicator reached the 50 line, which occurred during the retracement. Currently, the indicator is hovering in the upper area of 50/70, indicating the potential for increasing long positions.

As for the Alligator's MAs on the same chart, two out of three MAs are intertwined. This occurred due to the retracement. The signal for a change in direction is unstable, which may lead to a new upward phase for the pound.

Outlook

Keeping the price above the 1.2500 level may subsequently indicate an increase in the volume of long positions. In this case, the pair can hit the local high of the upward cycle. As for the bearish scenario, traders will consider this if the pair stays below the 1.2450 level.

The complex indicator analysis unveiled that in the short-term period, indicators are providing an upward signal. Meanwhile, in the intraday period, indicators are pointing to bearish sentiment due to the recent retracement.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română