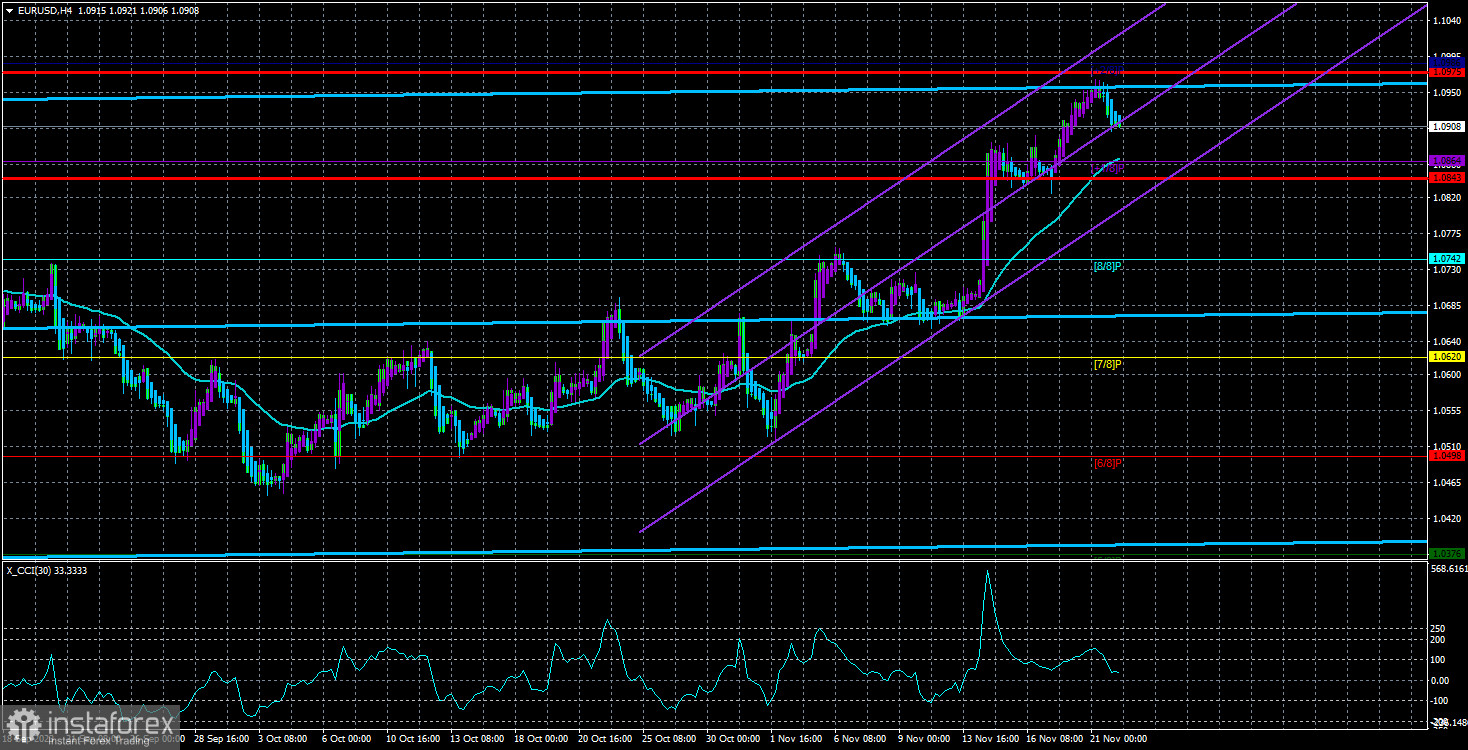

The EUR/USD currency pair reluctantly began to correct itself on Tuesday. We would not draw any loud conclusions about it because the current drop is only 40 points. The price has not even come close to the moving average line, which mostly moves towards it. Thus, it is too early to say that the two-month upward correction is complete. Such a conclusion would be appropriate only after the price consolidates below the moving average.

We continue to maintain our previous position. Even the rise over the past week and a half is unfounded, not to mention its continuation. Therefore, the EUR/USD pair will resume its medium-term downward trend. There are enough reasons to anticipate such a development. First, we should remember the triple overbought condition of the CCI indicator. We mention this every day because we consider this factor very important. Second, if we see no reasons for the medium-term growth of the European currency, there are two options now. If we are witnessing the emergence of a new upward trend that has been forming for a year and a half, then the pair should rise to at least the level of 1.1275, and ideally much higher. Is there any reason to believe the euro could add another 500–600 points? From our point of view, no.

The second option is that a new downward trend started on July 19. Then, all the movement of the last month and a half is a correction within this trend. If so, the decline should resume with targets around the 2nd level. This is the option we support.

Yesterday was supposed to be the speech of ECB President Christine Lagarde, but at the moment, there needs to be more information about this event. Most likely, nothing important was said, so there is nothing to discuss and analyze here.

Another passing Fed protocol

Also, yesterday evening, the protocol of the last Fed meeting was published. We warned that this document is not significant. It rarely contains important information yet to be discovered on the market. This was the case this time, too. The protocol stated that the regulator is concerned about the strong growth of the American economy because it believes it could provoke a new acceleration of inflation. However, there was no hint of additional tightening of monetary policy to "cool" the economy. Moreover, FOMC officials believe the economy will noticeably slow down in the fourth and first quarters, so they are not ready for active action. In principle, they do not need to do this, as inflation has returned to acceptable levels. There is no reason to panic.

The protocol also stated that all monetary committee members agreed that a cautious approach to rates should be maintained. According to them, monetary policy should remain restrictive until inflation begins to slow down "obviously." What this "obvious manner" means is unclear, but we remind you that at the last meeting, inflation was 3.7%, and now it is 3.2%. Therefore, the only thing that could have happened in the last three weeks is a softening of the hawkish sentiment of the Fed. If so, dreaming about a rate hike can be postponed for now.

According to the FedWatch tool, the market allows for a rate hike in December or January with a 5% probability. In other words, it does not believe in such an outcome. In the current circumstances, we agree with the market, although a few weeks ago, additional tightening seemed inevitable. The dollar lost one of its trump cards, but it should strengthen soon. However, selling the pair is not worth it if there are no corresponding trading signals.

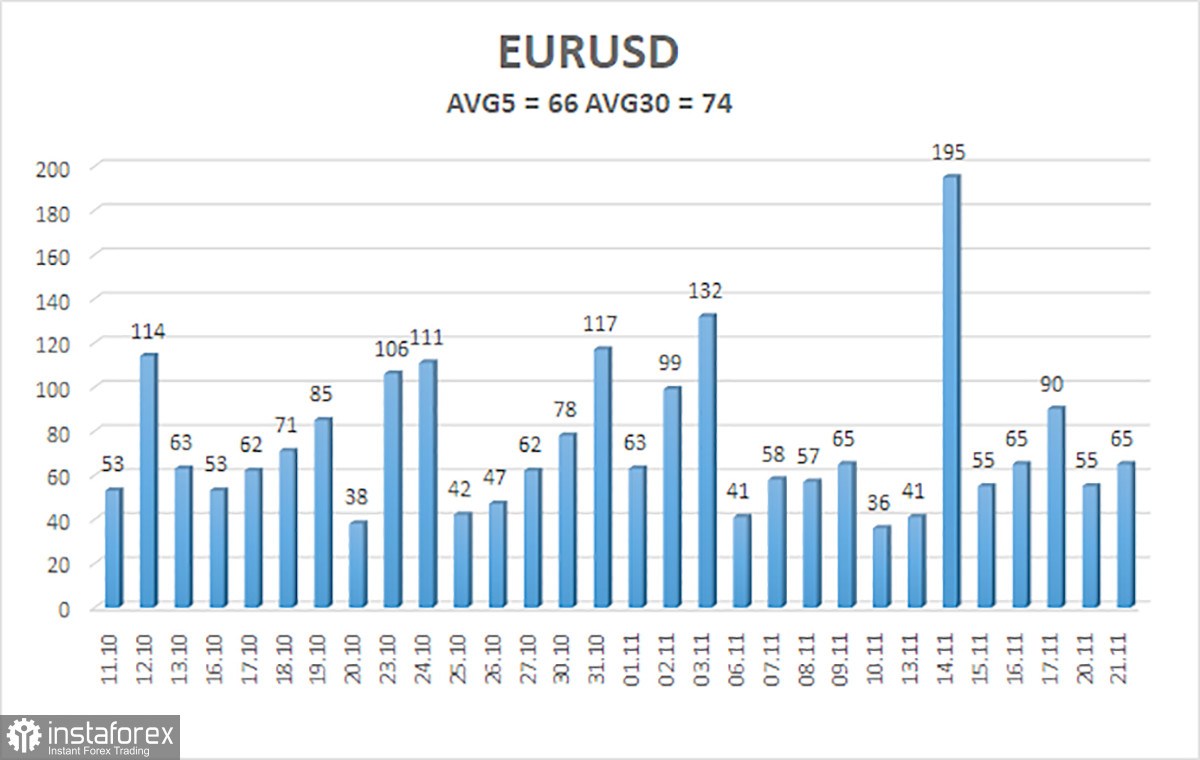

The average volatility of the EUR/USD currency pair for the last five trading days as of November 22 is 66 points and is characterized as "average." Thus, we expect the pair to move between the levels of 1.0843 and 1.0975 on Wednesday. A reversal of the Heiken Ashi indicator back upwards will indicate a possible resumption of the upward movement.

Nearest support levels:

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest resistance levels:

R1 – 1.0986

Trading recommendations:

The EUR/USD pair continues its new upward movement and is above the moving average. It is advisable to consider buying, but we still doubt that the pair's rise will continue, considering the triple overbought condition of the CCI indicator. Based on the "naked" technique, opening long positions with targets of 1.0975 and 1.0986 in case of a reversal of the Heiken Ashi indicator upwards is possible. Selling the euro will become relevant after the price consolidates below the moving average with a target of 1.0742.

Explanations for the illustrations:

Linear regression channels help determine the current trend. If both are directed in the same direction, the trend is strong.

The moving average line (settings 20.0, smoothed) determines the short-term trend and direction for trading.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day based on current volatility indicators.

CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is approaching in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română