EUR/USD

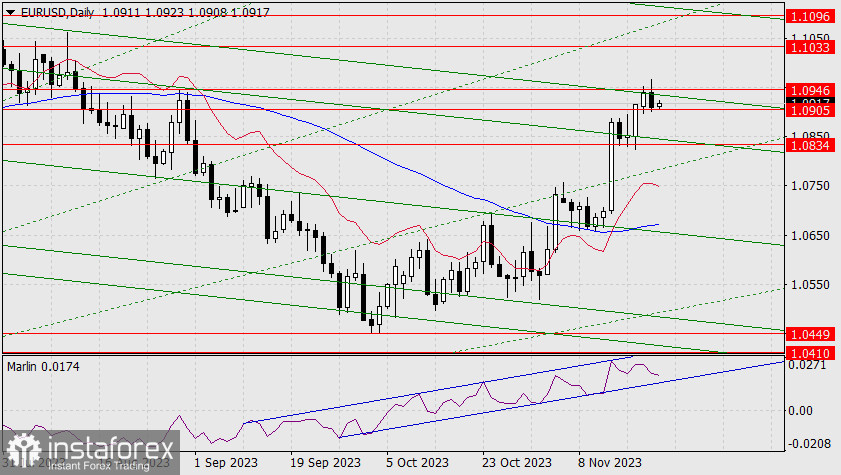

EUR/USD extends its consolidative phase around the 1.0905/46 trading range for the third day. Yesterday, it tried to consolidate above 1.0946 but ultimately failed. The price may still rise to 1.1033, but the pace of growth has slowed down, approaching a magnetic point in the area where three significant lines coincide (the target level of 1.1096 as the April peak, the upper band of the descending price channel, and a Fibonacci fan line). There is only one week left, and it's unlikely that the price will be able to cover 180 pips in the remaining time, especially with the declining Marlin oscillator, which is heading towards the lower band of its own ascending channel and the approaching holiday in the United States.

All of this suggests that the correction may occur earlier, for example, from the target level of 1.1033 (with support at 1.0946), and then the price may bypass the magnetic point in its trajectory, overcoming the level of 1.1096 much later in time. From a technical perspective, this would be much easier than attacking the level directly at the magnetic point, which could lead to a deeper correction.

So, we are waiting for the end of the consolidative phase within the 1.0905/46 range, afterwards, we expect the price to rise to the target level of 1.1033.

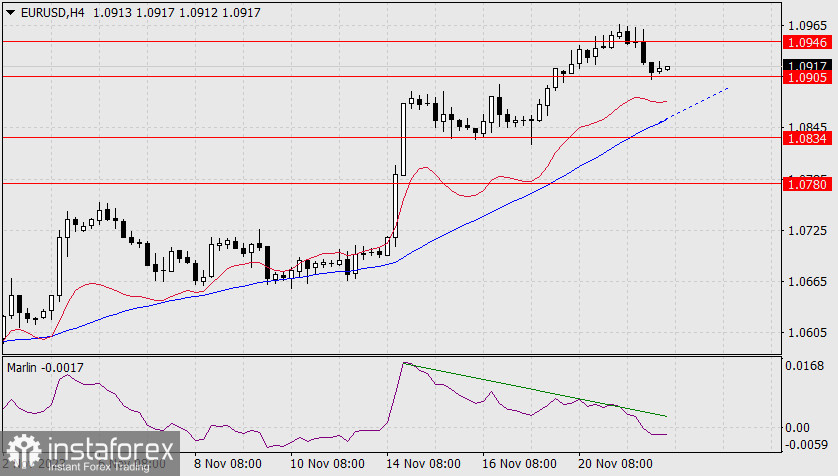

On the 4-hour chart, a divergence between the price and the Marlin oscillator has formed. If the price does not drop below 1.0905, the divergence will prevent the growth, and the pair will continue to move sideways. The MACD line is approaching 1.0905, preventing the price from a break below.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română