More and more investors expect the Fed to halt its rate hike cycle and start reducing them, at least by next year, to stimulate the US economy. This caused a decline in Treasury yields and dollar, while the stocks of US, Europe and the Asian regions rallied.

Considering that the Fed dominates the global financial system and its monetary policy affect other central banks, a halt in its rate increases will certainly influence others such as the ECB, the Bank of England and the like, especially in the wake of declining inflation.

And if such a stop really happens, company stocks will continue to grow, while pressure on dollar will intensify due to the rising demand for Treasuries, which will exert pressure on yields. Prices for commodity and raw material assets will also rise, primarily due to the weakening of dollar. Talks that the Fed may cut its key interest rate for the first time in May and overall reduce it by 1% in 2024 strengthens the possibility of all this happening.

For now, investors await the release of the Fed minutes, as well as the data on existing home sales in the US. If the minutes do not show any noticeable deviations from the outcome of the November Fed meeting and sales fall below expectations, the recent trends will continue.

Forecasts for today:

GBP/USD

The pair trades below 1.2535 due to the weakening of dollar. A consolidation above this level will likely bring the quote to 1.2680.

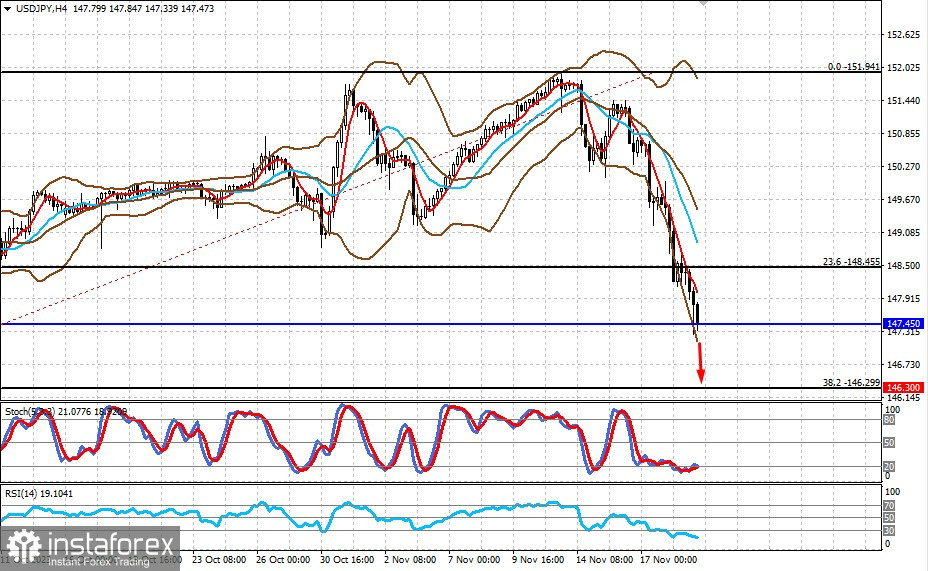

USD/JPY

The pair halted movement around 147.45 due to the weakness of dollar and the pair's strong overbought condition. A decline below this level will likely bring the quote to 146.30.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română