EUR/USD

Higher Timeframes

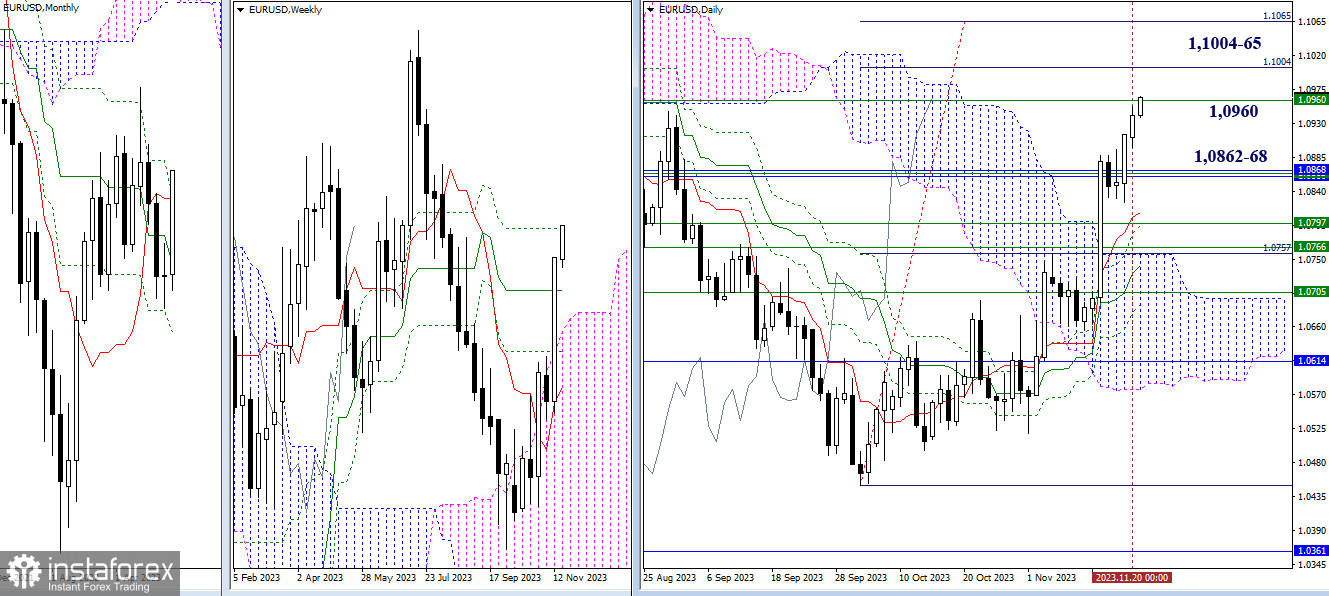

After a brief slowdown in the area of a cluster of strong resistance levels (1.0862 – 1.0868), the market resumed its upward movement. The levels passed the day before have changed their role and now serve as the nearest supports. Currently, the resistance of the final level of the death cross of the weekly Ichimoku cloud (1.0960) is being tested. Eliminating the weekly death cross will allow bulls to consider opportunities to execute the daily target for breaking through the Ichimoku cloud (1.1004 – 1.1065).

H4 – H1

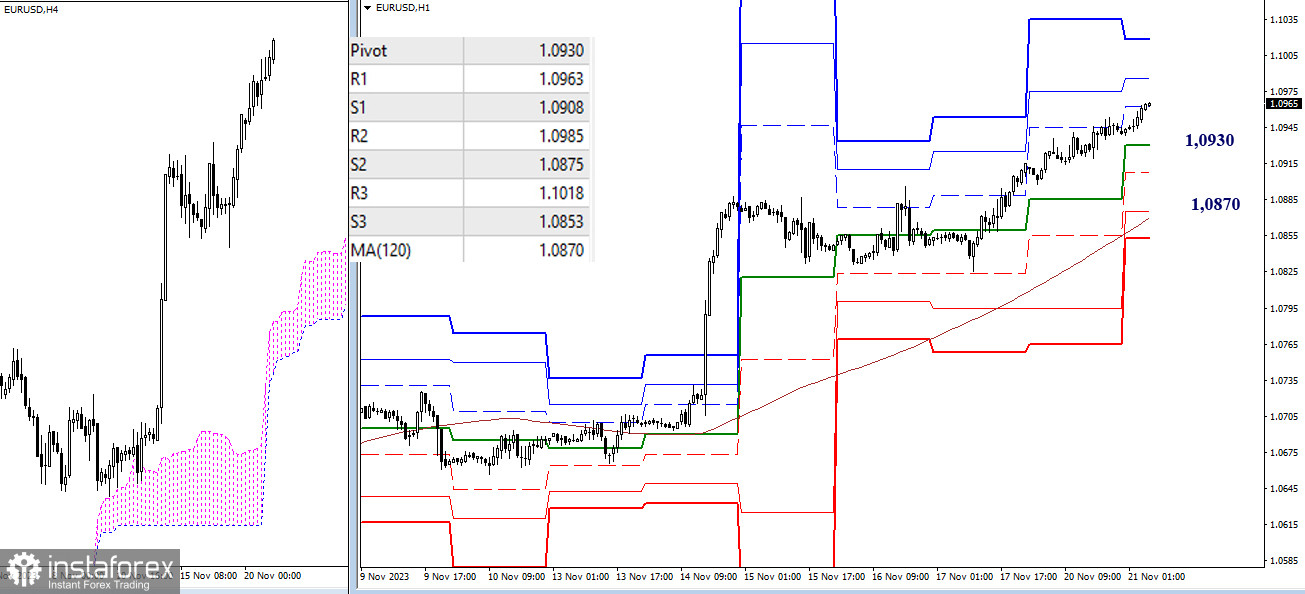

On lower timeframes, the advantage belongs to bullish players who continue to develop the upward trend today. The first resistance of the classic pivot points (1.0963) is currently being tested. Next, bulls' attention within the day will be on overcoming R2 (1.0985) and R3 (1.1018). A change in priorities and sentiments will bring relevance back to downward targets. First and foremost, bears will be interested in the result of interaction with key levels of lower timeframes, which can be noted today at 1.0930 (central pivot point of the day) and 1.0870 (weekly long-term trend). Intermediate support on this path may come from 1.0908 (S1) and 1.0875 (S2).

***

GBP/USD

Higher Timeframes

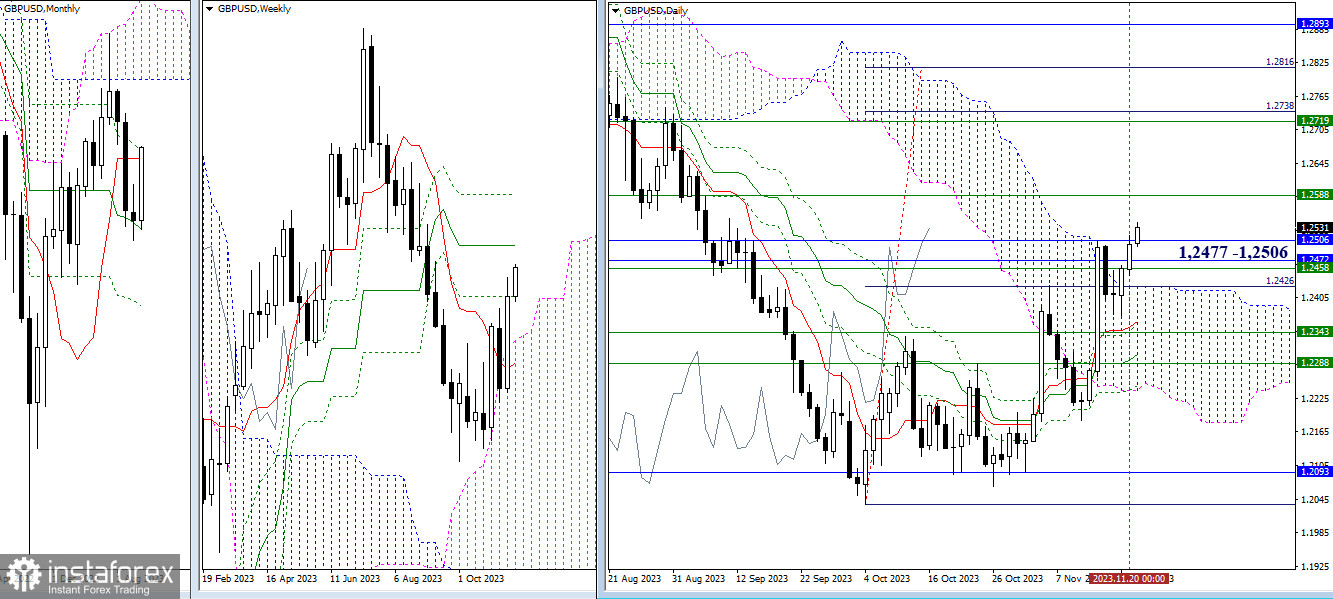

The corrective slowdown caused by encountering double resistance of monthly levels (1.2472 – 1.2506) ended with bullish players attempting to move higher. The nearest resistance now is the weekly medium-term trend (1.2588). Next, bulls' attention will be directed to eliminating the death cross of the weekly Ichimoku cloud (1.2719) and working out the daily target for breaking through the Ichimoku cloud (1.2738 – 1.2816).

H4 – H1

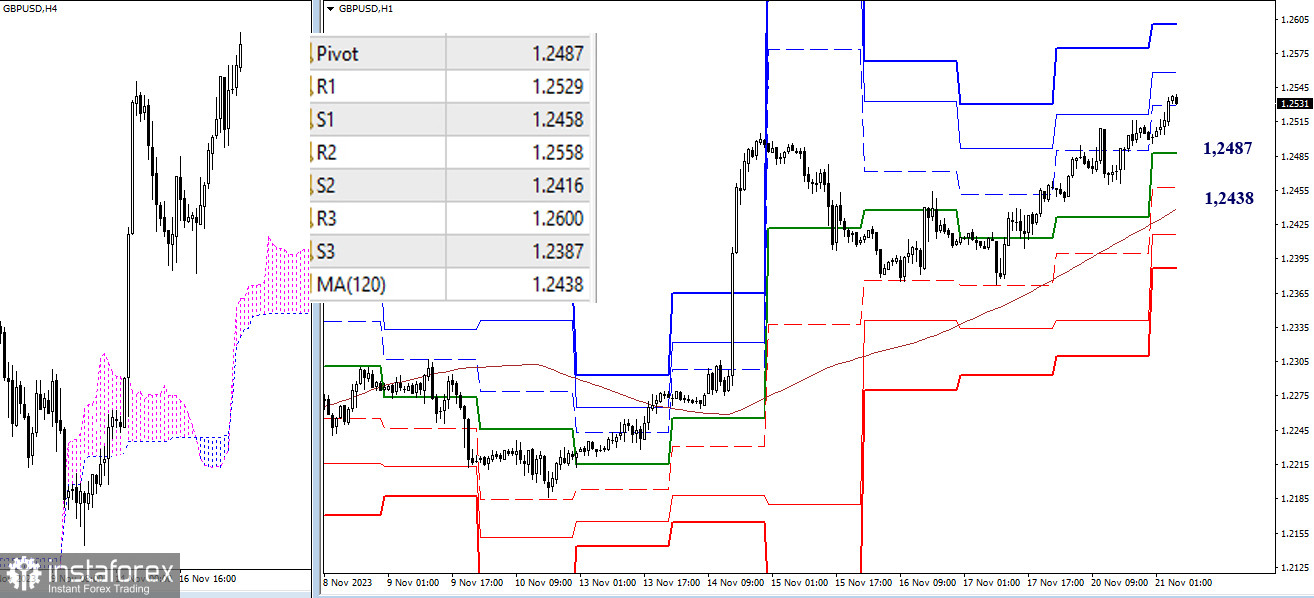

On lower timeframes, bulls have the advantage, forming an upward trend. Resistance levels of classic pivot points serve as intraday targets; the first resistance (1.2529) has already been worked out, so the current focus is on R2 (1.2558) and R3 (1.2600). The key levels of lower timeframes today act as the main landmarks for the development of corrective decline. They will meet the market at the levels of 1.2487 (central pivot point of the day) and 1.2438 (weekly long-term trend).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română