Analysis of macroeconomic reports:

For Tuesday, the lineup of macroeconomic events is practically barren. We can only highlight the number of existing home sales in the U.S., but this is not even a secondary data, but a tertiary report. No more important reports scheduled in the U.S., the EU, the UK, or Germany. The calendar is basically empty and the trading instruments will likely go through low volatility, but then again both the euro and the pound continue to rise. This is the illogical behavior that we mentioned in previous articles.

Analysis of fundamental events:

There are few fundamental events planned for Tuesday. European Central Bank representative Isabel Schnabel will deliver a speech, and the minutes of the last Federal Reserve meeting will be published. This is the so-called "FOMC minutes." We do not expect important information from either event. Members of the ECB's Governing Council have spoken hundreds of times in recent months, so we already have a clear understanding of what to expect from the ECB. As for the minutes, no important decisions were made, and there were no hints of important decisions in the future. Therefore, the minutes promise to be as dull and uninteresting as possible.

General conclusion:

On Tuesday, there are hardly any fundamental and macroeconomic events. However, Monday showed us that even in a complete absence of news and reports, we can still expect the euro and the pound to rise. We believe that the growth is illogical and a part of the corrective phase, but this does not negate the fact that it is persistent.

Basic rules of a trading system:

1) Signal strength is determined by the time taken for its formation (either a bounce or level breach). A shorter formation time indicates a stronger signal.

2) If two or more trades around a certain level are initiated based on false signals, subsequent signals from that level should be disregarded.

3) In a flat market, any currency pair can produce multiple false signals or none at all. In any case, the flat trend is not the best condition for trading.

4) Trading activities are confined between the onset of the European session and mid-way through the U.S. session, post which all open trades should be manually closed.

5) On the 30-minute timeframe, trades based on MACD signals are only advisable amidst substantial volatility and an established trend, confirmed either by a trend line or trend channel.

6) If two levels lie closely together (ranging from 5 to 15 pips apart), they should be considered as a support or resistance zone.

How to read charts:

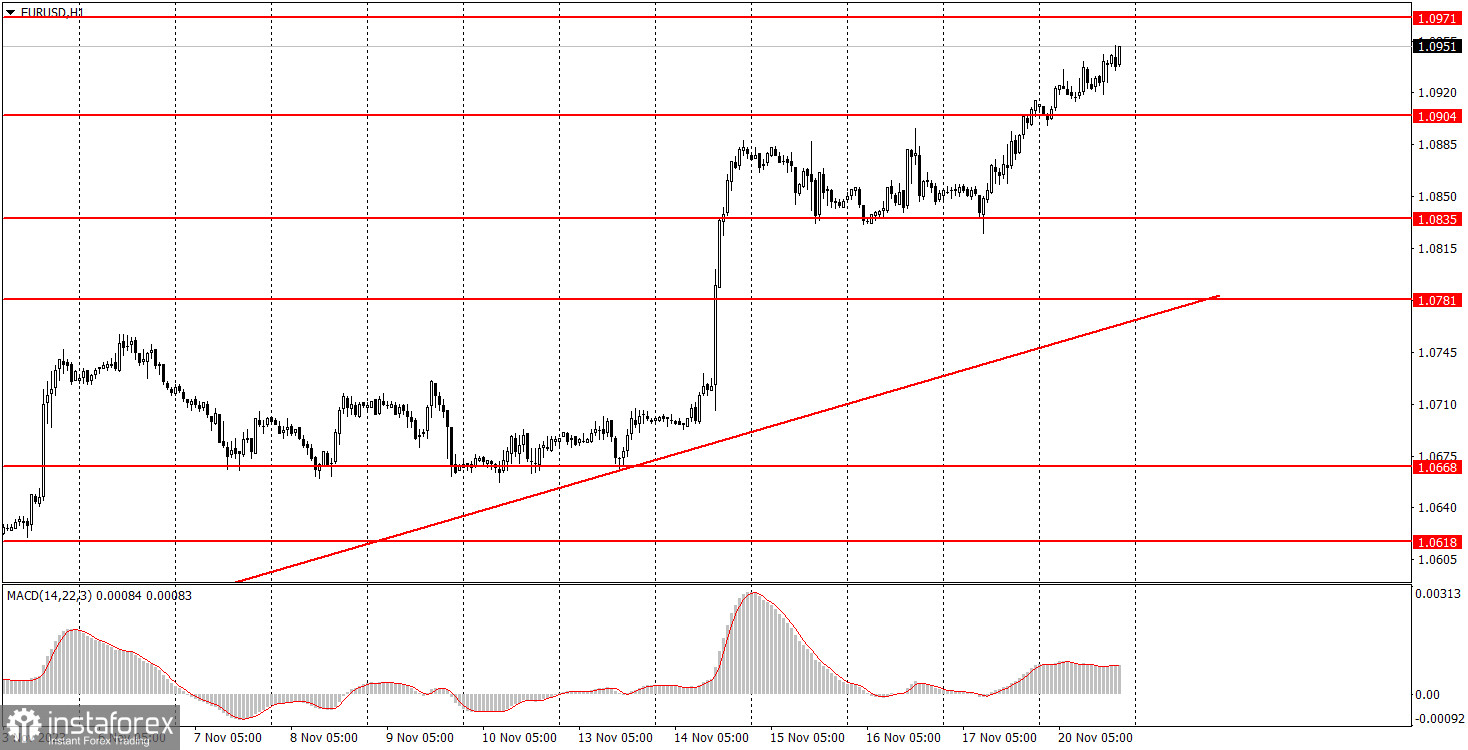

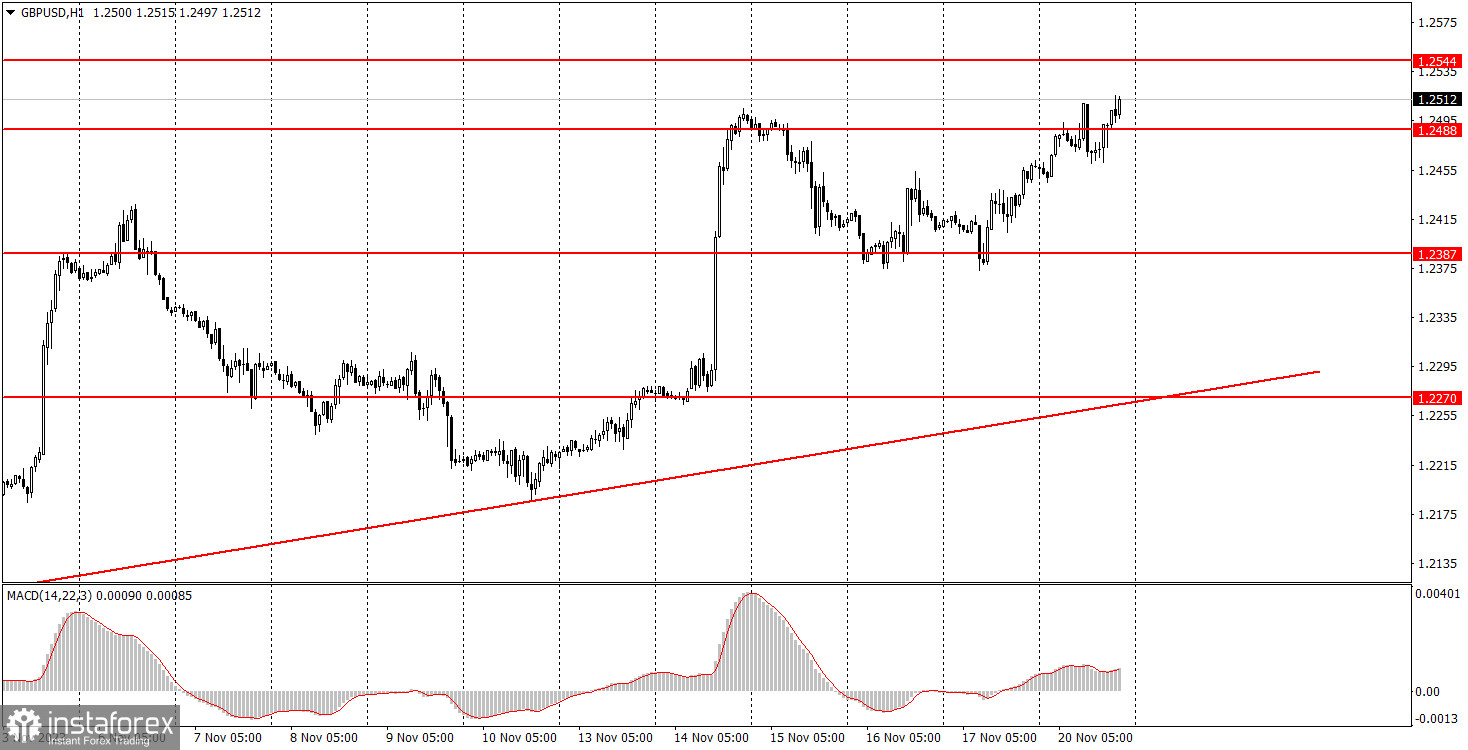

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines represent channels or trend lines, depicting the current market trend and indicating the preferable trading direction.

The MACD(14,22,3) indicator, encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a signal source.

Significant speeches and reports (always noted in the news calendar) can profoundly influence the price dynamics. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to prevent abrupt price reversals against the prevailing trend.

Beginning traders should always remember that not every trade will yield profit. Establishing a clear strategy coupled with sound money management is the cornerstone of sustained trading success.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română