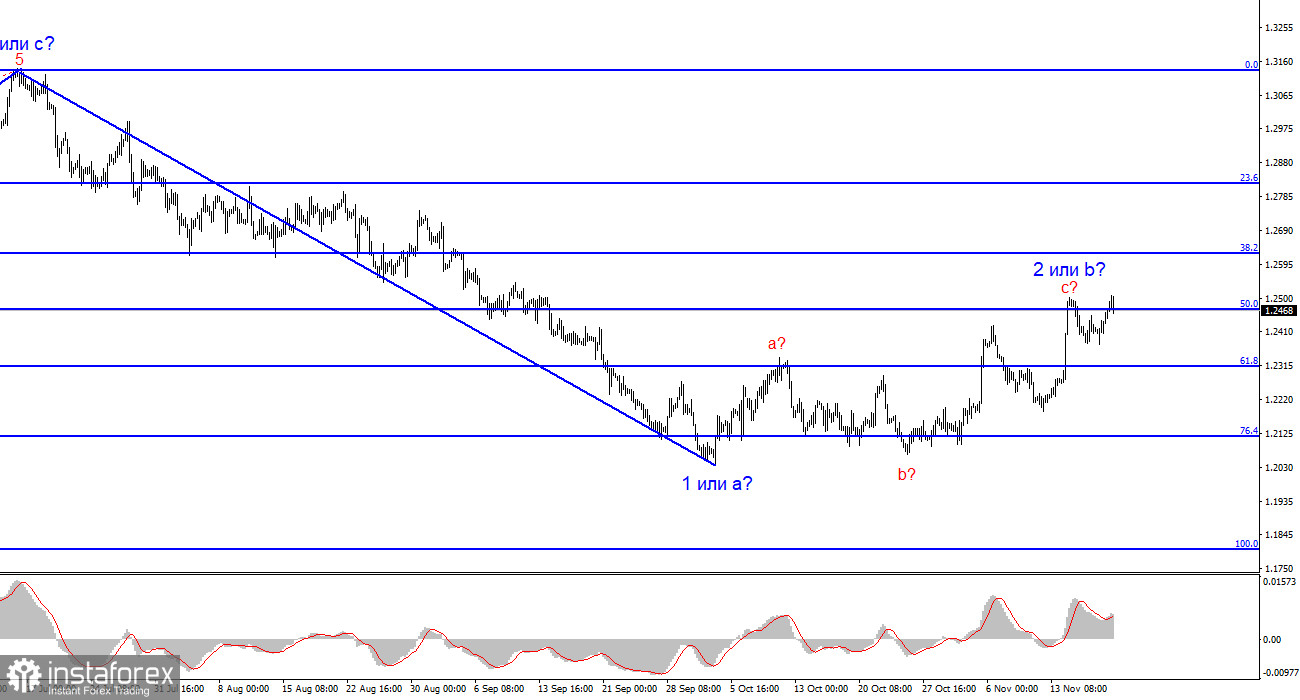

Like the euro, the British pound continues its local upward movement within the corrective wave, which appears complex. At the time of writing this article, the market cannot find economic justifications for reducing demand for the pound (or increasing it for the dollar). Therefore, the presumed wave 2 or b is not yet complete. If this is the case, it will continue to form this week. The news background over the next four days will be weak enough, so I don't think the British pound will find many reasons to start a new uptrend. However, it is not decreasing either, which further delays the construction of the necessary wave 3 or c.

British Prime Minister Rishi Sunak gave a major interview in which he talked about the economy, inflation, and prospects. In particular, he stated that inflation in the country has halved, allowing us to look to the future with optimism. "We can begin the next phase and turn our attention to cutting tax," Sunak said on Monday. However, the process will have to start with control over inflation to prevent its acceleration. He once again emphasized that the government and the Bank of England have fulfilled the promise to halve inflation, and five more important decisions will be made to stimulate economic growth. The prime minister did not disclose what these decisions are.

In my opinion, Sunak and BoE Governor Andrew Bailey started celebrating too early. It is important to remember the 2% target inflation rate. And this mark is still very far away. It may take 2-3 years to reach it, considering that the markets expect a rate cut in 2024. I do not think that the pound will find support in Sunak's words at the moment. Currently, the prospects of the pound depend on the market itself, its expectations, and its forecasts. So far, we see that the pound is not in the best position, but demand for it is still growing. Since there are no clear signs of the completion of wave 2 or b, I would not rush with short positions.

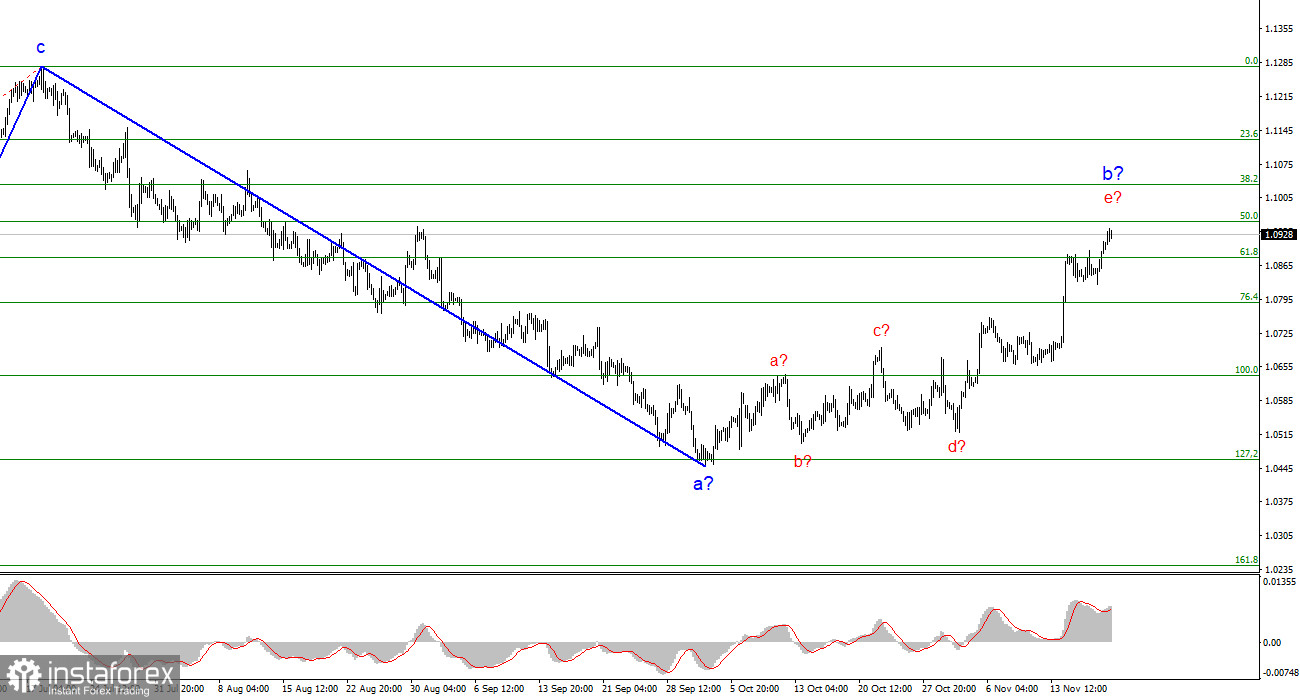

Based on the analysis, I conclude that a bearish wave pattern is still being formed. The pair has reached the targets around the 1.0463 mark, and the fact that the pair has yet to breach this level indicates that the market is ready to build a corrective wave. It seems that the market has completed the formation of wave 2 or b, so in the near future I expect an impulsive descending wave 3 or c with a significant decline in the instrument. I still recommend selling with targets below the low of wave 1 or a. But be cautious with short positions, as wave 2 or b may take a more extended form, or it would just be better to wait for signals of the end of the wave.

The wave pattern for the GBP/USD pair suggests a decline within the downtrend segment. The most that we can count on is a correction. At this time, I can already recommend selling the instrument with targets below the 1.2068 mark because wave 2 or b will eventually end. Initially, just a good amount of short positions should be enough because there is always a risk of complicating the existing wave.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română