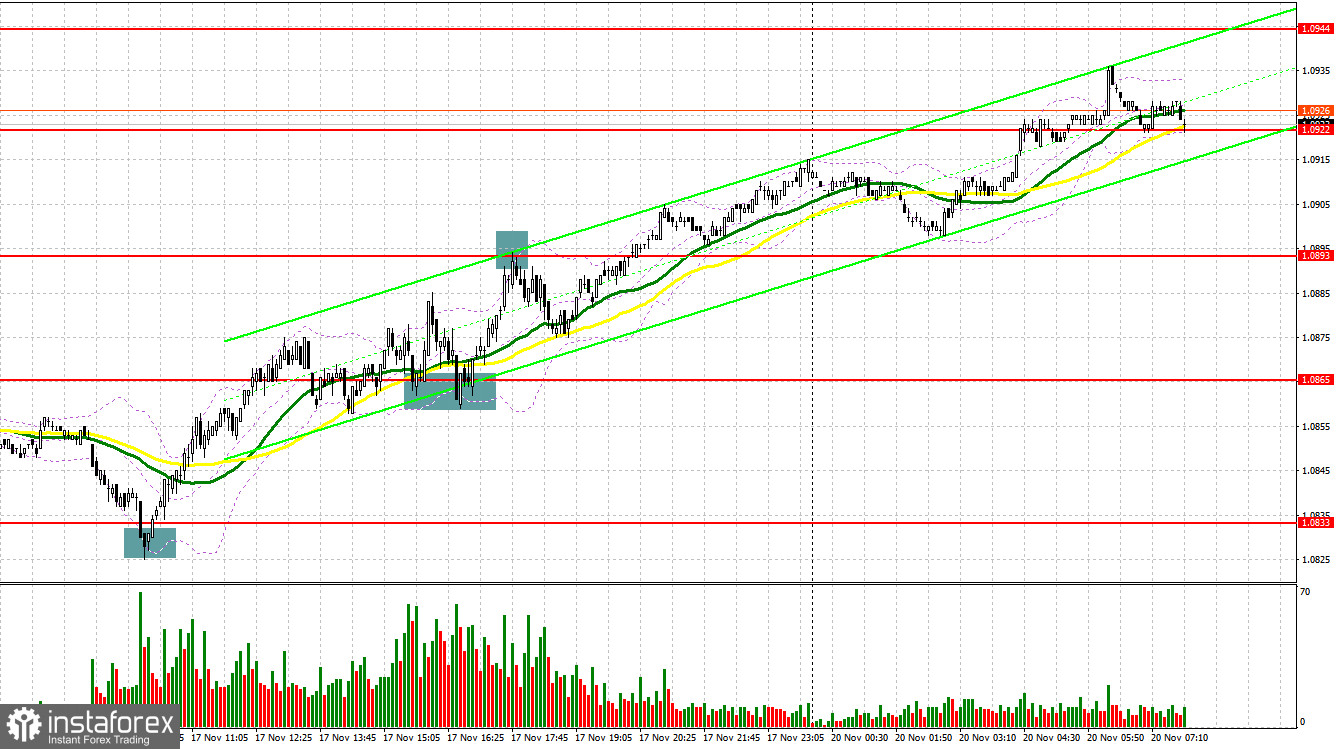

On Friday, the pair formed several good entry signals. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0833 as a possible entry point. A decline to this level and its false breakout generated a good entry point into long positions with anticipation of a further rise. As a result, the euro went up by around 40 pips. In the afternoon, the price settled above 1.0865 and retested it from above, thus creating another entry point and pushing the price up by 30 pips. Selling after a false breakout at 1.0893 caused a slight correction of 15 pips and then the demand for the pair strengthened again.

For long positions on EUR/USD

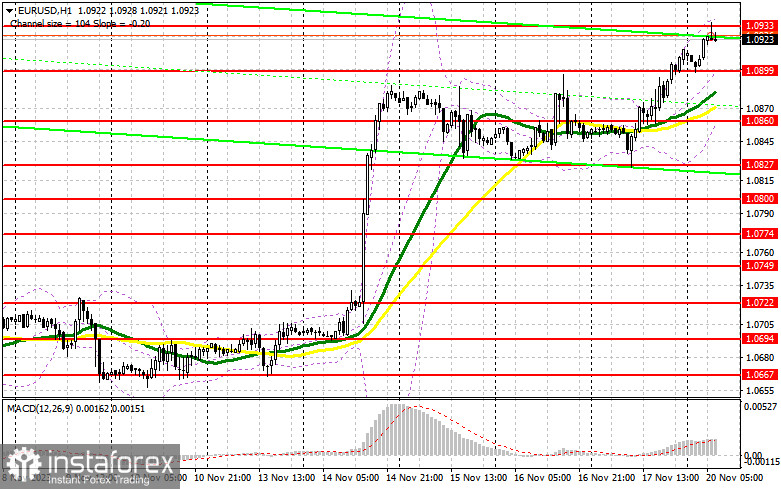

Even strong US real estate market data is no longer saving the American dollar from further decline against risk assets. It seems there is almost no chance that the Federal Reserve will raise interest rates again, which is reflected in the market. Today, apart from the German Producer Price Index and the Bundesbank report, no significant events are expected, so the euro has every chance to continue building an upward trend. It would be best to buy on a decline and formation of a false breakout at the level of 1.0899, similar to what I discussed earlier. This will provide a good entry point for long positions in anticipation of further growth and a test of the resistance at 1.0933, formed during the Asian session. A breakout and downward retest of this range, along with decreasing inflation in Germany, will give another signal for buying the euro and a chance to update the monthly high around 1.0970. The most distant target will be the area of 1.1004, where I plan to take profit. If EUR/USD declines and there is no activity at 1.0899 in the first half of the day, it won't particularly affect the buyers' position. One can always enter the market after a false breakout around the next support at 1.0860, where the moving averages, favoring buyers, are located. I will open long positions immediately on a rebound from 1.0827, aiming for an upward correction of 30-35 pips within the day.

For short positions on EUR/USD

Sellers are suffering losses, and there is no serious indication of their return to the market. Nothing on the macroeconomic front could support the bears and allow them to regain control of the market, so I will trade against the trend quite cautiously. Only the formation of a false breakout at 1.0933 will signal a selling opportunity, aiming for a downward correction and a test of the support at 1.0899, where I expect the emergence of major buyers. After breaking and consolidating below this range, as well as its upward retest, I expect to get another sell signal, targeting 1.0860. The farthest target will be the low of 1.0827, where I will take profit. If EUR/USD moves upwards during the European session and bears are absent at 1.0933, trading will remain within the upward channel, opening the way for buyers to new monthly highs. In this scenario, I will postpone sales until the price tests 1.0970. It is possible to sell there but also only after a failed consolidation. I will open short positions immediately on a rebound from 1.1004, aiming for a downward correction of 30-35 pips.

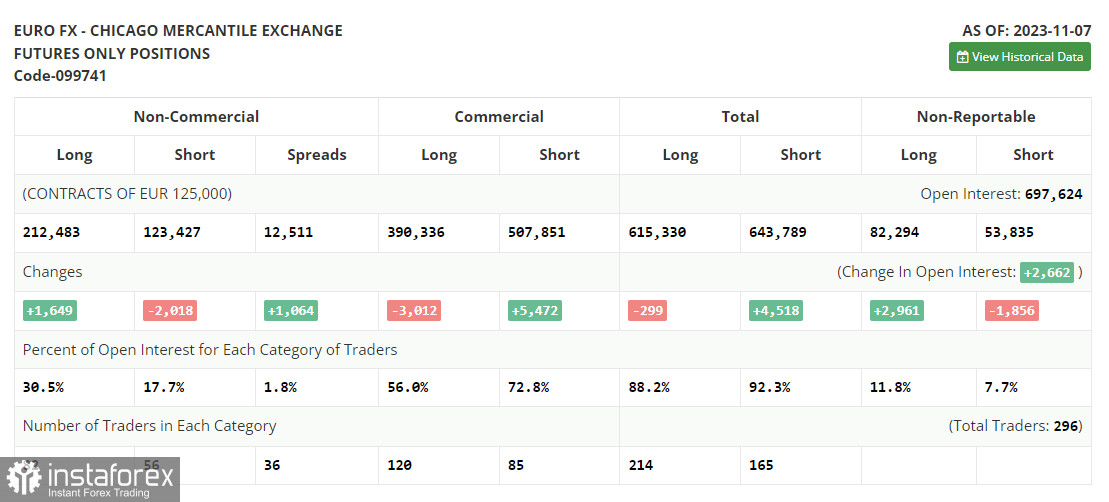

COT report

The Commitments of Traders (COT) report for November 7 indicated a decrease in short positions and an increase in long positions. It is important to note that these figures only reflect the market's reaction to the Federal Reserve's decision to maintain its policies unchanged. However, last week, Fed representatives made it clear that the future of interest rates would entirely depend on incoming data, not ruling out another hike by the end of this year. The upcoming US inflation report, which could set the direction for the pair for the coming weeks, along with other crucial statistics, is eagerly awaited. The COT report indicated that non-commercial long positions increased by 1,649 to 212,483, while non-commercial short positions decreased by 2,018 to 123,427. Consequently, the spread between long and short positions widened by 1,064. The closing price saw a sharp rise, settling at 1.0713 from the previous value of 1.0603.

Indicator signals:

Moving Averages

Trading above the 30- and 50-day moving averages indicates a continued rise in the euro.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair declines, the lower band of the indicator at 1.0753 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română