The EUR/USD currency pair unexpectedly and oddly resumed growth on Friday because of no significant fundamental or macroeconomic events. Oddly, the price did not even correct slightly downward after a 200-point rise on Tuesday. We have already mentioned that the market's reaction to a fairly mundane inflation report is inadequate. Of course, analysts immediately came up with a bunch of theories about why the dollar fell so sharply. The most viable is the rate cut in the first half of next year amid a new inflation decline. We consider this theory incorrect because the ECB will also likely begin lowering rates next year. And the ECB rate (for those who don't remember) is 1.25% lower than the Fed's rate. Therefore, monetary policy in the United States remains tighter and will likely stay that way for a long time.

Even if the market is currently selling the dollar due to concerns about a rate cut in 2024, how much will the dollar fall based on this factor alone? In the first half of this year, we have already witnessed "market concerns about the completion of monetary policy tightening in the United States." Remember that the dollar began to fall last fall when inflation in the United States began to slow down. Thus, the market has been working off its concerns for almost a year. Nothing is reasonable to expect if a new "working off of concerns" starts now.

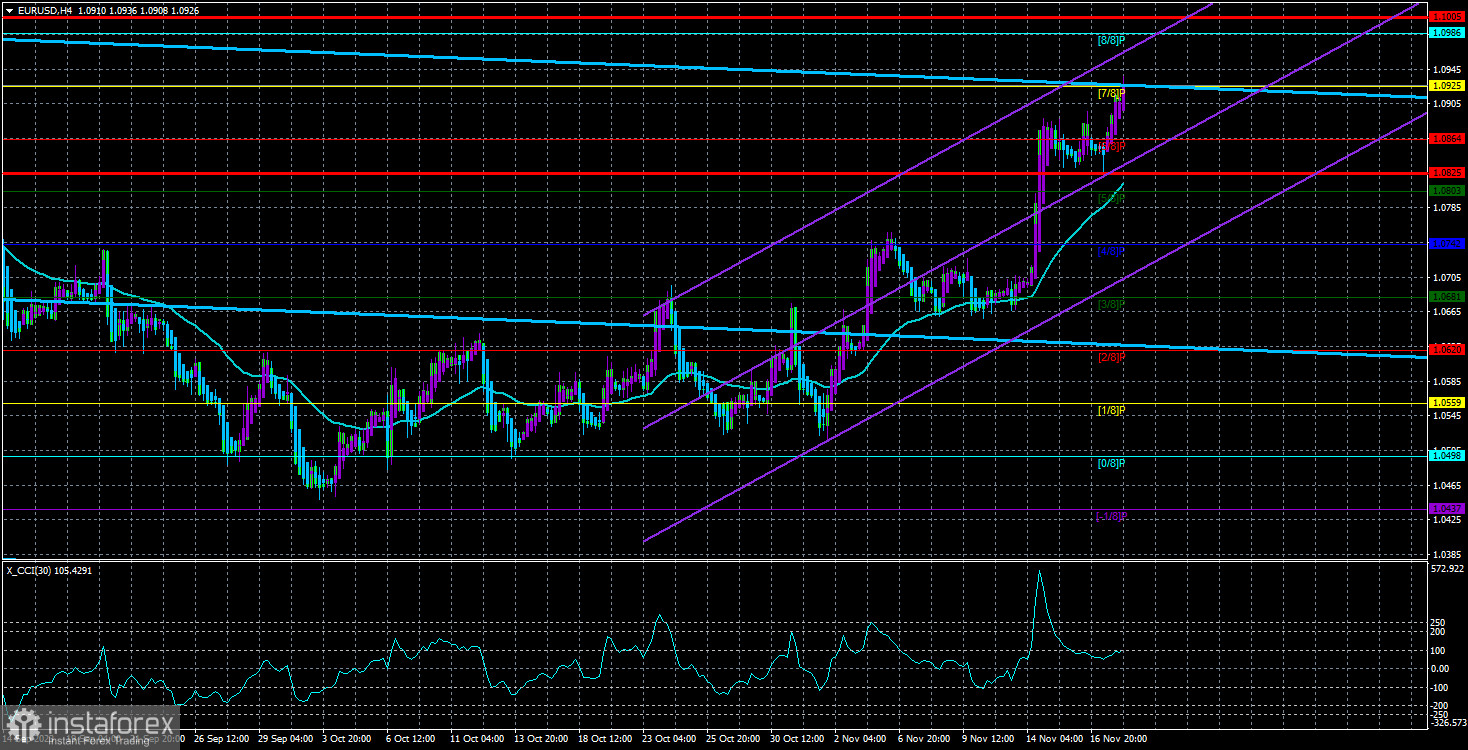

The CCI indicator has entered the overbought zone three times, macroeconomic statistics from the European Union are worse than those from the United States, and the Fed's rate, as already mentioned, is higher than the ECB's rate. On what basis is the euro growing at this time? In essence, we currently have a situation where almost all factors point to a decline in the pair and a rise in the dollar, but what we see on the charts is the opposite movement. Therefore, the conclusion is obvious: the market has again entered a phase of unfounded buying, and no one knows how long it will last. Therefore, it is necessary to follow the trend, keeping in mind the CCI indicator's strong overbought condition and the current rise's baselessness.

Is the dollar returning to free fall?

Monday started with the European currency growing even stronger. Yes, this growth cannot be called strong, but in combination with the movement on Friday and Tuesday of last week, the euro is practically growing continuously. In principle, there is nothing more to say about the technical picture. On the 24-hour TF, the pair hit the Fibonacci level of 50.0%-1.0940, and this is a chance for a downward bounce. The price reached an important level + a strong overbought condition of the CCI indicator. Perhaps these two factors will at least stop the rise of the euro, which is very difficult to explain in words.

As we have already found in recent articles, the main danger for the US dollar is the American macroeconomic background. There will be a few important events in the United States this week. There are a couple of reports, but even they can provoke a new drop in the dollar. A 3.2% reduction is expected in the indicator of orders for goods of long-term use. Business activity indices have long been balancing on the brink of collapse below the "waterline" of 50.0. A slight decrease in these indicators - and they will fall below the key level of 50.0, which market participants can interpret as a reason for new sales of the American currency.

The most important thing now is the market sentiment. If the market is set for selling the dollar, then no statistics will help. The market will interpret any report not in favor of the dollar, and those that cannot be interpreted in this way will simply be ignored. Therefore, unfortunately, we can now expect a period of illogical movements when the US currency will fall against all odds.

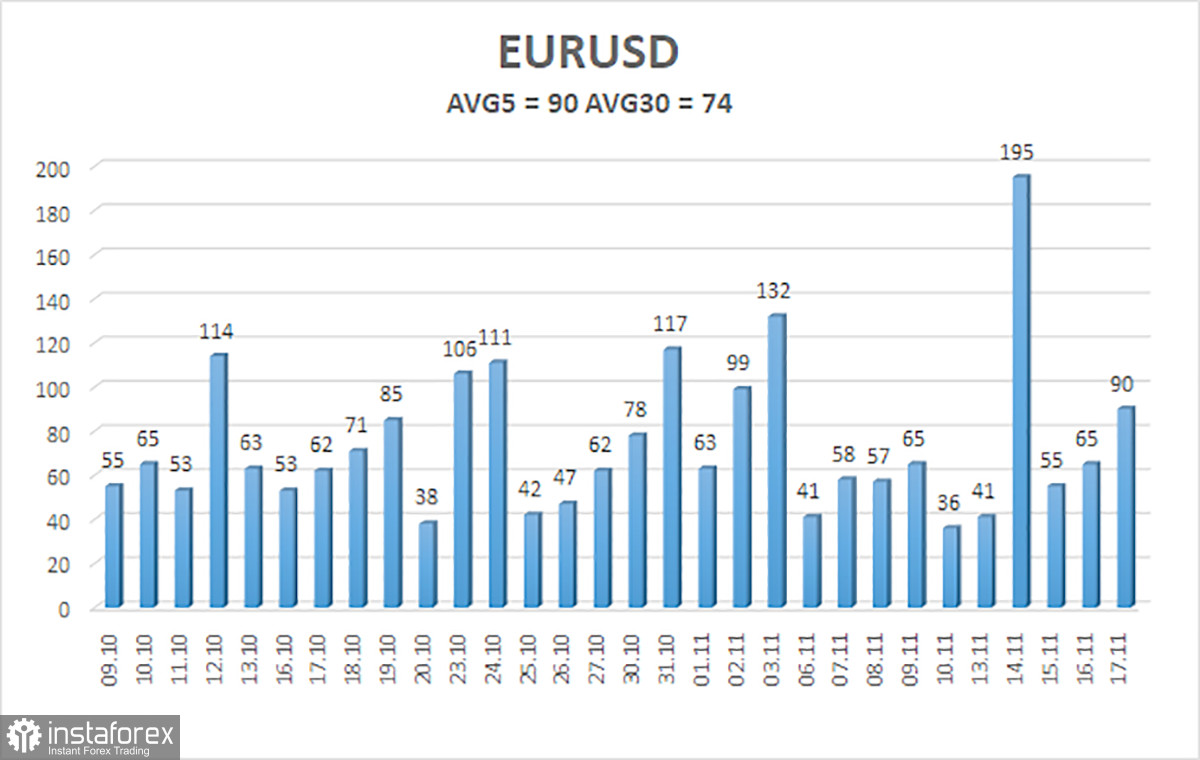

The average volatility of the euro/dollar currency pair for the last five trading days as of November 19th is 90 points and is characterized as "average." Thus, we expect the pair to move between the levels of 1.0825 and 1.1005 on Monday. A downward reversal of the Heiken Ashi indicator will indicate a possible start of a downward correction.

Nearest support levels:

S1 - 1.0864

S2 - 1.0803

S3 - 1.0742

Nearest resistance levels:

R1 - 1.0925

R2 - 1.0986

R3 - 1.1047

Trading recommendations:

The EUR/USD pair showed a new twist in the upward movement and is above the moving average. It is advisable to consider buying now, but we still strongly doubt that the pair's growth will continue, considering the triple overbought condition of the CCI indicator. Based on "bare" technical analysis, you can try various purchases with targets at 1.0986 and 1.1005, but be careful. Sales of the euro will become relevant after the price is fixed below the moving average, with targets at 1.0742 and 1.0681.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, the trend is strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which to trade.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or the overbought zone (above +250) indicates that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română