Nothing much happened in the beginning, but the dollar started to actively lose ground when the US trading session opened. This was due to a series of speeches by Federal Reserve officials. Although none of them uttered a word about the need to lower interest rates, they all unanimously spoke about the need to stop tightening monetary policy, thereby confirming investors' expectations. This implies a subsequent rate cut, not in the current year, but probably at the beginning of 2024. Although the situation at the European Central Bank is somewhat similar, there are two important points to take note of. Firstly, the Fed's actions have much greater significance and impact. Secondly, the interest rate level in Europe is lower than in the United States, meaning the European Central Bank has more room for maneuver. Not to mention the fact that the inflation rate in Europe is higher. So, once again, the prospect opens up that at some point in time, the interest rate level in the EU will be higher than in the US. This is currently the main driving force that is pushing the euro higher.

The EUR/USD pair concluded a three-day consolidation with a bullish momentum. This led to an increase in the volume of long positions, which prolonged the upward cycle.

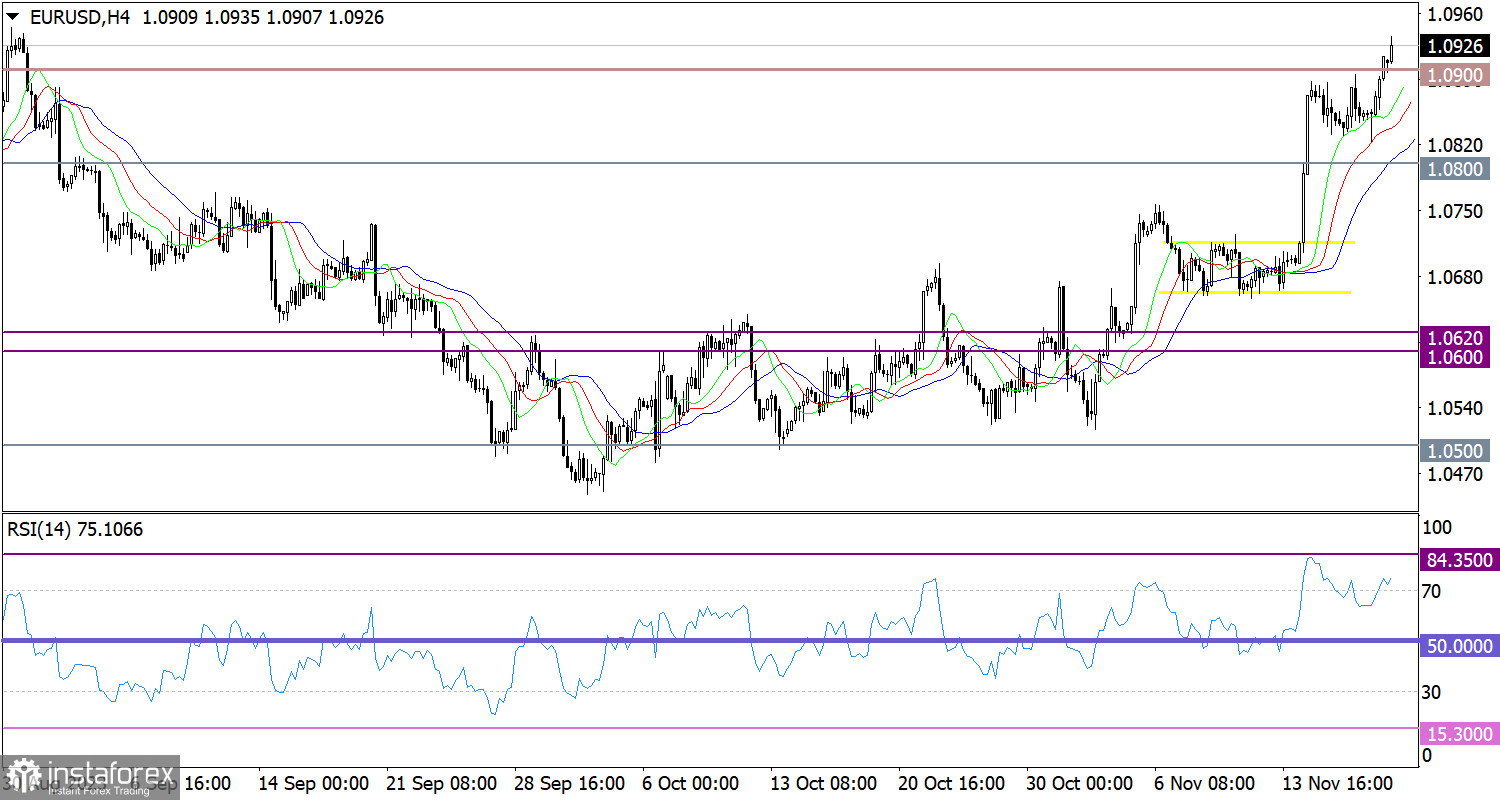

On the four-hour chart, the RSI upwardly crossed the 70 line. This indicates the euro's overbought condition. However, it isn't excessive, and the exchange rate may still rise.

On the same chart, the Alligator's MAs are headed upwards, which reflects the upward cycle.

Outlook

In case the pair rises further, the price could move towards the psychological level of 1.1000. This will signal the pair's recovery from the decline it went through during the summer. However, in case the price returns below the level of 1.0900, buying volumes may decrease, which could lead to a rebound.

The complex indicator analysis points to an upward cycle in the short-term, medium-term and intraday periods.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română