The European currency and the British pound continue to form a corrective wave 2 or b. For the pound, this wave has taken on a three-wave form, while for the euro, it has a five-wave structure. However, the important thing is that both of these waves have a completed form, so both instruments can start building downward waves. However, this scenario faces problems due to the recent US data. Reports on ISM, Nonfarm Payrolls, and inflation turned out differently than the markets expected, leading to a decrease in demand for the US currency. I now assume that waves 2 or b may take an even more extended form. The longer these waves turn out, the longer we may have to wait for the start of wave 3 or c.

European Central Bank President Christine Lagarde gave another interview this week, stating that the central bank may lower rates later than expected. Lagarde believes that inflation in the EU will return to the target level only if rates are kept at the current level for a long time. The ECB will not begin cutting rates for at least "the next couple of quarters", Lagarde has said. The ECB head also noted that the current level of inflation (2.9% y/y) is due to lower energy prices, but warned that quick disinflation may be ending soon

It is worth noting that almost all members of the ECB's Governing Council have expressed support for keeping the rate at its current level rather than raising it. Therefore, the central bank is not planning further rate hikes. The only way for it to influence inflation is by keeping the rate at its peak. The Fed is also not ready for further tightening, especially after the latest inflation report, which was highly praised by FOMC members.

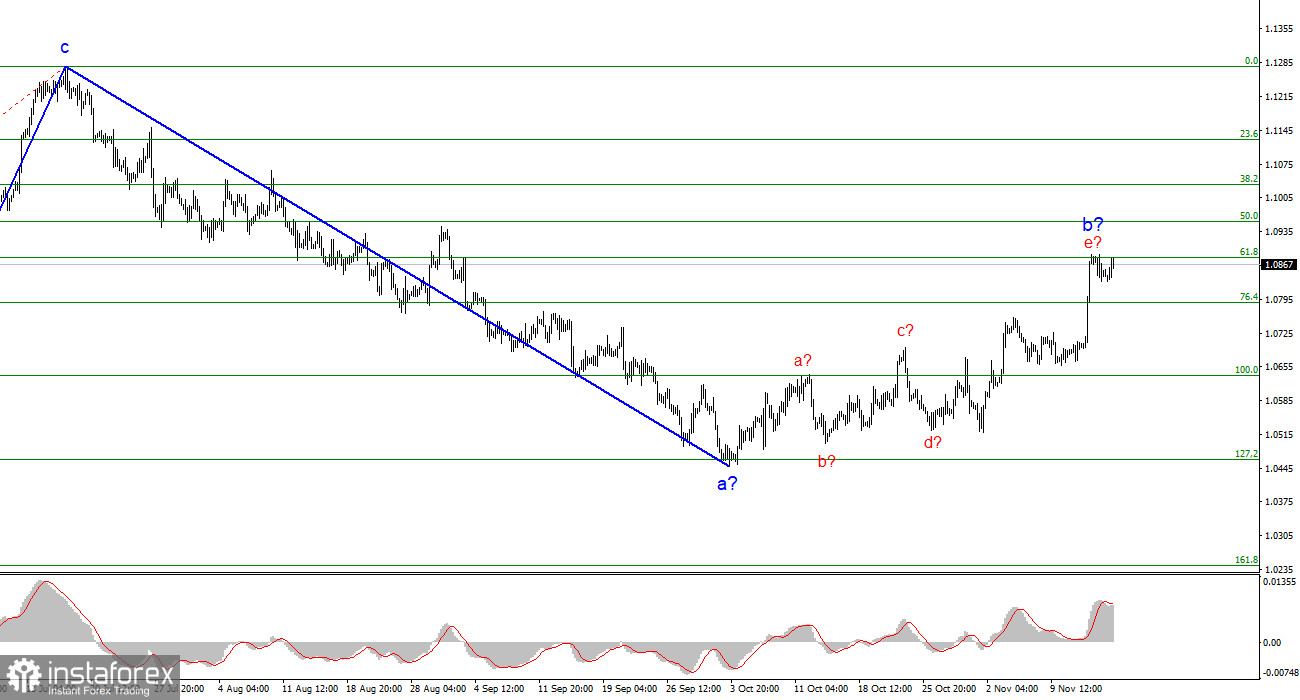

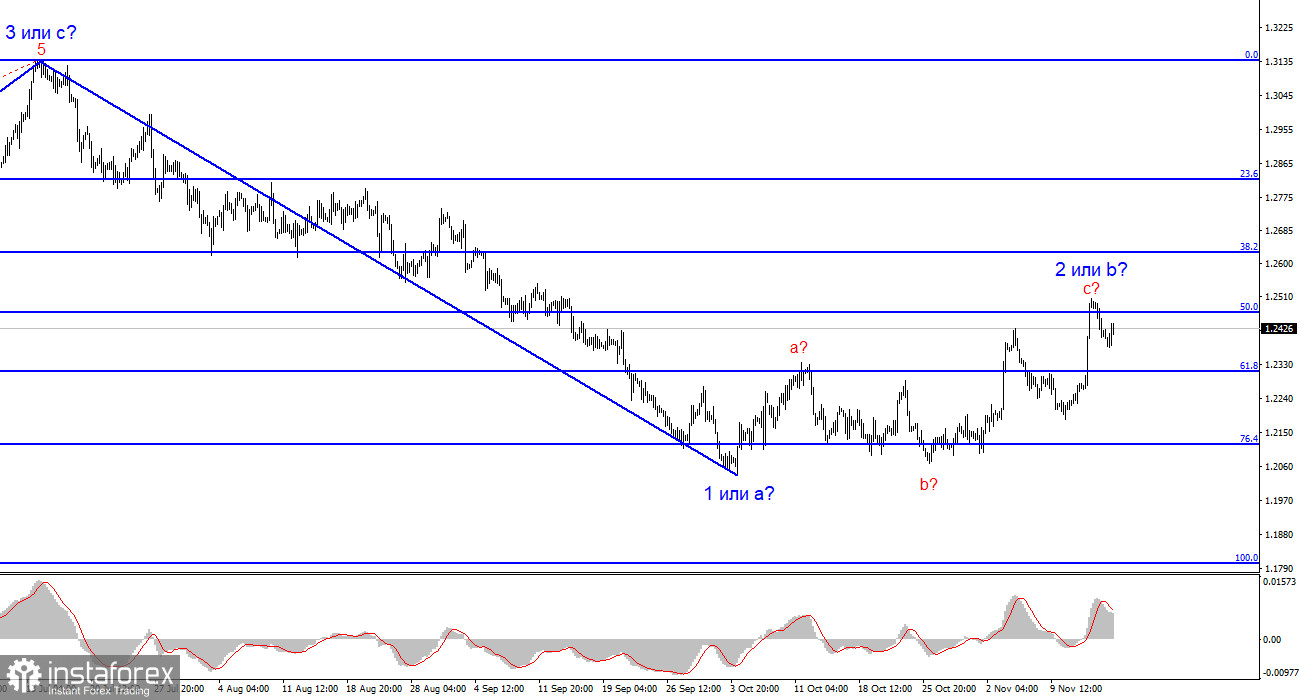

Based on everything mentioned above, I believe that now is a good time to complete waves 2 or b. For the euro, you can use the level of 1.0880 as a reference point, which corresponds to 61.8% according to Fibonacci. An unsuccessful attempt to break through it may indicate the market's readiness to build a downward wave. For the pound – the same, but with the level of 1.2467, which is equivalent to 50.0% according to Fibonacci.

Based on the analysis, I conclude that a bearish wave pattern is still being formed. The pair has reached the targets around the 1.0463 level, and the fact that the pair has yet to breach this level indicates that the market is ready to build a corrective wave. It seems that the market has completed the formation of wave 2 or b, so in the near future I expect an impulsive descending wave 3 or c with a significant decline in the instrument. I still recommend selling with targets below the low of wave 1 or a. But be cautious with short positions, as wave 2 or b may take a more extended form.

The wave pattern for the GBP/USD pair suggests a decline within the downtrend segment. The most that we can count on is a correction. At this time, I can already recommend selling the instrument with targets below the 1.2068 level because wave 2 or b will end. It would have already ended if not for a series of disappointing reports from America. Initially, just a good amount of short positions should be enough because there is always a risk of complicating the existing wave.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română