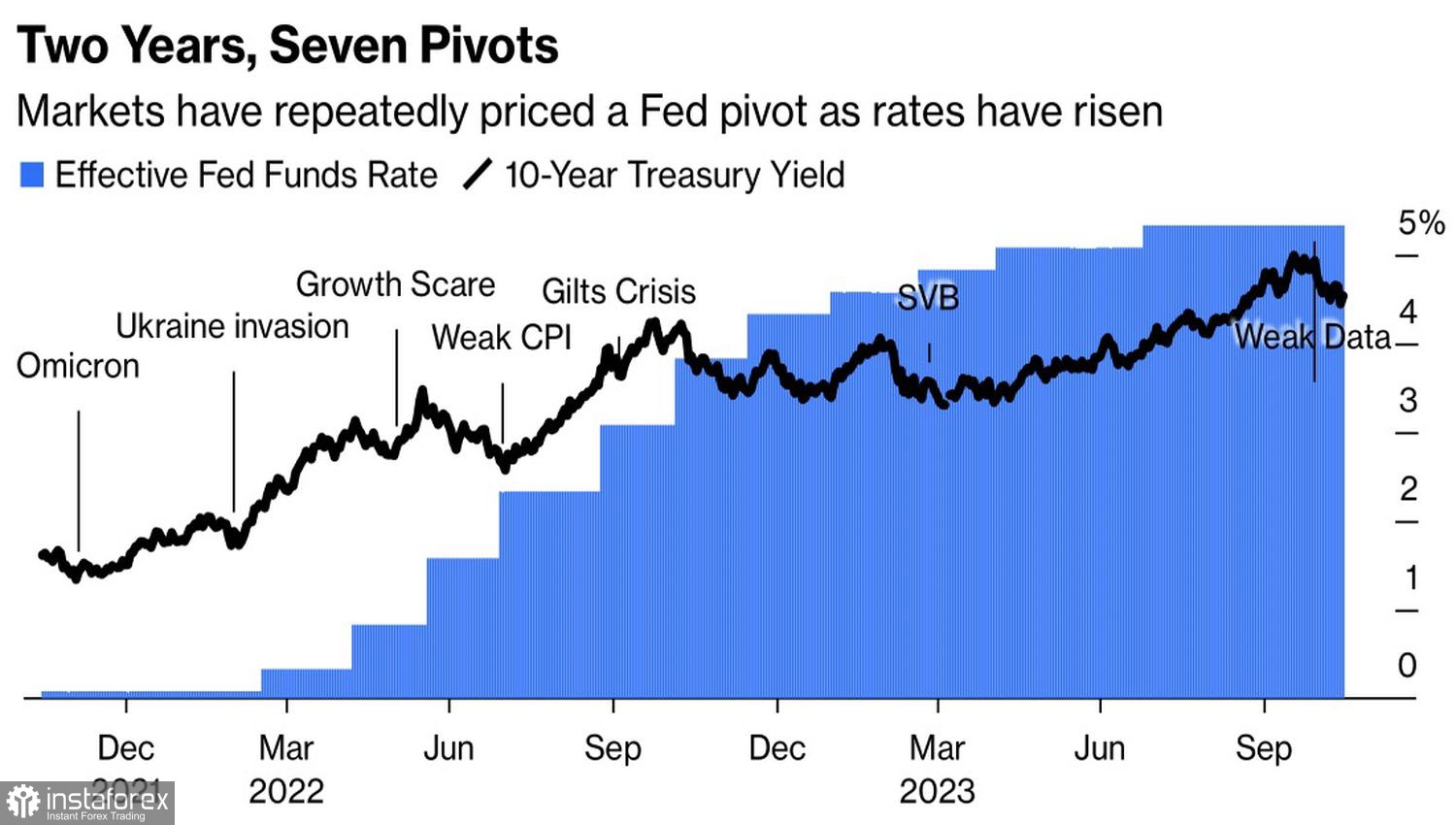

Measure seven times, cut once. Seven times in the current cycle of monetary restriction by the Federal Reserve, financial markets attempted to test the central bank's resilience. They bet on a dovish pivot, and each time, they lost. As a result, EUR/USD quotes declined, and some banks were already discussing parity back in October. Why would investors succeed in defeating the Federal Reserve on the seventh attempt? And is the downward trend broken on the main currency pair?

Federal Reserve Rate and U.S. Treasury Bond Yields Dynamics

In reality, the same scheme was at play: as inflation slowed down, the futures market began predicting a rate cut in federal funds in 2024. This led to a weakening of financial conditions and hawkish rhetoric from FOMC members. In the end, investors gave up the fight for the sixth time. However, in November, everything changed.

It's easy to assume that the reason for all the previous attempts to challenge the Federal Reserve was the slowdown in inflation growth. In theory, the lower consumer prices, the weaker the economy. As PCE approached the target, markets believed in the cooling of the U.S. GDP. It didn't happen. Moreover, in the third quarter, gross domestic product expanded by a staggering 4.9%. As a result, investors had to abandon their bets on the Federal Reserve's dovish pivot. They admitted defeat.

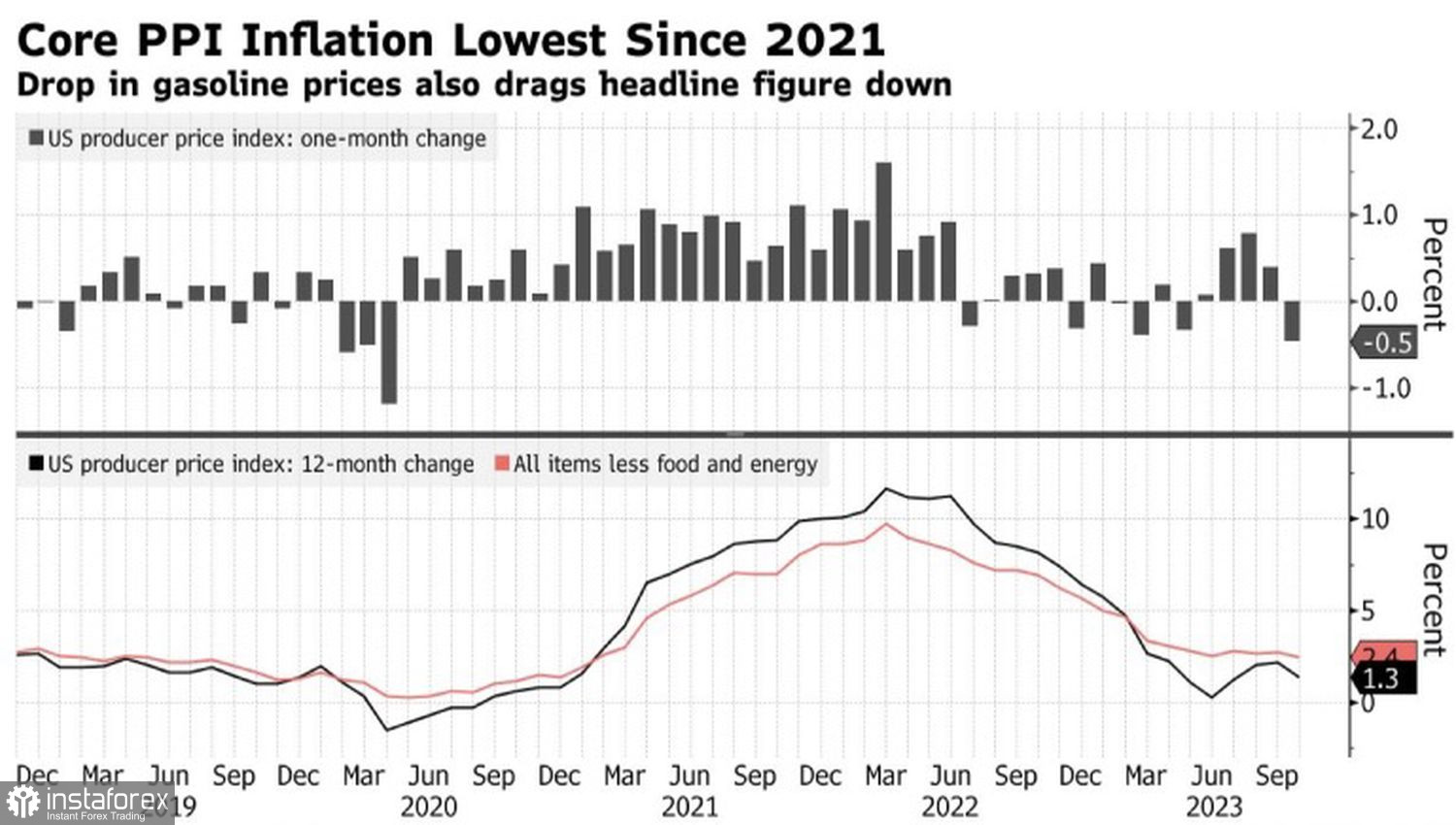

However, in November, it all started with disappointing employment statistics in the United States. Furthermore, the final data on consumer prices and core inflation turned out worse than expected. The Consumer Price Index fell at the fastest pace since April 2020, when the country was in the clutches of the pandemic. Retail sales decreased for the first time since March.

Producer Price Index Dynamics

Thus, one confirmation follows another: the American economy is cooling, which fully aligns with the actual slowdown in inflation. If the situation continues in the same vein, instead of a soft landing, markets will start talking about a recession. The current composition of the Federal Reserve wants to make history—taming high prices without an economic downturn in the United States.

What to do? Of course, start cutting rates as soon as you smell something burning. Further deterioration of macro statistics in the United States will bring the date X closer—the moment of the first act of monetary expansion. Currently, derivatives suggest it will happen in May, but a 30% chance in March also looks impressive.

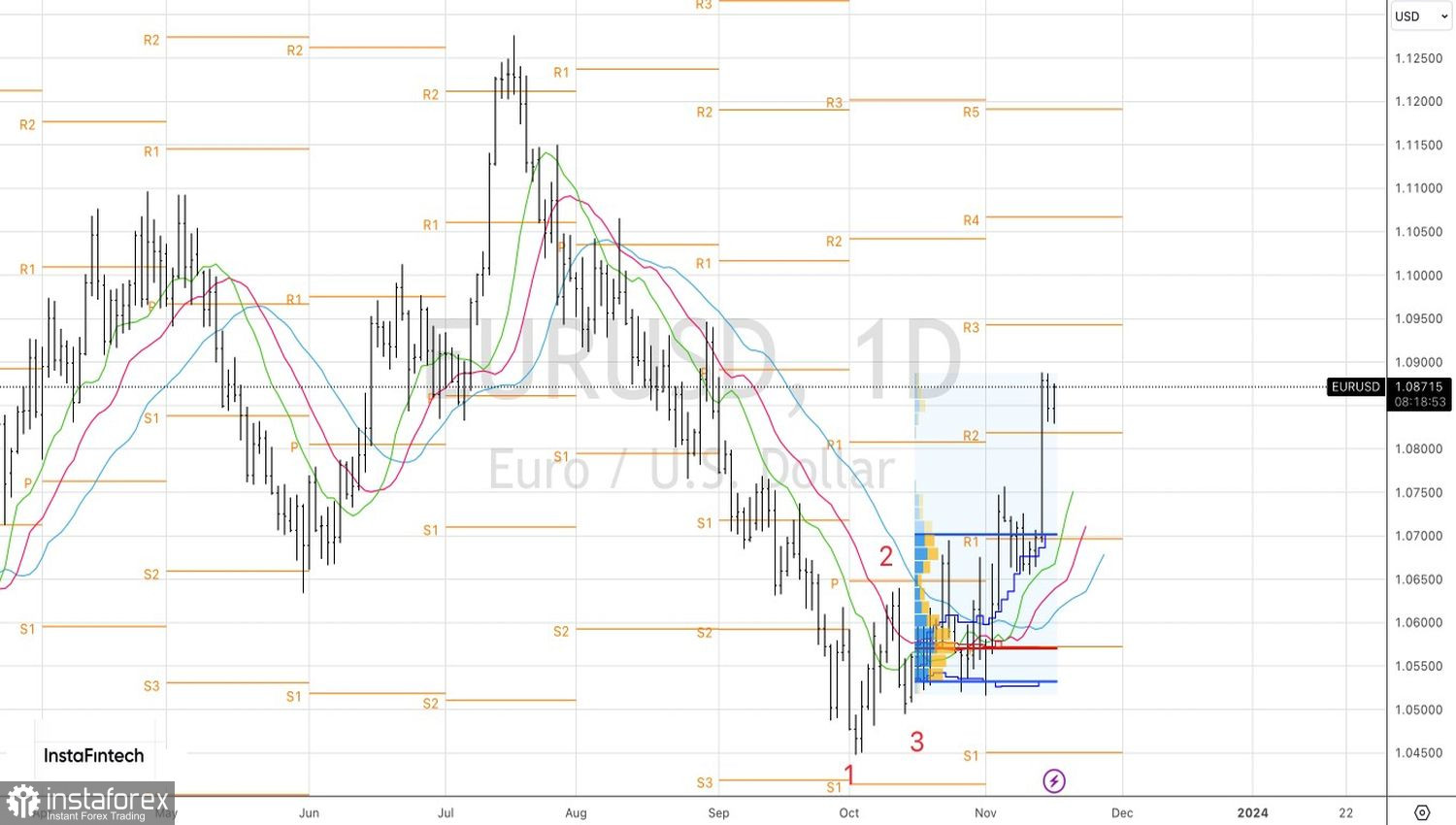

Against this background, the U.S. dollar has nothing to envy. Over the past two years, it has dominated the Forex market, feeling like a king. And now it's time to leave the throne.

Technically, on the daily chart of EUR/USD, the bears failed to play out the inside bar, indicating their weakness. If the market doesn't go where it is expected to, it is more likely to move in the opposite direction. Therefore, breaking through the upper boundary of the inside bar at 1.0885 will allow increasing the formed longs from 1.07 and 1.072.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română