EUR/USD

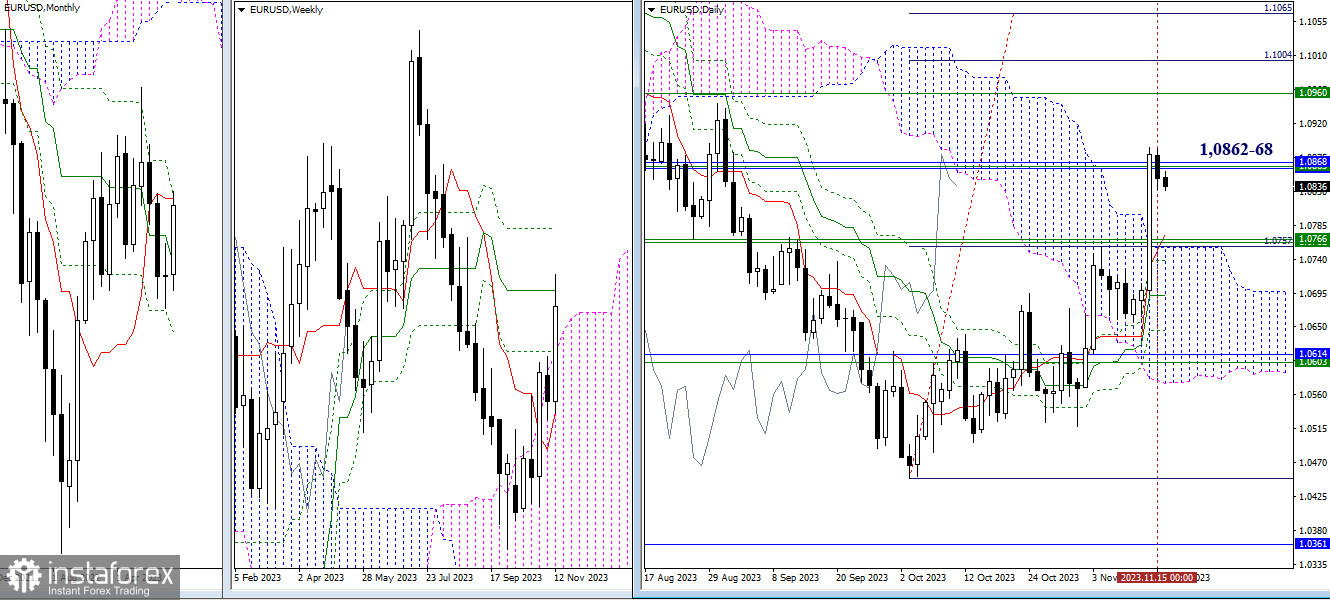

Higher Timeframes

The encounter with the zone 1.0862–1.0868, which merged several strong resistances, did not go unnoticed. As a result, yesterday, we observed a slowdown and some bearish activity. The upcoming days will determine the outcome of the encounter. Bearish activity and a decline will draw the market's attention to the supports accumulated at 1.0756-1.0766 (weekly and daily levels), while overcoming 1.0862-68 will pave the way to the final resistance of the weekly death cross (1.0960) and the daily target for breaking through the Ichimoku cloud (1.1004-1.1065).

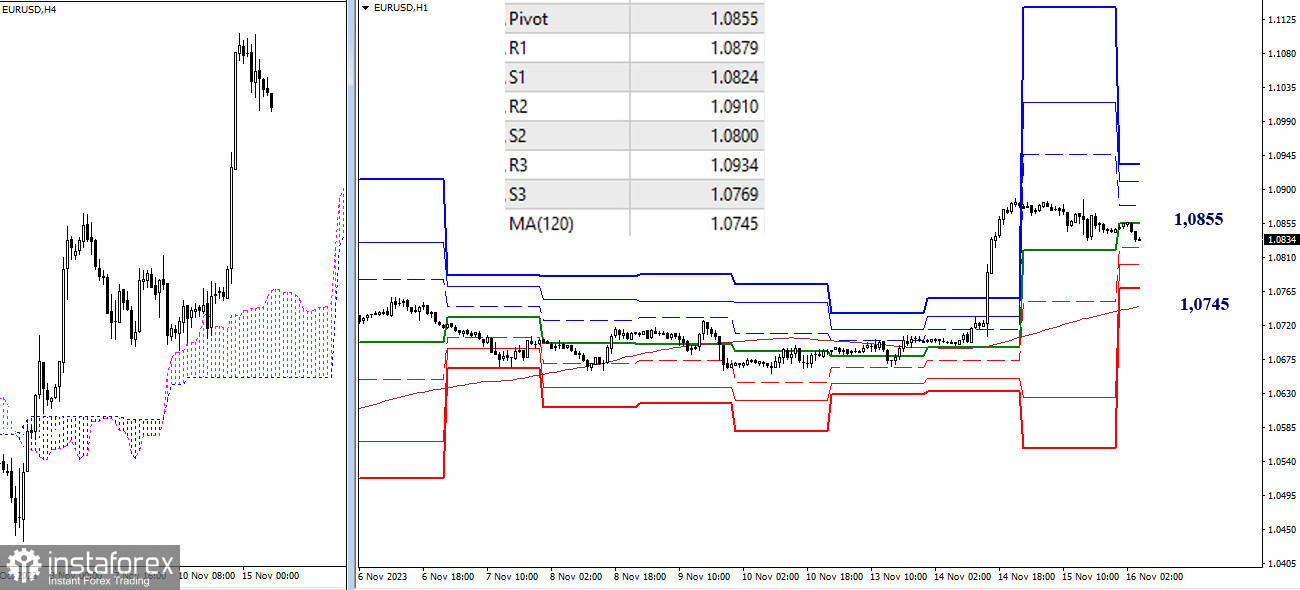

H4 - H1

On the lower timeframes, there is a corrective decline, but bulls maintain a general advantage. At the moment, the reference points for the resumption of the ascent could be 1.0855-1.0879-1.0910-1.0934 (classic pivot points). Strengthening bearish sentiments today may occur through breaking the supports at 1.0824-1.0800-1.0769 (classic pivot points). To change the current advantage to the bears' side, it is necessary to break and reverse the moving average—the weekly long-term trend, which, in the current situation, is at 1.0745.

***

GBP/USD

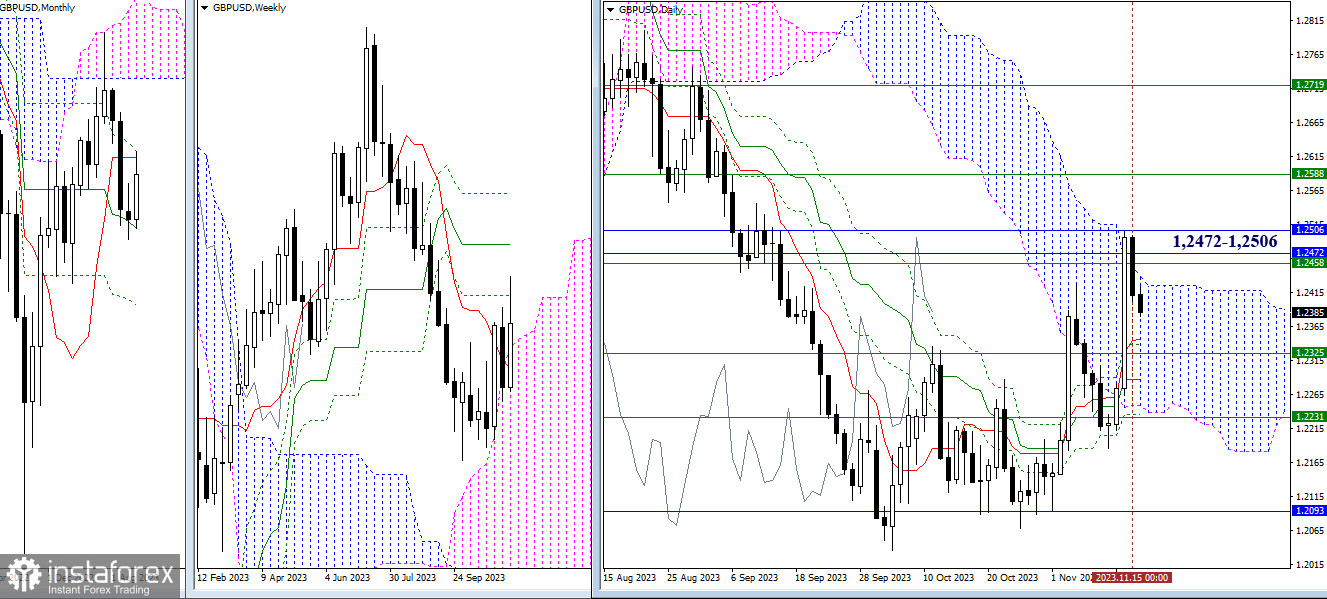

Higher Timeframes

As of yesterday, the pound can boast more impressive results than the euro. The market failed to overcome the accumulation of strong resistances, such as the weekly Fibonacci Kijun (1.2458), the monthly short-term trend (1.2471), and the monthly Fibonacci Kijun (1.2505). If bears continue to recover their positions, there is a broad support zone on this part of the market, consisting of levels from various timeframes and located at 1.2346-1.2325-1.2287-1.2248-1.2231.

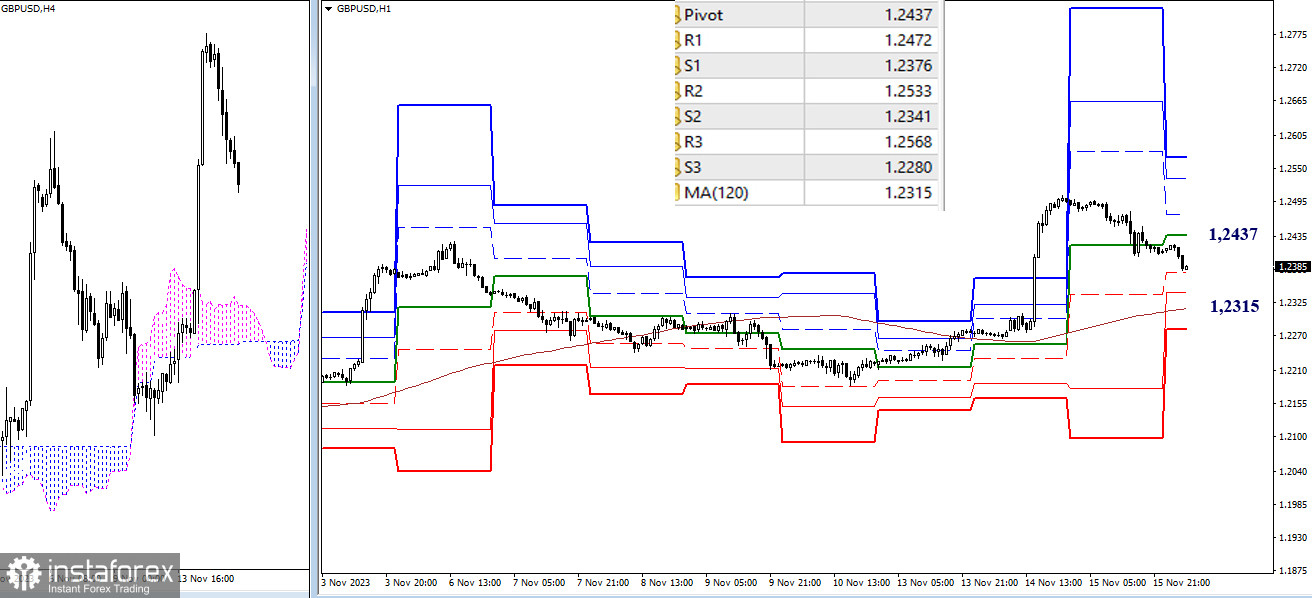

H4 - H1

Bulls failed to update the previous day's high and continue the ascent, while the opponent, developing the decline, has now consolidated below the central pivot point of the day (1.2437). The continuation of the descent now lies through testing and breaking the supports at 1.2376-1.2341 (classic pivot points). A shift in the main advantage and the current sentiment is possible after testing, overcoming, and reversing the weekly long-term trend (1.2315).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română