Analysis of macroeconomic reports:

There are hardly any macroeconomic events on Thursday. We will only highlight the US reports on industrial production and jobless claims. We may see a market reaction if there are significant deviations from the forecasts. There are no important reports lined up in the UK and the EU. Since the current upward movement in both pairs is part of a corrective phase, we believe that the dollar should continue to strengthen on Thursday regardless of the macroeconomic background.

Analysis of fundamental events:

Several fundamental events are planned for Thursday, and some of them may be interesting. In the EU, Christine Lagarde and Luis de Guindos will deliver speeches. We don't expect them to share any important information, as inflation in the EU has already fallen to 2.9%, and European Central Bank representatives have repeatedly stated that they do not plan to raise the key rate in the near future. In the UK, Dave Ramsden, a representative of the Bank of England, will speak and may comment on the latest inflation report. However, Ramsden is not one of the "key figures" of the British central bank, so we do not expect crucial comments from him.

As usual, several Federal Reserve officials will speak. At different times, there will be speeches and interviews with Lael Brainard, Michael Barr, Loretta Mester, John Williams, and Christopher Waller. Naturally, some of them may touch on the latest inflation report and indicate what impact it will have on future decisions of the US central bank. This information will be interesting, but we probably shouldn't expect a swift market reaction.

General conclusion:

Several events and a couple of reports on Thursday, but almost all of them are secondary of importance. We should focus on the speeches of Lagarde and de Guindos, but the ECB head and her deputy are not expected to deliver crucial remarks. Everything indicates that both pairs will trade calmly on Thursday, and the corrective phase may continue.

Basic rules of a trading system:

1) Signal strength is determined by the time taken for its formation (either a bounce or level breach). A shorter formation time indicates a stronger signal.

2) If two or more trades around a certain level are initiated based on false signals, subsequent signals from that level should be disregarded.

3) In a flat market, any currency pair can produce multiple false signals or none at all. In any case, the flat trend is not the best condition for trading.

4) Trading activities are confined between the onset of the European session and mid-way through the U.S. session, post which all open trades should be manually closed.

5) On the 30-minute timeframe, trades based on MACD signals are only advisable amidst substantial volatility and an established trend, confirmed either by a trend line or trend channel.

6) If two levels lie closely together (ranging from 5 to 15 pips apart), they should be considered as a support or resistance zone.

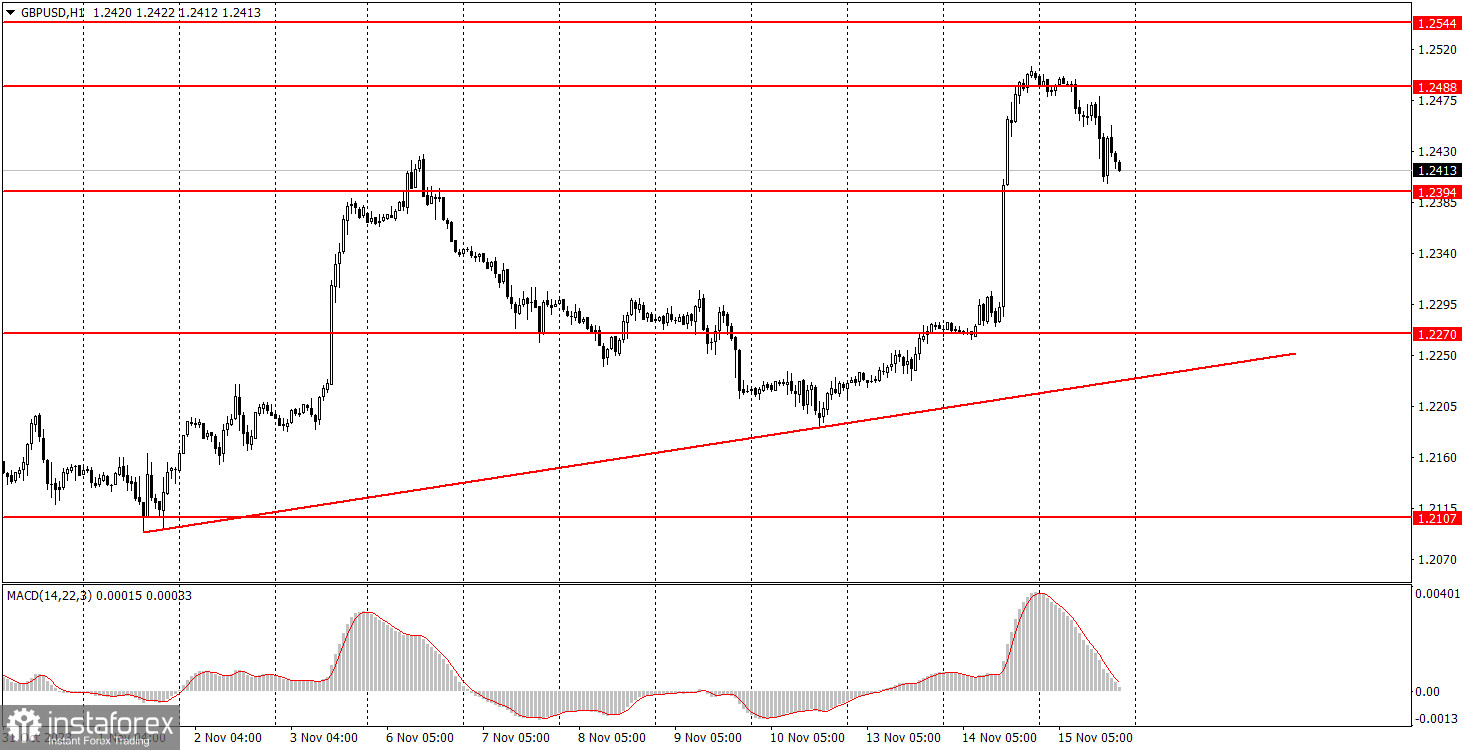

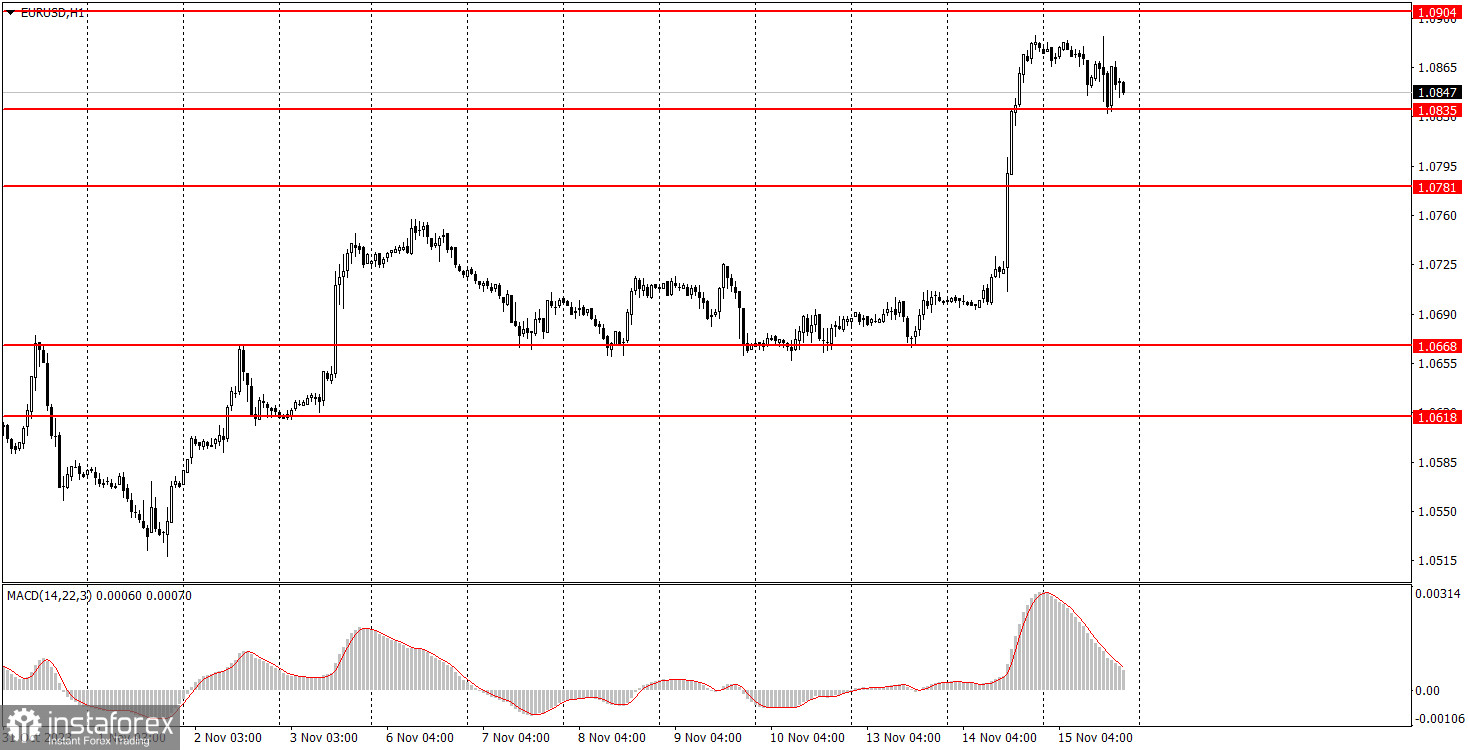

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines represent channels or trend lines, depicting the current market trend and indicating the preferable trading direction.

The MACD(14,22,3) indicator, encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a signal source.

Significant speeches and reports (always noted in the news calendar) can profoundly influence the price dynamics. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to prevent abrupt price reversals against the prevailing trend.

Beginning traders should always remember that not every trade will yield profit. Establishing a clear strategy coupled with sound money management is the cornerstone of sustained trading success.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română