The EUR/USD pair eased after it rallied towards the 1.09 level on Tuesday. Although the bulls failed to test the resistance level at 1.0900 (the upper line of the Bollinger Bands on the four-hour chart), they were still able to update the 2.5-month price high. The last time the pair was in this price range was at the end of August, driven by a strong euro and a weak greenback. This time, the driving force behind the rise is the dollar, as it cannot recover after the release of the October inflation report. To recall, all components of the Consumer Price Index came out in the red, reflecting a slowdown in inflation in the United States. On Wednesday, another inflation report (Producer Price Index) was published in the United States, which also exerted pressure on the greenback. Only the "green tint" of the retail sales data helped the bears in preventing another surge.

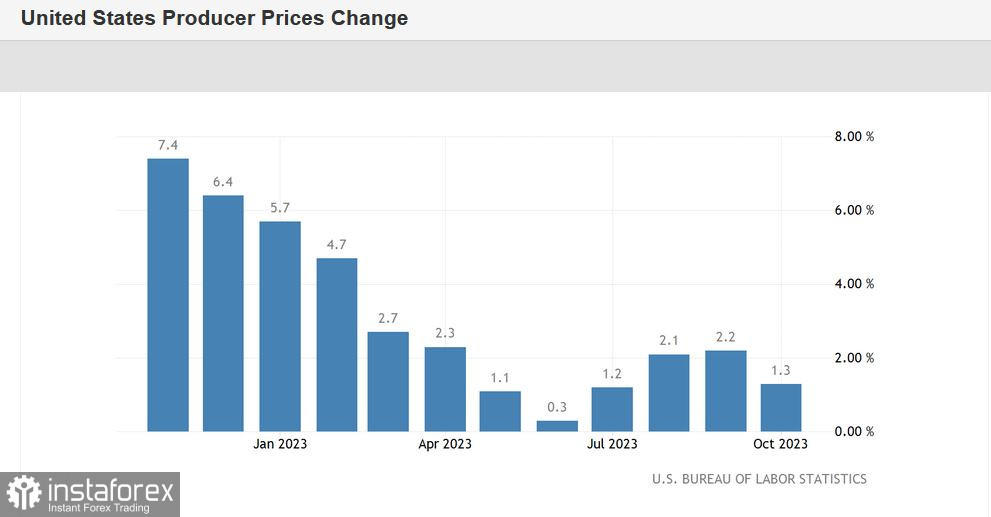

The PPI on an annual basis over the past 12 months (from June 2022 to June 2023) had been consistently decreasing, reaching 0.2% YoY in June. However, the index began to rise again, reaching 0.8% in July, 2.0% in August, and 2.2% YoY in September. The October value was released on Wednesday and contrary to forecasts of a decline to 1.9%, it fell more significantly to 1.3% YoY. The important thing here is the trend itself, as the indicator has started to slow down again. The Core PPI followed a similar trajectory. In September, the Core PPI reached 2.7%, but in October, it slowed down to 2.4% YoY, with a forecasted increase to 2.8%.

Simultaneously, the retail sales report was also published. It turned out that U.S. retail spending dropped in October, dipping 0.1% from September (with a forecasted decline of 0.4%). Excluding automobile sales, the indicator remained positive (+0.1%), while most experts predicted a decrease to -0.4%.

The retail sales report provided some support to the dollar, allowing the bears to prevent further growth. However, in my opinion, one should approach the current corrective pullback with great caution, as there are no clear reasons for a downward movement.

The latest inflation report served as another confirmation that inflation in the U.S. is slowing down, and, therefore, there is no urgent need for additional tightening of monetary policy. The CME FedWatch Tool data also support this conclusion. After the release of the CPI report, the probability of the Federal Reserve raising interest rates at the December meeting sharply decreased to 5%. After the release of the PPI data, the probability of a rate hike next month has dropped to zero. As for the January meeting, a similar picture has emerged: the probability of maintaining the status quo is at 97.8%.

At the same time, there is growing confidence in the market that the Fed will resort to easing monetary policy in the first half of 2024. According to the CME FedWatch Tool, the probability of a rate cut in the spring (following the May meeting) is now at 50%! The sharp decline in hawkish expectations and the gradual rise of dovish sentiments weigh on the greenback: the U.S. Dollar Index hit a two-month low on Tuesday, returning to the 103-level. Major dollar pairs have adjusted their configurations accordingly.

As mentioned earlier, traders had a weak reaction to the PPI, focusing their attention on another report (which turned out slightly better than expected) – the U.S. retail sales report. Why did this happen? I suppose the market had already discounted the prospects of tightening monetary policy in December/January after the CPI. The latest report confirmed the traders' conclusions, but overall, market participants had already priced in this information.

Typically, after such impulsive price movements, a corrective pullback follows (which we are currently observing). In order to develop the uptrend, the bulls need another impetus, one that not only helps them surpass the resistance level of 1.0900 but will also solidify the pair in the ninth figure region.

To reiterate, the market has come to terms with the fact that the central bank will maintain its policy unchanged after the next two meetings. Meanwhile, the question of rate cuts in the next six months remains a matter of discussion. Therefore, any hints that the Fed will go in that direction will exert significant pressure on the greenback. Dovish statements from Fed officials will enable the bulls to consolidate around the ninth figure and approach the main price barrier at 1.1000. On the one hand, this is a relatively straightforward recipe for an uptrend. However, on the other hand, there is no clear alternative to this – the euro is not capable of rallying on its own, and the dollar has already played out the preservation of the status quo at the upcoming meetings. Undoubtedly, the most important economic reports (Nonfarm Payrolls, inflation, GDP) can reinforce traders' dovish expectations, but the Fed should play a key role in this (whose representatives must acknowledge at least a hypothetical possibility of rate cuts in the first half of 2024).

Currently, the bears are testing the support level at 1.0840 (the upper line of the Bollinger Bands indicator on the daily chart). If bears push through this target, they will open the path to the next price barrier at 1.0750 (the upper line of the Kumo cloud on the same timeframe). It's worth noting that the corrective pullback has paused at the 1.0840 support level, so you should only consider short positions once the pair breaches this mark.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română