JP Morgan's calls to stop overly emotionally reacting to one month's data, the worsening forecasts for the EU economy, and the weakening of the pound after the release of British inflation data for October have forced EUR/USD bulls to retreat. However, the bears' counterattack looks so weak that it risks ending without really starting.

According to JP Morgan, the market overly reacted to the information about zero growth in core inflation in October. It is necessary to stop doing this. The Fed perceives the data flow and will not make decisions based on a single report. This position seems reasonable at first glance. However, in reality, such words are nothing more than an attempt to put on a brave face in a bad game. JP Morgan had previously talked about continuing the tightening cycle of the Fed's monetary policy and claimed that the yield on 10-year Treasury bonds could reach 7%.

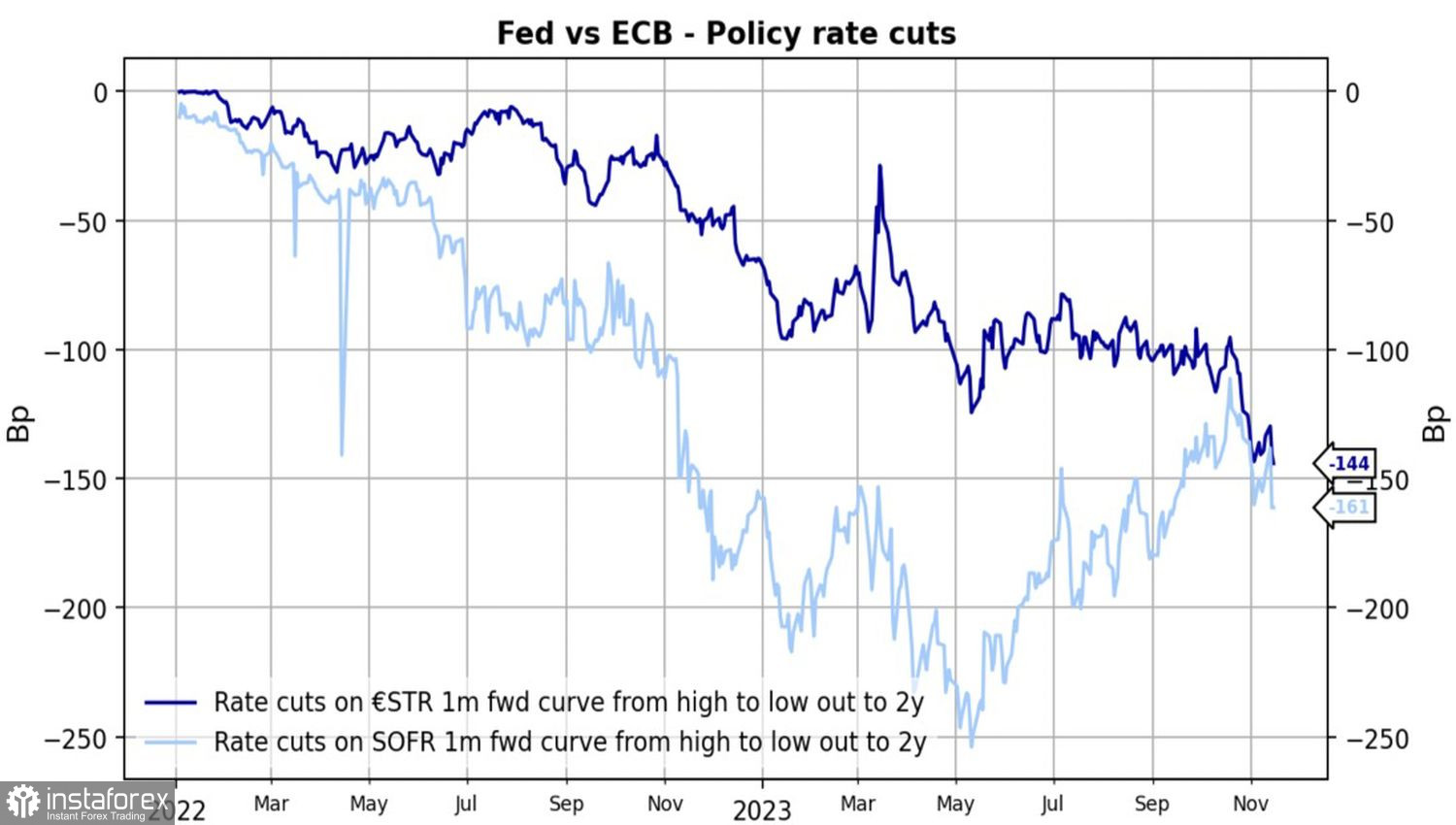

The reality is that rates on 10-year bonds are more likely to fall than rise. The market is counting on monetary stimulus from the Fed as early as 2024 and predicts that, in two years, the cost of borrowing will fall by 161 bps. For comparison, the derivatives estimate a 144 bps decrease in the ECB deposit rate.

Dynamics of Market Expectations for ECB and Fed Rates

The pressure on the euro came from information about the slowing growth of consumer prices from 6.7% to 4.6% in October. As a result, the forecasts for the first repo rate cut by the Bank of England shifted from August to June, and the pound weakened. Investors recalled that all central banks are in roughly the same position; they have completed monetary restriction cycles and will move on to stimulus after some time.

However, the dollar remains the dollar. The lion's share of Forex transactions involves this currency. It is not surprising that everyone is watching the Fed and American macrostatistics. In addition, the USD index has been rising for two years in a row, and the volumes of bullish bets on the dollar are off the charts. Therefore, the mass closure of speculative positions became a catalyst for the rise of EUR/USD after the release of U.S. inflation data for October.

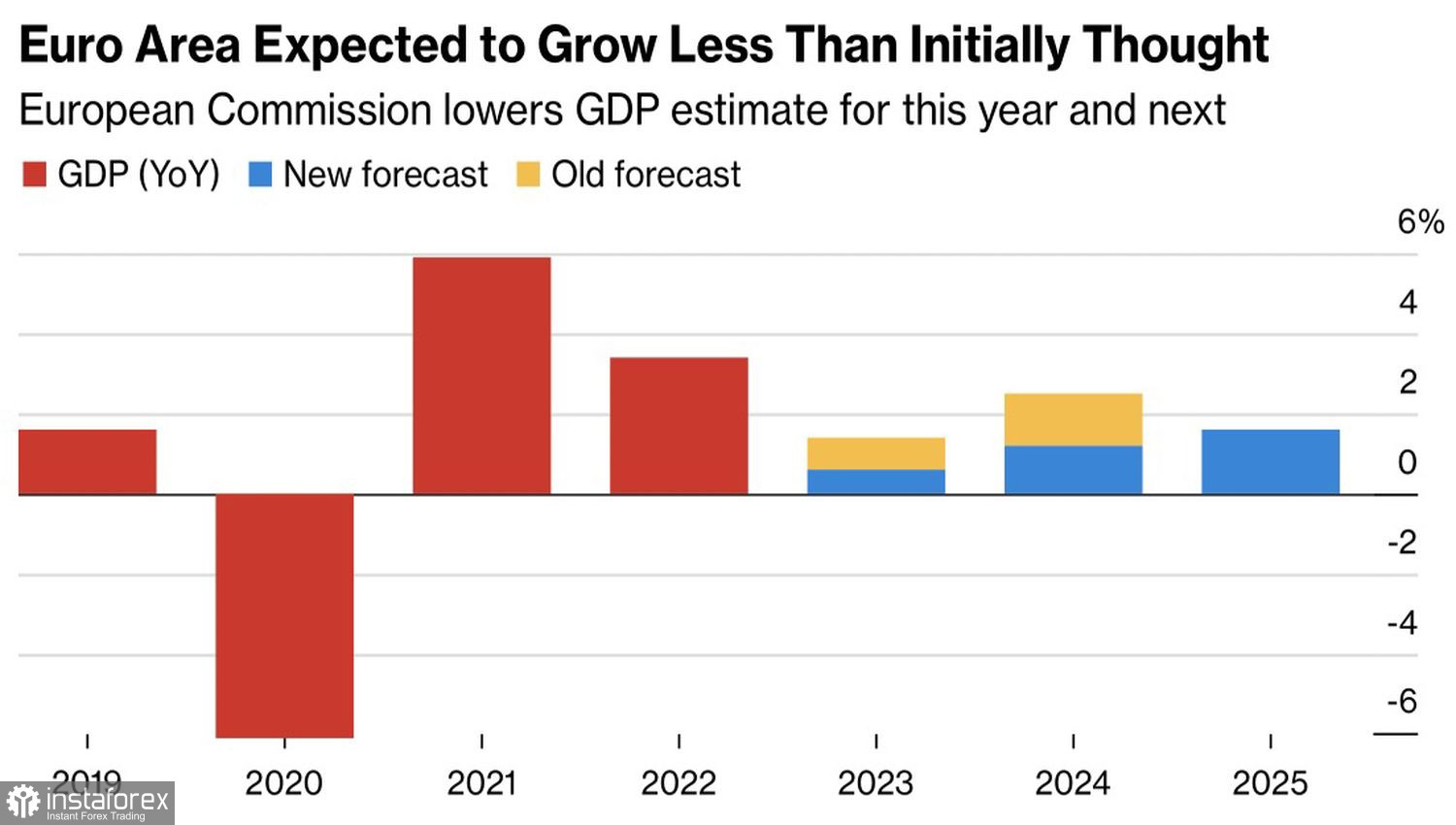

The euro also dealt a blow from the European Commission, which lowered the GDP growth forecast for the currency bloc to 0.6% for 2023 (from 0.8%) and 1.2% for 2024 (from 1.6%). The main reasons cited are increased price pressure, the aggressive rise in ECB rates, and weak demand from abroad.

EU GDP Forecasts for the Eurozone

Nevertheless, even the latest EU estimate is higher than that of the ECB. EUR/USD bulls should not worry about this. The divergence in economic growth between the U.S. and the Eurozone will still decrease, creating a tailwind for the euro.

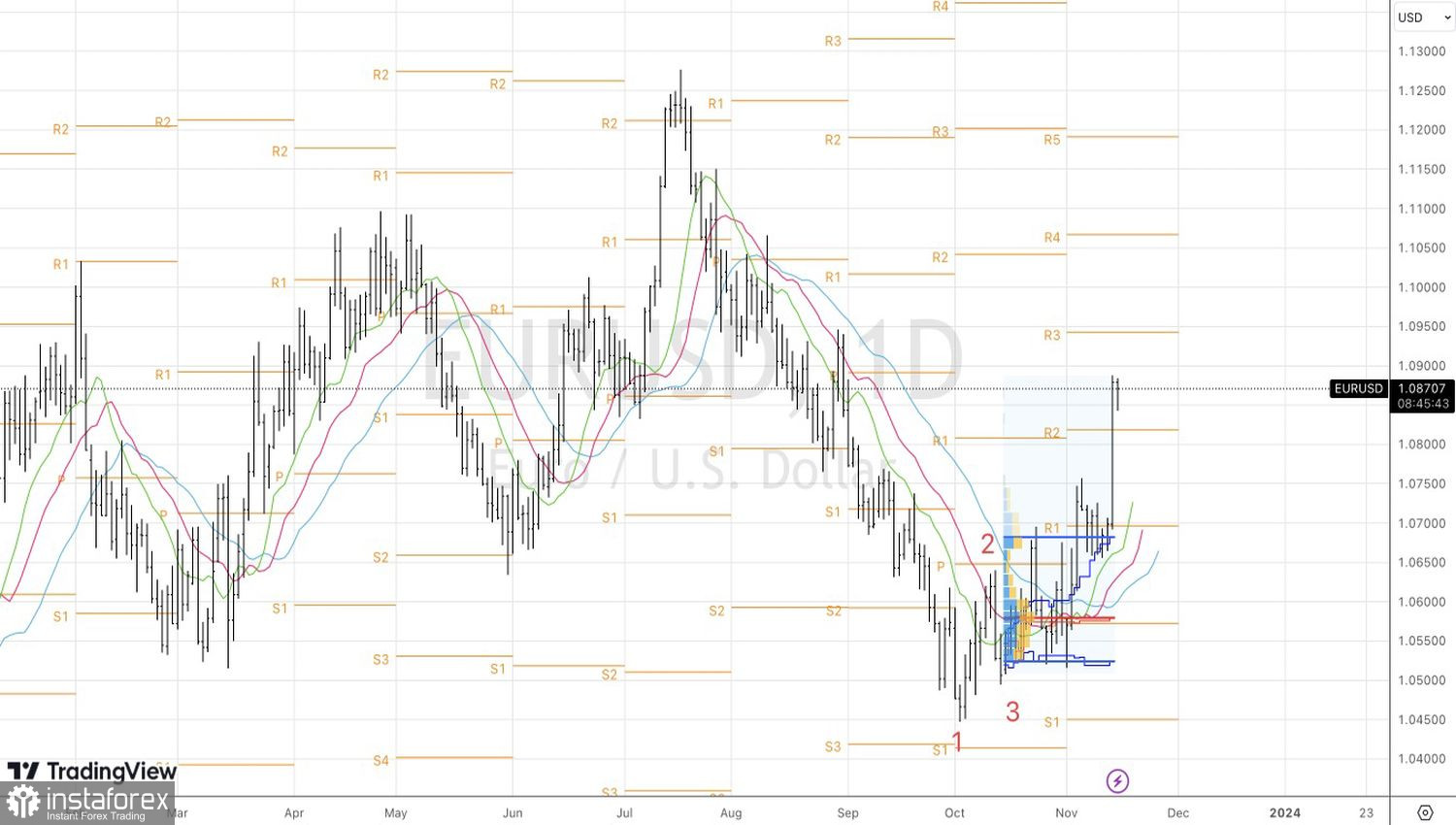

Technically, on the daily chart of EUR/USD, after the formation of a bar with a wide price range, sellers went on the counterattack and are trying to play out the 20-80 pattern. At the same time, the market sentiment remains bullish, and a rebound from the pivot levels at 1.082 and 1.080 makes sense to use for building up previously formed long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română