The pound-dollar pair surged by more than 200 points yesterday, reacting to the publication of inflation growth data in the United States. The resonant release put an end to discussions about the Federal Reserve's future steps—at least in the context of the December meeting. The probability of the Fed raising interest rates in December decreased to 5%, meaning the market is almost certain that the U.S. regulator will maintain the status quo next month.

The inflation report played the role of a cold shower for dollar bulls. Last week, Federal Reserve representatives, including Chairman Jerome Powell, thoroughly heated the public with their hawkish statements, so the sharp shift in sentiment significantly impacted the greenback. The U.S. Dollar Index dropped from 105.60 to 103.80 in just a few hours, reflecting the anti-rally of the American currency. The GBP/USD pair did not stay on the sidelines and updated a two-month price high, testing the 1.2500 level for the first time since September.

But, as they say, "not everything is rosy." The pound rested on its laurels only briefly, as inflation data in the United Kingdom were also published following the U.S. report. It can be said that today, GBP/USD buyers also experienced a cold shower, as almost all components of the UK data were in the red. Certain conclusions can be drawn here as well, primarily regarding the prospects of tightening monetary policy by the Bank of England. These conclusions do not favor the pound as they suggest the central bank will maintain the status quo after the upcoming meetings.

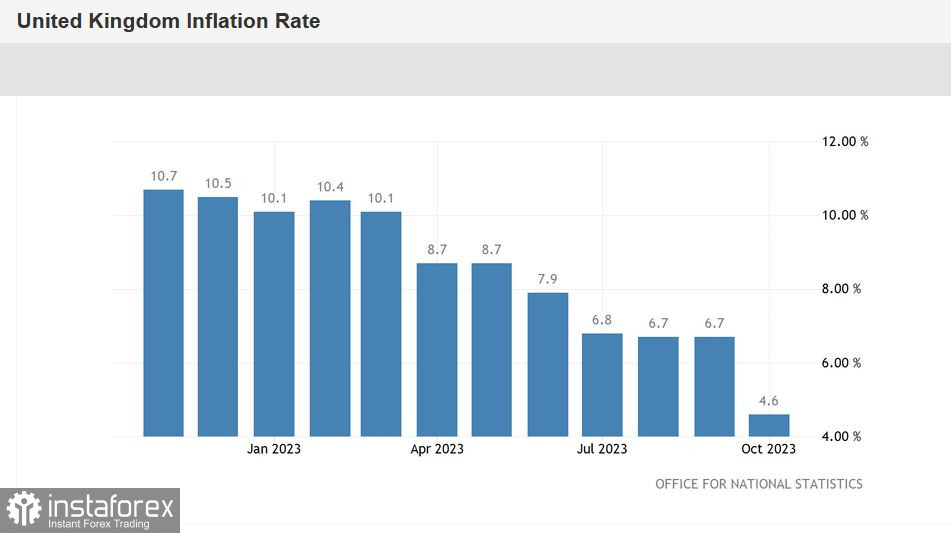

For instance, the overall Consumer Price Index in the UK sharply dropped to zero month-on-month (forecasted to decline to 0.1%) after two consecutive months of growth (0.5% in September). In the year-on-year calculation, the overall index also ended up in the red, reaching 4.6% (forecast at 4.8%)—the weakest growth rate since October 2021. For comparison, the overall CPI was at 6.7% YoY in September.

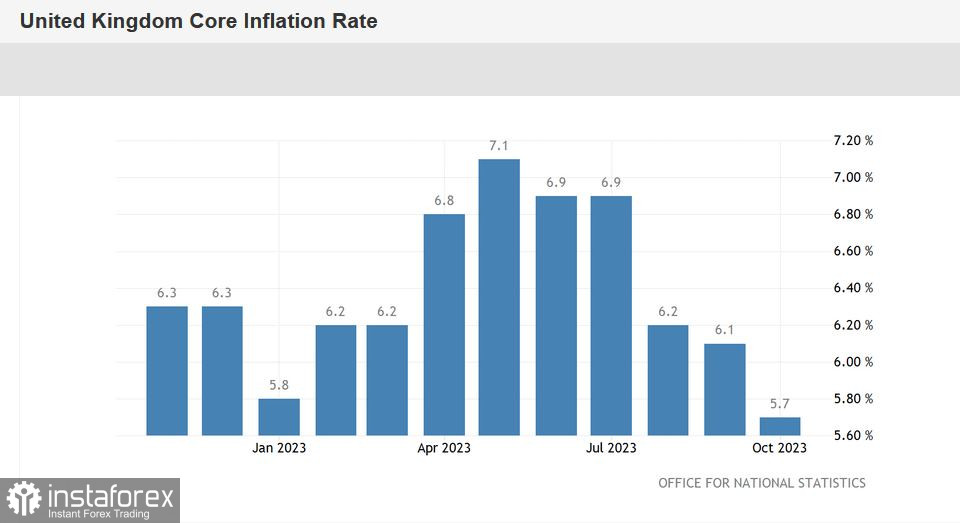

A separate line needs to be drawn for the core Consumer Price Index, excluding energy and food prices. In June and July, it was at 6.9%, but it dropped to 6.2% in August. In September, the indicator again demonstrated a downward trend (6.1%), as well as in October—5.7% (while most experts predicted a decline to 6.0%). This is the lowest value of the indicator since March 2022.

The Retail Price Index, used by British employers in salary negotiations, similarly ended up in the red zone: -0.2% MoM (forecasted to grow by 0.1% MoM) and 6.1% YoY (forecasted to grow to 6.3%)—a two-year low, the weakest growth rate of the indicator since October 2021.

However, some components of the data entered the green zone but remained in the negative territory. For example, the Producer Purchase Price Index in the year-on-year calculation rose to -2.6% (forecast at -3.3%), and the Producer Selling Price Index reached -0.6% YoY (forecasted to decline to -1.0% YoY).

Commenting on the published report, the chief economist of the Office for National Statistics stated that the decline in inflation occurred against the backdrop of falling energy prices. According to him, the downward trend in key indicators is associated with the decrease this month in the maximum level of energy prices, which limits the amount that suppliers can charge consumers per unit of energy.

The sharp decline in inflation in the United Kingdom is a significant blow to the positions of the British currency. However, an interesting situation has developed for the GBP/USD pair: the dollar is knocked out after yesterday's release, and the pound is knocked down after today's news. Sellers of the pair managed to muffle the upward impulse but failed to turn the situation in their favor.

At the moment, it is challenging to say whether sellers of GBP/USD will be able to reverse the trend. Despite the weak positions of the pound, the pair may resume its upward movement due to further weakening of the American currency. The disappointment of the dollar bulls is too great: just last week, Powell stated that the current level of the Fed's rate might be "insufficient" to curb inflation. However, after the publication of CPI growth data in October, his words lost their relevance. Therefore, rushing to sell GBP/USD now may not be advisable—after a short pause, buyers may regain the initiative in the pair.

From a technical perspective, the pair is currently testing the support level of 1.2450 (the upper line of the Bollinger Bands indicator on the daily chart). In this price range, the downward pullback has stalled. This is another signal indicating the unreliability of short positions. It is advisable to consider selling only after sellers firmly establish themselves below the 1.2450 target—in this case, the next price target will be the level of 1.2340 (the Tenkan-sen line on D1).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română