The European Stoxx 600 index climbed by 0.6%. Alstom SA shares plunged by 17% after the train manufacturer announced job cuts and asset sales to strengthen its balance sheet. London's FTSE 100 rose by over 1%, and the British pound fell as UK inflation slowed more than expected. This bolstered optimism that the Bank of England, like the Federal Reserve, might stop raising rates.

Markets are now awaiting US retail sales and producer price data. Interest rate swaps nearly rule out a Fed rate hike and anticipate a 50 basis point cut by next July. However, stronger retail data could dampen some enthusiasm for rate cuts.

Recent statements by Federal Reserve officials reaffirm inflation is on the right track. Many welcomed the latest data showing inflation decline but noted there is still a long way to go before reaching the central bank's 2% target. The focus is not on overall prices but on core inflation, which only dipped to 4.0% from 4.1% a month earlier.

Investors will also monitor consumer demand through upcoming reports from retail chains Target Corp. and Walmart Inc., with the former expected to report a second consecutive sales decline. On Tuesday, Home Depot Inc. reported signs of decreasing volumes.

In Asia, the MSCI index gained over 2%. Sentiment improved further after China's central bank injected the largest cash amount into the banking system since 2016, aiming to boost economic growth. Wednesday's meeting between Chinese President Xi Jinping and US President Joe Biden will also be closely watched for potential easing of tensions.

Oil prices stabilized after a brief rise.

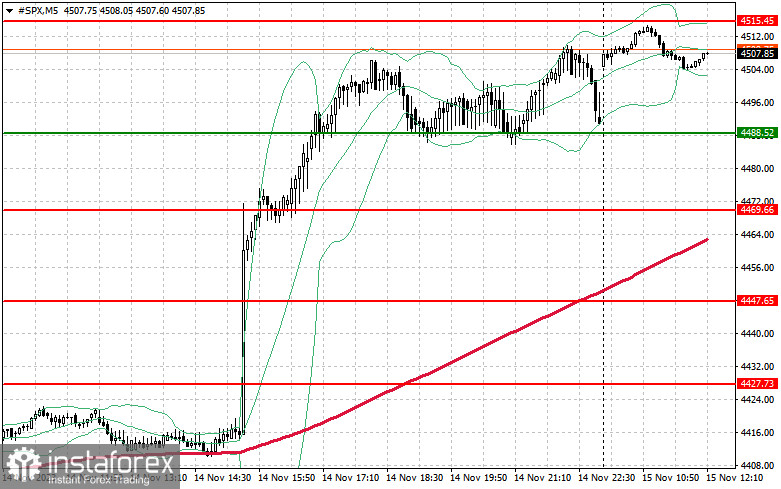

As for the S&P 500 index, the demand for the trading instrument remains. Bulls need to defend $4,488 and take control of $4,515. This will help to strengthen the uptrend and also open the possibility of a breakout to the new level of $4,539. They also should control $4,557, which will strengthen the bull market. If the index declines on the background of decreasing demand for risk appetite, bulls will have to protect $4,488. Breaking through this level, the index may decline to $4,469 and $4,447.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română