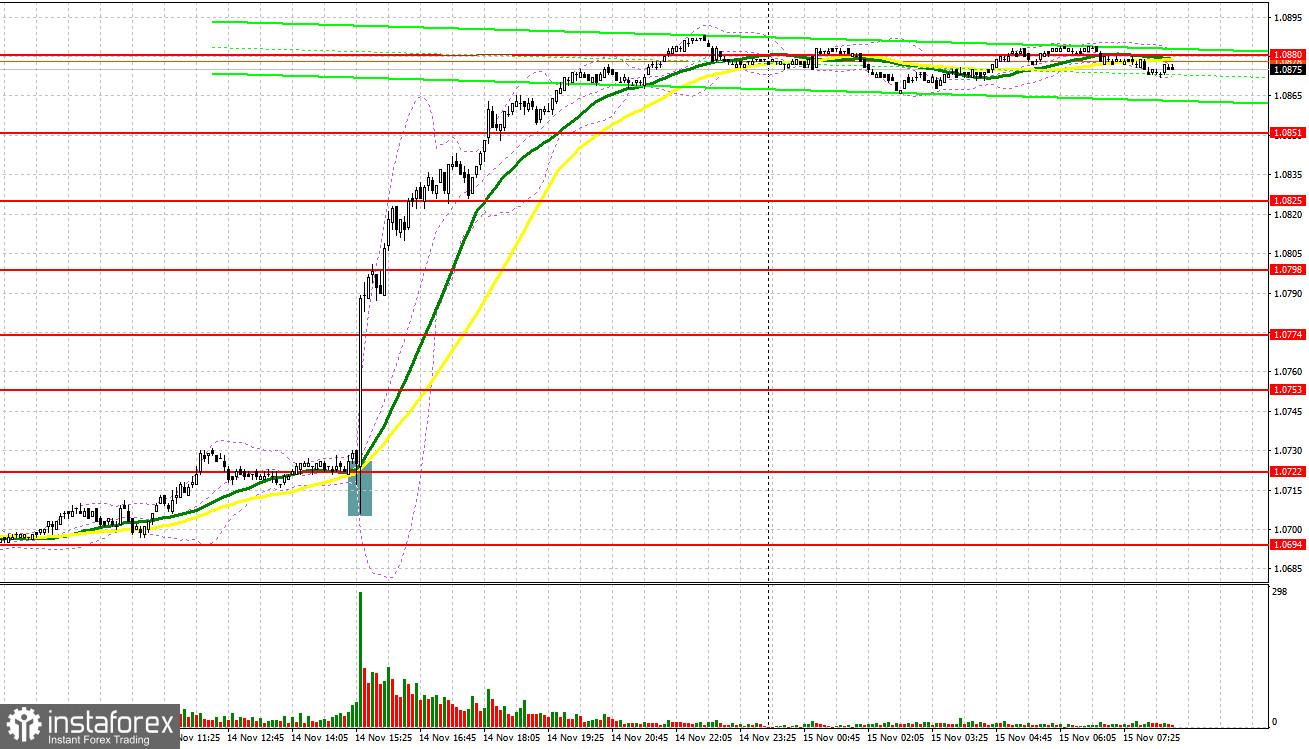

Yesterday, the pair formed only one entry signal. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0692 as a possible entry point. The price declined to this level but failed to form a false breakout there. So, no relevant entry point was formed. In the afternoon, the price broke through 1.0722, settled firmly above it, and retested this level, thus creating a good buying signal. As a result, the euro surged by more than 100 pips.

For long positions on EUR/USD

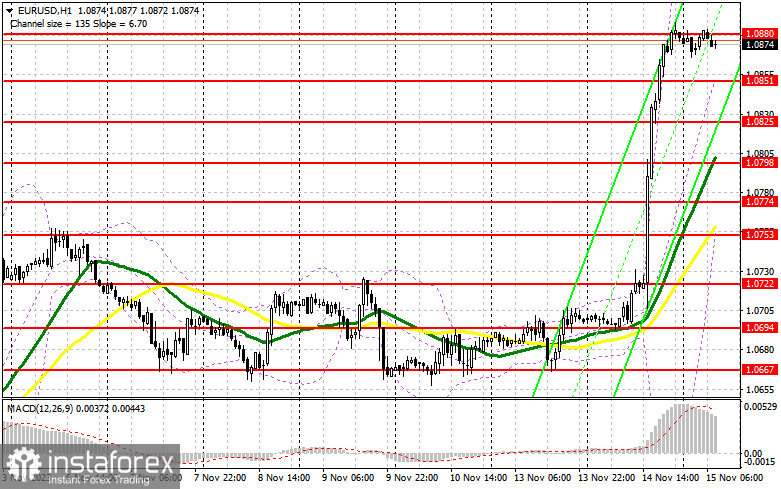

The recent US inflation data have clarified the situation significantly. Following the news that price growth slowed more than economists anticipated in October, the Federal Reserve now has every reason to announce the end of the current interest rate hiking cycle in December. This weakened the dollar's position, allowing the euro to reach 1.0880. Today, the market is expecting figures on consumer price indices from France and Italy, changes in Eurozone industrial production, and trade balance data. If these indicators reveal nothing alarming, the euro is likely to continue its ascent. Ideally, a correction to the 1.0851 area, where buying is more preferable than at the current highs, would be great. A false breakout at 1.0851, similar to what was analyzed above, would provide a good entry point for long positions, aiming for a further rise and a test of the 1.0880 resistance formed yesterday. Breaking and retesting this range from above could pave the way to 1.0908. The furthest target is set at 1.0938, where I plan to take profits. If EUR/USD drops and there is no activity at 1.0851 in the first half of the day, it is not a big concern. Re-entering the market around 1.0825 is always an option. A false breakout there would create a strong entry signal. I plan to open long positions immediately on a rebound from 1.0798, aiming for an upward correction of 30-35 pips within the day.

For short positions on EUR/USD

It is hard to give advice right now to the sellers. There is no expectation of a new bear market developing soon. Only very weak data from the Eurozone could temporarily keep the pair below 1.0880. A false breakout there may not provide a strong signal, but it could lead to a minor downward correction towards the 1.0851 support, where I expect significant buyers. Only after breaking and consolidating below this range, and a retest from below, do I anticipate another sell signal targeting 1.0825. The furthest target is the 1.0798 low, where I plan to take profits. This level is also where the moving averages, favoring the buyers, are situated. If EUR/USD moves up during the European session and there are no bears at 1.0880 – which is likely – it is best to postpone selling until the price hits 1.0908. It is possible to sell there but only after an unsuccessful consolidation. I will open short positions immediately on a rebound from the high of 1.0938, aiming for a downward correction of 30-35 pips within the day.

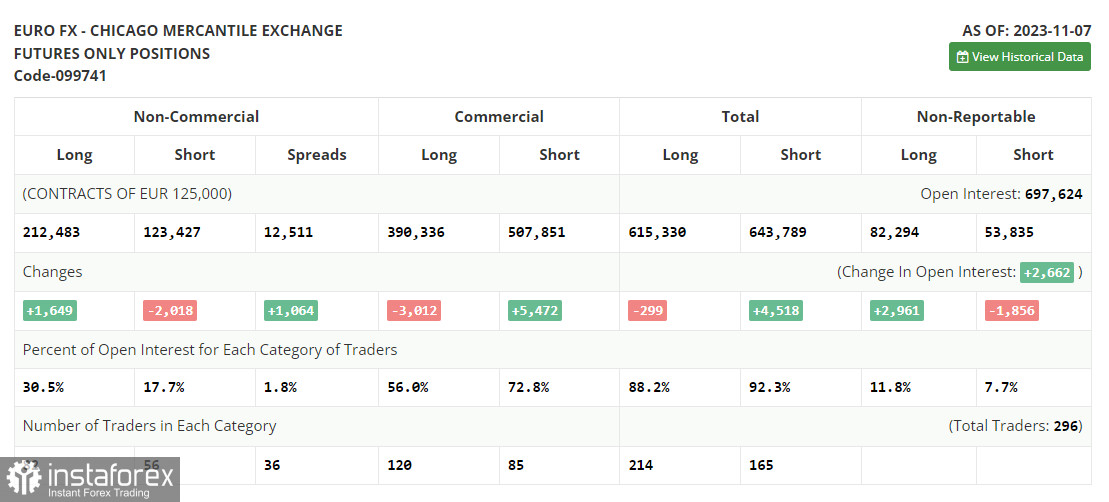

COT report

The Commitments of Traders (COT) report for November 7 indicated a decrease in short positions and an increase in long positions. It is important to note that these figures only reflect the market's reaction to the Federal Reserve's decision to maintain its policies unchanged. However, last week, Fed representatives made it clear that the future of interest rates would entirely depend on incoming data, not ruling out another hike by the end of this year. The upcoming US inflation report, which could set the direction for the pair for the coming weeks, along with other crucial statistics, is eagerly awaited. The COT report indicated that non-commercial long positions increased by 1,649 to 212,483, while non-commercial short positions decreased by 2,018 to 123,427. Consequently, the spread between long and short positions widened by 1,064. The closing price saw a sharp rise, settling at 1.0713 from the previous value of 1.0603.

Indicator signals:

Moving Averages

Trading above the 30- and 50-day moving averages indicates a continued rise in the euro.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair declines, the lower band of the indicator at 1.0753 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română